Unhealthy, Not Wealthy, and Far from Wise, The Changing Healthcare World

Companies / Healthcare Sector Oct 13, 2015 - 10:07 PM GMTBy: John_Mauldin

“The first wealth is health.”– Ralph Waldo Emerson

“The first wealth is health.”– Ralph Waldo Emerson

“Man needs difficulties. They are necessary for health.” – Carl Jung

Decisions, decisions. Many Americans will have to make a big one in the next 60 days or so. How you decide will affect both your health and your wallet. Hospital management and doctors are seeing significant differences in the trends of patient care and are moving to adapt. Some of the changes they implement are going to create significant economic impacts on households and local communities.

In this week’s letter we’re going to take another look at healthcare trends. Healthcare is roughly 20% of the economy and every bit as impactful as the energy and food sectors.

Two years ago this week I wrote “The Road to a New Medical Order” with my friend and personal physician, Dr. Mike Roizen of the Cleveland Clinic. That letter was an attempt to calmly discuss the Obamacare launch and the changes it would bring. Rereading it now, I see that we missed some points but were on target with others. (Mike is the Chief Wellness Officer and head of The Wellness Institute at the Cleveland Clinic. He is one of the premier antiaging doctors of the world. He has sold over 12 million books (including numerous bestsellers), has written 165 peer-reviewed publications, holds 14 patents, and serves on all sorts of FDA committees and boards. His awards are numerous. He has often appeared on the Oprah Winfrey Show with “Dr. Oz.”)

Mike and I have had an ongoing conversation about the changes in the healthcare world, and we visited at length as I was preparing this letter. Some of the changes that are coming are very positive, and others are downright remarkable, creating trends that no one seems to have even guessed at. Others are not so salutary. We’ll examine the great and not so great trends. Plus, I’ll offer some practical healthcare-related personal-finance tips for those of us of a certain generation. I was actually pretty excited to find some of this information, and so I’m going to enjoy passing it on to you. This week’s letter should be fun. Let’s dive right in.

We are approaching “open enrollment” time for Medicare, Obamacare, and many employer health insurance plans. You can keep what you have – maybe. You can change plans, too. Should you change? No one really knows. Even if you manage to decipher what a plan does or doesn’t cover and at what cost, the realities of your coverage and costs can change very quickly.

Readers outside the United States often tell me they can’t understand why we tolerate such a dysfunctional health care system and seemingly do our best to make it a little worse each year. I don’t understand, either. There are at least a dozen potential “fixes” to the Affordable Care Act (ACA, aka Obamacare) that 90% on both sides of the political aisle agree on, but there seems to be little willingness on either side to bring up a bill in Congress to accomplish those changes. One side wants to make wholesale changes in the system, and the other side wants no changes unless we go further down the road to a single-payer system.

Healthcare really should not be a politically divisive issue. We all want to stay in good health; we all want sick people to receive good care; and we all want to do it economically and sustainably. Yet our healthcare system will probably be a major issue in next year’s election campaigns. As usual, the rhetoric will generate more heat than light.

Today we will revisit some of the 2013 issues and predictions Mike and I shared with you and see how things are working out. Progress may not be the right word, but we definitely see change.

We’ll begin with an impending change in the Medicare program for senior citizens like me. Having just turned 66, I’ve been on Medicare for a full year. So far, my experience has been unproblematic. I haven’t had any major health issues, so the worst part has been paying the monthly premiums.

Premiums? This might come as a shock to younger people who already see Medicare tax money leaving their paychecks, but you will keep paying after you sign up for Medicare. Depending on your income, the 2015 “Part B” premiums are between $104.90 and $335.70 per month, per person. (So a married couple pays double those amounts.)

In July, the Medicare trustees issued a report estimating that next year’s Part B premium will have to rise 52% in order to keep the system solvent. That’s right, 52%. This will be an increase of $50 to $175 per month, again depending on your income. So much for 2% inflation.

(I’m not really complaining, because my overall health insurance cost went down the day I went on Medicare – I was surprised by how much. And I haven’t noticed a significant difference in service, not that I’m in a hospital or the doctor’s office very much.)

Those increases won’t stress me, but they will definitely be significant for many retirees who live on fixed incomes. These increases also illustrate the nuttiness of our system. Health and Human Services Secretary Sylvia Burwell, who will make the final decision on next year’s rates, has already pledged that some 70% of Medicare enrollees will be exempt from the rate increase.

It gets worse. By what criteria, you may ask, will HHS decide who pays more or less?

Current Medicare recipients who have their premiums deducted from their monthly Social Security checks won’t see a rate increase. That’s because the Social Security Act has a “safe harbor” provision that stipulates that a Medicare premium increase cannot exceed enrollees’ annual cost of living adjustments. And because we have almost zero inflation, Social Security will likely have no COLA this year.

Who gets to hold the bag, then? Anyone who is currently on Medicare but pays premiums separately because they haven’t yet filed for Social Security. That includes people between ages 65 and 70 who are using the popular “file and suspend” strategy.

It also includes anyone who first enrolls in Medicare during calendar 2016. They will pay the higher rates from the very start.

This is obviously insane. Healthcare costs did not suddenly increase 52%, so premiums don’t need to go up that much for anyone. Yet because we have no inflation (at least according to the CPI), the government can’t legally raise rates for most Medicare participants. It has to make up the difference by extracting extra-high premiums from the unlucky few to which it has recourse.

It gets worse. If you are in the unlucky 30%, you may have an escape clause. If you are over 65 and did the file and suspend trick, Kenny Landgraf at Kenjol Capital Management suggests just un-suspending for the rest of 2015. That will shift you to the other group so you can avoid the premium increase. Then you can refile and suspend again… maybe. No one seems completely sure about this.

That maneuver, if it works, may be more hassle than it’s worth for many people, but the need for it definitely points up the absurdity of our Rube Goldberg healthcare machine. And we haven’t even looked at Obamacare yet.

For those under 65, the ACA was supposed to make healthcare affordable and protect patients. Did it? The answer is a resounding “Maybe!”

The reports I’ve seen show rates, coverage, and quality are all over the board, depending on who you are and where you live. The only obvious winners are people with preexisting conditions who didn’t have employer-provided coverage. In many states they couldn’t buy health insurance at any price prior to Obamacare. Now they can at least get overpriced and underwhelming Obamacare policies. For this group there has been a clear improvement.

Don’t underestimate how much this development could help the economy as a whole. Economists have long noticed a “job lock” phenomenon. People hold on to jobs longer than is rational, simply because they need the insurance benefits. My good friend Patrick Watson (who now works with us at Mauldin Economics) wrote about this back in 2013, calling the insurability of people with preexisting conditions a possible Obamacare “silver lining.”

I think Patrick’s point may well be proven right in time. As a nation, we can’t afford to let talented people languish in jobs that don’t fully utilize their skills. Job lock depresses economic growth and ultimately punishes everyone. To the extent Obamacare solves this problem, it is an improvement on the pre-2014 system.

That may be where the improvement ends, though. Obamacare’s expensive and complicated plumbing seems to have limited its value to millions of people. Going into 2014, about 32 million nonelderly Americans were uninsured, according to Kaiser Family Foundation. As of June 2015, some 10 million people had enrolled in state and federal Obamacare marketplace plans. Another 14 million had enrolled in Medicaid. These are moving targets, so the numbers are approximate.

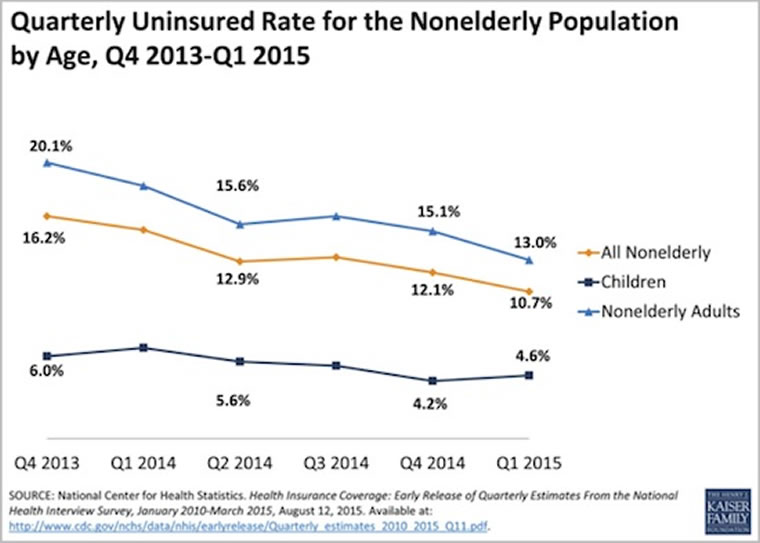

These newly covered people took the uninsured rate down from 16.2% just before the Obamacare rollout to 10.7% by Q1 2015.

A majority of those who remain uninsured are self-employed or work for firms that don’t offer insurance. That means they are probably eligible for Obamacare marketplace plans. Why don’t they buy one? According to surveys, most say the plans cost too much. The tax credits available to those with incomes under 400% of poverty level don’t seem to work for many in the target audience.

And let’s be clear: in some states there have been health insurance cost increases of 50 to 100% since 2010.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.