Are Stock Markets About to Repeat the 1929 Crash?

Stock-Markets / Stock Markets 2015 Oct 17, 2015 - 06:24 PM GMTBy: Graham_Summers

In the early 2000s, Alan Greenspan was worried about deflation. So he hired Ben Bernanke, the self-proclaimed expert on the Great Depression from Princeton. The idea was that with Bernanke as his right hand man, Greenspan could put off deflation from hitting the US. Indeed, one of Bernanke’s first speeches was titled “Deflation: Making Sure It Doesn’t Happen Here”

In the early 2000s, Alan Greenspan was worried about deflation. So he hired Ben Bernanke, the self-proclaimed expert on the Great Depression from Princeton. The idea was that with Bernanke as his right hand man, Greenspan could put off deflation from hitting the US. Indeed, one of Bernanke’s first speeches was titled “Deflation: Making Sure It Doesn’t Happen Here”

The US did briefly experience a bout of deflation from late 2007 to early 2009. To combat this, Fed Chairman Ben Bernanke unleashed an unprecedented amount of Fed money. Remember, Bernanke claims to be an expert on the Great Depression, and his entire focus was to insure that the US didn’t repeat the era of the ‘30s again.

Yellen and Bernanke Are the Same

Current Fed Chair Janet Yellen is cut of the same cloth as Bernanke. And her efforts (along with Bernanke’s) aided and abetted by the most fiscally irresponsible Congress in history, have recreated an environment almost identical to that of the 1920s.

Let’s take a quick walk down history lane.

In the 1920s, most of Europe was bankrupt due to after effects of WWI. Germany in particular was completely insolvent due to the war and due to the war reparations foisted upon it by the Treaty of Versailles. Remember, at this time Germany was the second largest economy in the world (the US was the largest, then Germany, then the UK).

Germany attempted to deal with the economic implosion created by WWI by increasing social spending: social spending per resident grew from 20.5 Deutsche Marks in 1913 to 65 Deutsche Marks in 1929.

Since the country was broke, incomes and taxes remained low, forcing Germany to run massive deficits. As its debt loads swelled, the county cut interest rates and began to print money, hoping to inflate away its debs.

When the country lurched towards default, US and other banks loaned it money, doing anything they could to keep the country from defaulting on its debt. As a result of this and the US’s relative economic strength compared to most of Europe, capital flew from Europe to the US.

How the 1929 Crash Happened

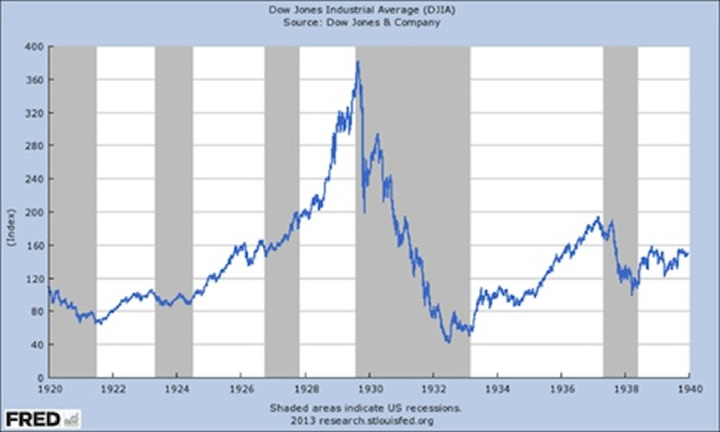

This created a MASSIVE stock market bubble, arguably the second largest in history. From its bottom in 1921 to its peak in 1929, stocks rose over 400%. Things were so out of control that the Fed actually raised interest rates hoping to curb speculation.

The bubble burst as all bubbles do and stocks lost 90% of their value in a mere two years. This was the dreaded 1929 Crash.

Today, the environment is almost identical but for different reasons. The ECB first cut interest rates to negative in June 2014. Since that time capital has fled Europe and moved into the US because 1) interest rates here are still positive, albeit marginally, and 2) the US continues to be perceived as a safe-haven due to its allegedly strong economy.

This process has accelerated in 2015.

- Globally, there have been over 20 interest rate cuts since the years started a mere 10 months ago.

- Interest rates are now at record lows in Australia, Canada, Switzerland, Russia and India.

- Many of these rates cuts have resulted in actual negative interest rates, particularly in Europe (Denmark, Sweden, and Switzerland).

- Both the ECB and the Bank of Japan are actively engaging in QE programs forcing rates even lower.

- All told, SEVEN of the 10 largest economies in the world are currently easing.

Because the US is neutral, money has been flowing into the country by the billions. A lot of it is moving into luxury real estate (particularly in LA and York), but a substantial amount has moved into stocks as well as the US Dollar.

Stocks Are Almost As Rich As They Were Before the 1929 Crash

As a result of this, the US stock market is trading at 1929-bubblesque valuations, with a CAPE of 27.34 (the 1929 CAPE was only slightly higher at 30. And when that bubble burst, stocks lost over 90% of their value in the span of 24 months.

Another Crash is coming… and smart investors would do well to prepare now before it hits.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis “Round Two” Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

To pick up your FREE copy, swing by…

https://www.phoenixcapitalmarketing.com/roundtwo-ZH.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.