Forex Trading: "Elliott wave analysis helps me cut to the chase."

Currencies / Forex Trading Oct 09, 2015 - 10:45 AM GMTBy: EWI

Fresh insights from Elliott Wave International's Senior Currency Strategist, Jim Martens

Fresh insights from Elliott Wave International's Senior Currency Strategist, Jim Martens

Jim Martens is one of the few forex Elliott wave instructors in the world and a long-time editor of Elliott Wave International's forex-focused Currency Pro Service. A sought-after speaker, Jim has been applying Elliott waves since the mid-1980s, including two years at the George Soros-affiliated hedge fund, Nexus Capital, Ltd.

Jim Martens is one of the few forex Elliott wave instructors in the world and a long-time editor of Elliott Wave International's forex-focused Currency Pro Service. A sought-after speaker, Jim has been applying Elliott waves since the mid-1980s, including two years at the George Soros-affiliated hedge fund, Nexus Capital, Ltd.

Below is an excerpt from his latest interview. To read the full interview -- and get Jim's latest big-picture forecast for EURUSD, tips on how to learn Elliott fast, and practical ideas on how to treat your forex trading as a business -- complete your free Club EWI profile. It only takes 30 seconds.

Jim, thanks for joining us today. The U.S. dollar recently hit its highest level in many weeks. Were you surprised by that?

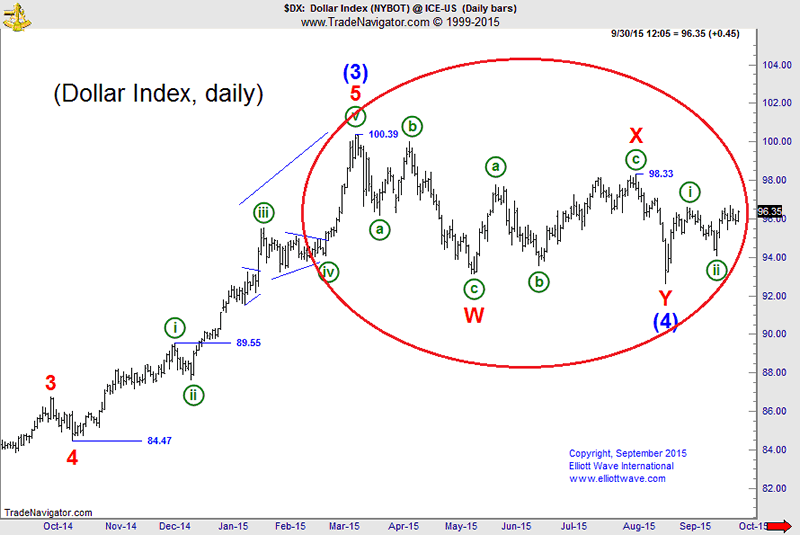

Jim Martens: The strength in the U.S. Dollar Index came as no surprise. And that's not just me bragging. We track its Elliott wave patterns daily, even intraday. Since the dollar's peak back in March of this year, the decline has taken a decidedly corrective Elliott wave look: The price action has been choppy, overlapping, and generally lacking direction, as you see on the circled portion of the chart below. Any time you see that on a price chart, that's your first clue that the market must be taking a "breather" before the larger trend resumes. In this case, the larger trend has been higher, so when the dollar popped back up recently, to us it meant that the correction must be over.

For Elliott wave fans among your readers, it looks like the correction since March took the shape of a pattern called a "double zigzag," labeled in circled green "abc"-"abc" on this chart:

As you can see, we have labeled the entire correction as a wave 4 within a basic 5-wave Elliott wave pattern called an "impulse," with wave 5 most likely starting now. So, the USDX has higher to go -- much higher, in fact, because by the looks of the Elliott wave pattern underway, the latest dollar strength is only the start of the move. We are expecting the Dollar Index to move well above 100.

And, because the U.S. Dollar Index moves inversely to the euro-dollar, looking at a EURUSD chart, we are expecting significant weakness in this key forex pair... [EURUSD chart with a forecast follows -- Ed.]

(To read the full interview, complete your free Club EWI profile. It only takes 30 seconds. You'll learn: Jim's latest big-picture forecast for EURUSD, tips on how to learn Elliott fast, and practical ideas on how to treat your forex trading as a business.

Already a Club EWI member, access the full report now >>

This article was syndicated by Elliott Wave International and was originally published under the headline Forex: "Elliott wave analysis helps me cut to the chase.". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.