Stock Market Initial Projection Reached (Short-Term Top Expected)

Stock-Markets / Stock Markets 2015 Oct 13, 2015 - 09:46 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market?

Intermediate trend - SPX is in the midst of an intermediate correction (at least).

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

INITIAL PROJECTION REACHED

(SHORT-TERM TOP EXPECTED)

Market Overview

A strong up-thrust from 1872 took SPX all the way to the previous top of 2020, where it is at least likely to consolidate. There are several good technical reasons for that! First, it met a projection to 2016-2022 which originated from the base built between 1872 and 1926. Next, at Friday's close, negative divergence was apparent in the daily and hourly A/Ds. Finally, this level is fraught with considerable resistance which should repel a short-term overbought condition. This should be enough to generate a period of consolidation, at a minimum.

What, exactly is the significance of all this strength? We should find out over the next few days or weeks. On the P&F chart, the pattern of the move from 1872 is very similar to the one which was generated after the first correction, at the end of August. That one was followed by a fairly deep correction and then a volatile and choppy move to 2020. It's possible that, for the present move, this is where the similarity will end. But the path of the index from here on should be fairly easy to follow. I will show you why in the analysis section.

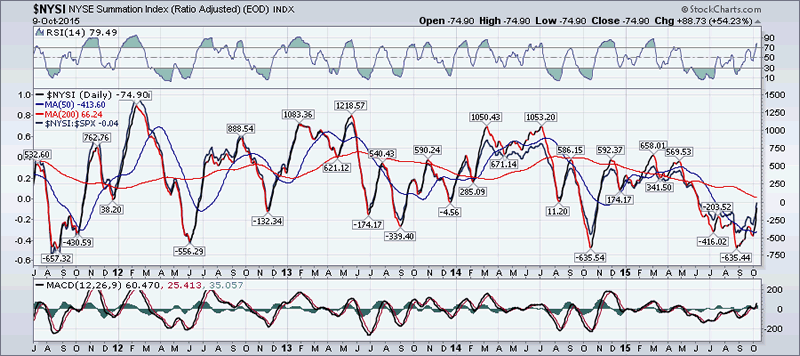

Intermediate Indicators Survey

The weekly MACD has turned up, but at -30.19, it remains very oversold.

The weekly cumulative A/D line had a good rally.

So did the NYSI (courtesy of Stockharts.com) which was very oversold. It has surpassed its former near-term high and re-established a short-term uptrend.

The 3X P&F chart appears to have filled its full count from the base formed above 1872, although one could come up with a possible extreme count to 2040.

Chart Analysis

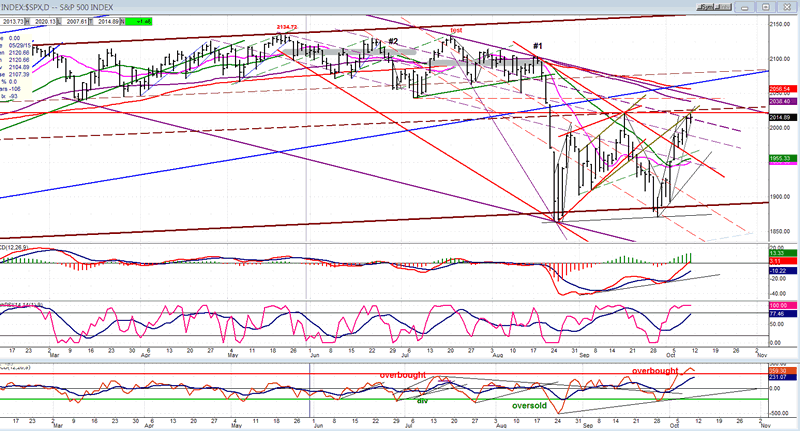

Daily SPX chart (courtesy of QCharts.com, as well as others below).

Las week, I mentioned that the SPX had possibly shifted its primary trend to a large sideways channel which was delineated by the brown trend line drawn across its last two tops with a parallel starting at the October 2014 low. I also mentioned that in order to show that it had, instead, started a full-blown intermediate trend, it would have to break below the lower channel line. This has not happened, yet. Instead, prices staged a strong rally after touching it on 9/29. Obviously, the index is not ready to move through it at this time, but that does not mean that it won't be after some additional distribution. The question is now whether or not we are ready to change the pattern to a new uptrend, or simply to trade sideways for a while and then go through. How about something in between? Just as it was premature to expect SPX to break below 1867 this early, making a new high may not be in the cards for quite a while.

My best argument against a new high anytime soon is that the distribution phase which was registered between May and August is far too important to be taken lightly and it carries a count which is far beyond the lows that have already been established. As pointed out earlier, only the first phase which represents approximately one fourth of the total potential count has been filled. Until this is completely nullified by a new high in the index, it is best to apply a little human logic and, since the market has shown so much resilience (assuming that it was not a bear market rally), allow for higher prices over the short-term. A good target would be a back-test of the broken intermediate channel, whose lower channel line is shown above as a blue trend line.

But not before we consolidate, first. On a short-term basis, the index is overbought and is beginning to show signs of price deceleration. It has also filled a valid target determined by a count across the 1872 base. Note that it has also risen to the level of the former 2020 high which was stopped by resistance also present at the September 2014 high (which preceded the October 2014 low). We can make a case for even more sources of resistance at this level, but will wait until we analyze the hourly chart where it is more visible.

The filling of the P&F target or 2016/2020 is an important adjunct to the overhead resistance, with price deceleration, overbought indicators, and A/D negative divergence filling the blanks. In other words, these are good technical reasons to believe that we are probably ready for some consolidation before attempting to move higher.

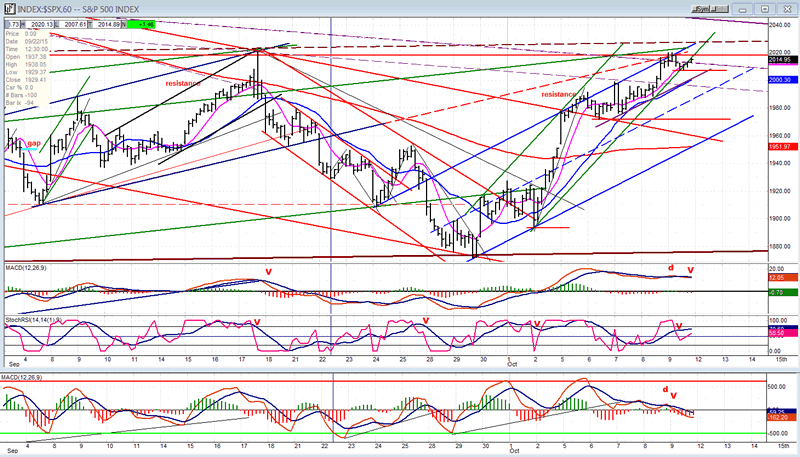

Hourly SPX chart.

On the daily chart, we saw that the rally moved the index out of the red short-term channel. On this chart, the price shows a slight back-test of the broken (red) trend line, followed by the formation of two new channels: the steep green one, and the wider blue one. The inability of price to move above the blue upper trend line to the top of the green channel is the first important sign of deceleration in this trend, and this has caused it to angle over to the point where it is now ready to break outside of the green channel.

At the top of the move, the (red) resistance line drawn from the September 2014 high, and the dashed mid-channel line of the primary trend channel are reinforced by several other trend/resistance lines which should put a cap on prices for the time being, especially considering the condition of the oscillators which are giving sell signals preceded by negative divergence. Add this to the fact that a projection target was met, and it would be unusual for the index to continue on its upward path without correcting first.

Being able to combine P&F targets with resistance levels and pattern completions gives an analyst greater confidence in projecting the end of a move. Of course, one has to get the count right and distinguish between partial and full counts. Everything considered, a decisive break of the green channel should be imminent, with a move below 2008 confirming that a near-term correction is underway. If we consider the entire move from 1872 to 2020 as one phase, a normal .382 retracement of that distance would take the price back to about 1963 and to the level of the lower blue channel line. This might be a little too perfect to be realistic!

Whatever near-term activity the SPX chooses, even a minor correction would change the uptrend from a fairly steep trajectory to one less severe and, as long as the price remains within the confines of the blue channel it will remain in force, perhaps allowing for a move to or close to the blue intermediate channel line as a back-test of that line. That would entail being able to move through a stiff band of resistance and show that the move has some staying power and was not jsimply a bear market rally.

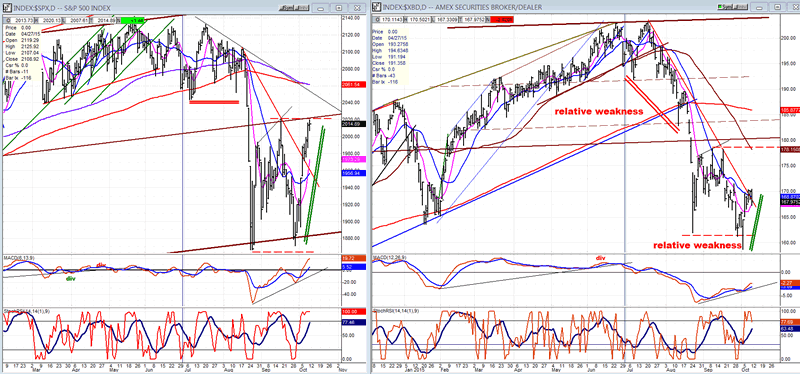

XBD (American Securities Broker/Dealer)

Another look at XBD is a must! Especially in light of its recent trading pattern vs. SPX.

A better perspective can usually be achieved by comparing the action of a leading indicator which has a good track record vs. the index of choice. Here, the XBD may be telling us a story which is not apparent in the SPX alone. We don't have to do a full analysis of the two charts, but simply focus on the beginning of the decline and then on the current rally. For easier comparisons, I have drawn a double red line in both charts to mark how the two indexes each warned of the approach of a selling phase. Note that these lines connect the same time frames. It's easy to see that XBD was already in an established downtrend while SPX was still trying to hold on to its previous lows. I pointed out this relative weakness last week whereby XBD warned of an impending correction several days ahead of SPX.

Now, let's compare the two rallies! Do I need to spell it out? So far, it's only a warning, and a reminder that in weak markets, rallies can often take an appearance of unsual strength which does not last. So let's watch closely the action of these two indices over the next couple of weeks.

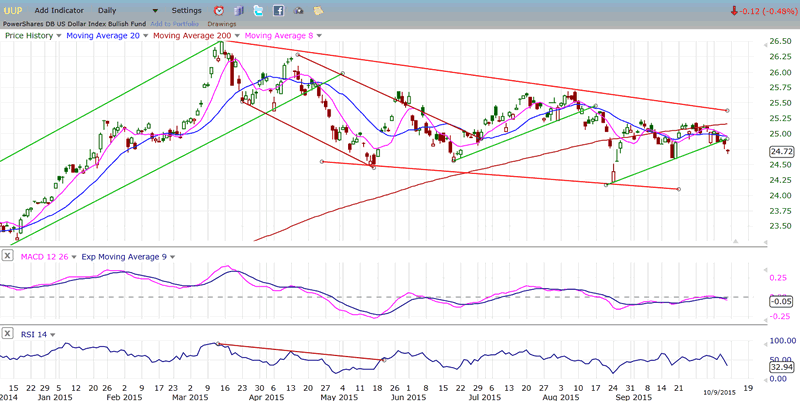

UUP (dollar ETF)

The dollar could not break out of its consolidation pattern. It has ended its attempt at overcoming the 200-DMA but, at least for now, it does not look as if it wants to turn its consolidation into a downtrend. It may simply be biding its time for a more favorable moment to move higher and fill its potential P&F target.

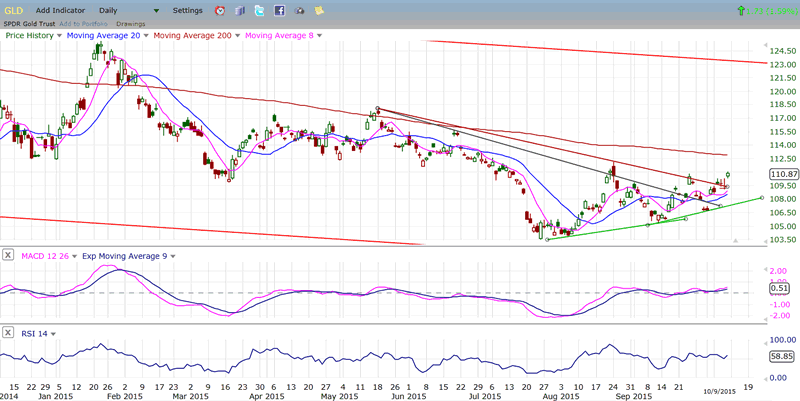

GLD (Gold trust)

GLD is doing the reverse of the dollar. It is trying to move up but not very convincingly, so far. If it is going to start a significant uptrend it will have to show more eagerness to do so. Most indications begin with an upward thrust which leaves no doubt about their intention. A slow but steady acceleration upward could also take place. The problem with GLD is that it may require more basing action before being ready for a prime time reversal of trend.

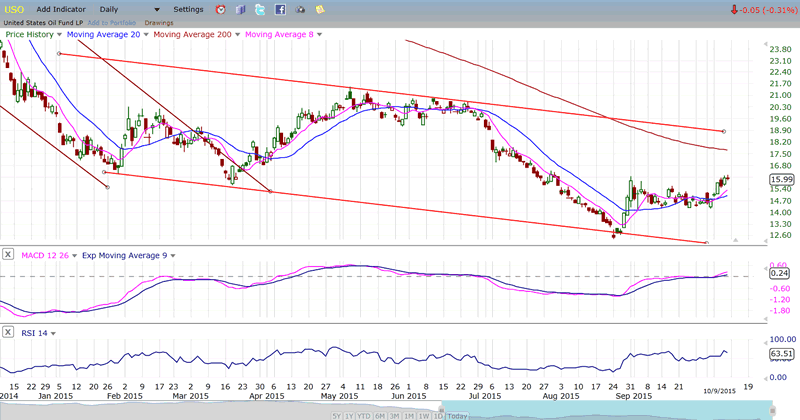

USO (United States Oil Fund)

USO may be ready to break out of its consolidation pattern. If so, it would have to clear 16 with a pick-up in volume. Should it do so, the next obstacle will be its 200-DMA (18.99). Even if it can get past it, about 21 should be the extent of its effort for now.

Summary

SPX is at an important juncture. After holding support at 1872, it has quickly run up to the level of the August rally peak. To convince us that this show of strength is something more than a typical bear market rally, it must continue its advance after overcoming a strong resistance band which begins where it stopped, and gets increasingly tougher, especially above 2040.

A short-term overbought condition, the appearance of price deceleration, and negative divergence in the A/D all suggest that it will at least pull-back a little before moving higher. The manner in which it pulls back, how far, and its ability to push ahead afterwards will give us some important clues about its intentions. The next week or two should be particularly revealing.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.