Walmart’s Ominous Stock Market Signal

Stock-Markets / Stock Markets 2015 Oct 16, 2015 - 06:38 PM GMTBy: John_Rubino

Companies like Walmart and McDonalds’s have made their investors rich by squeezing costs and cutting prices. But it turns out that low-cost means low-wage, and as this model spread it contributed to the now-impossible-to-ignore migration of income and wealth from workers to owners of the capital and symbol manipulation skills that such a system demands.

Now these internal contradictions have come home to roost. Workers who were forced down to bare subsistence can’t afford to buy what American companies are selling. But they can demand a bigger piece of the pie via the ballot box and direct action. In May, for instance, McDonald’s headquarters was swamped by protesters demanding $15/hour starting pay.

And raising the minimum wage in general has become a political winner. Here’s the current administration’s take on the subject:

In the 2014 State of the Union address, President Obama called again on Congress to raise the national minimum wage, and soon after signed an Executive Order to raise the minimum wage for the individuals working on new federal service contracts.

Raising the minimum wage nationwide will increase earnings for millions of workers, and boost the bottom lines of businesses across the country. While Republicans in Congress continue to block the President’s proposal, a number of state legislatures and governors, mayors and city councils, and business owners have answered the President’s call and raised wages for their residents and employees.

Meanwhile, forcing the 1% to share the wealth via higher taxes is back in vogue. In the most recent democrat party presidential debate, everyone on the stage promised new social programs to be financed by insisting that the rich “pay their fair share.”

Broadly speaking, this is normal and natural. Resources are limited and there will always be give and take over who gets what. It’s also poetic justice. The corporate/political class ignored the obligations that come with aristocracy and is now paying the inevitable price. Markets, over long periods of time, work these things out.

But in the near term, anyone buying US equities based on the hope that the past decade’s surge in corporate profitability will continue is in for a shock. If workers are going to get higher wages, then the rest of the pie — comprising corporate earnings — is by definition going to shrink, leaving less for shareholders.

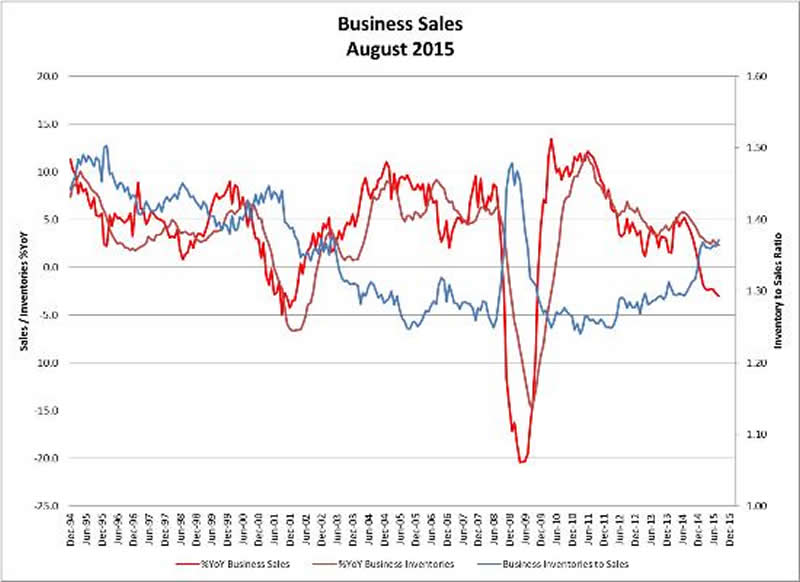

Walmart’s recent massive earnings miss is, then, a sign of things to come rather than a company-specific hiccup. The following chart (compiled by friend and DollarCollapse reader Michael Pollaro) shows US business sales (red line) already falling towards recession levels. Combine this ongoing trend with sharply-narrower profit margins as wage costs rise, and the result will be a few years of consistent earnings disappointment. Hardly the kind of thing that fuels a bull market.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.