Stock Market Bubble Balloons in Search of Needles

Stock-Markets / Stock Markets 2015 Sep 28, 2015 - 06:07 PM GMTBy: John_Mauldin

I love waterfalls. I’ve seen some of the world’s best, and they always have an impact. The big ones leave me awestruck at nature’s power. It was about 20 years ago that I did a boat trip on the upper Zambezi, ending at Victoria Falls. Such a placid river, full of game and hippopotamuses (and the occasional croc); and then you begin to hear the roar of the falls from miles away. Unbelievably majestic. From there the Zambezi River turns into a whitewater rafting dream, offering numerous class 5 thrills. Of course, you wouldn’t want to run them without a serious professional at the helm. When you’re looking at an 8-foot-high wall of water in front of you that you are going to have to go up (because it’s in the way); well, let’s just say it’s a rush.

I love waterfalls. I’ve seen some of the world’s best, and they always have an impact. The big ones leave me awestruck at nature’s power. It was about 20 years ago that I did a boat trip on the upper Zambezi, ending at Victoria Falls. Such a placid river, full of game and hippopotamuses (and the occasional croc); and then you begin to hear the roar of the falls from miles away. Unbelievably majestic. From there the Zambezi River turns into a whitewater rafting dream, offering numerous class 5 thrills. Of course, you wouldn’t want to run them without a serious professional at the helm. When you’re looking at an 8-foot-high wall of water in front of you that you are going to have to go up (because it’s in the way); well, let’s just say it’s a rush.

If there were rapids like this in the United States, it’s doubtful professional outfits could get enough liability insurance to make a business of running them. In Zimbabwe we just signed a piece of paper. Our guides swore nobody had ever been lost – well, except for a few people who disobeyed the rules and leaped in the water in the calm sections because it was 100° out. That’s where the crocs are. They promised we wouldn’t run into any in the rapids, which was good. More than a few of us got dumped in the water trying to run the rapids, but they had teams of kayakers who got you out quickly. The canyon below the falls is unbelievable, and below that is the even more impressive Bakota Gorge. And yes, you then had to walk to the top of the canyon up a switchback trail to get home. I would do it all over again in a heartbeat, but I would spend at least three months training for the hike out. That was most definitely not in the full-disclosure-of-risks one-page piece of paper.

It would be hard to miss an analogy to the stock market. Everything’s peaceful and calm, you’re drinking some fabulous wine, eating some fantastic fresh game and fish, looking at all the beautiful animals as you drift easily with the current. Anybody can steer the boat in a bull market. Until the rapids hit and the bottom falls out.

As an aside, while the large waterfalls are majestic and awe-inspiring, the smaller ones are more hypnotic. I love the sound of falling water. I could listen for hours.

The one place I don’t like to see waterfalls is on stock charts. Those leave me awestruck at the market’s power. They do have the power to focus the mind, however, especially when we own the shares that just went over the falls.

The US stock market is having the most turbulent year we’ve seen in a while. It’s not terrible by historical standards, but we have a full quarter to go. And next week it’ll be October, a month in which the stock market has run into trouble before. With all that in mind, this week I want to take a look at where stocks stand and maybe offer a thought or two about the events that could bring us to the next waterfall.

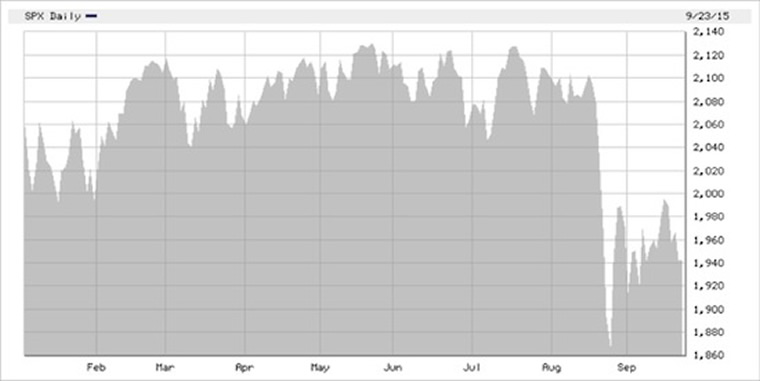

Here is how the waterfall looks so far this year. Barely a 10% move peak to trough, and it lasted for just a few days. We see a lot of jostling, followed by the harrowing plunge in August, and then a partial (less than halfway) recovery. Where do we go from here?

Let’s start with the macro view. Back in July I showed you some research that I did with Ed Easterling of Crestmont Research. This was before the China sell-off accelerated into the headlines, so it is very interesting to read again in hindsight. (See “It’s Not Over Till the Fat Lady Goes on a P/E Diet”).

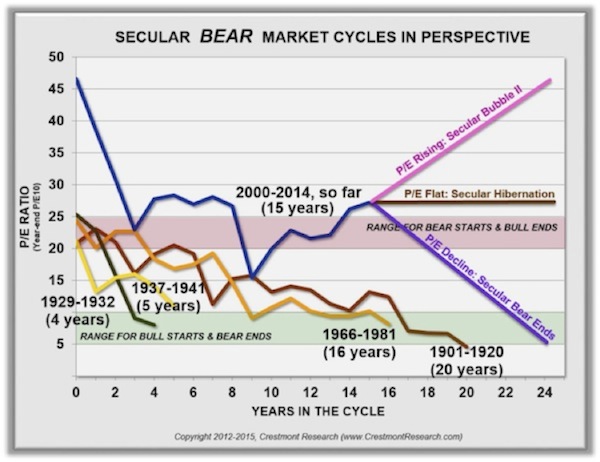

Our view is that we are still in a secular bear market, and have been since the 2000 Tech Wreck. You may find that view surprising, since the benchmarks have roughly tripled since the 2009 low. Our analysis looks at price/earnings ratios to identify when bull and bear markets begin or end. P/E multiples were close to 50 in year 2000. In order for that bear market to end, they needed to drop into the very low double-digit or single-digit range, which has been the signal for the end of every long-term secular bear cycle for over 100 years. That hasn’t happened during the intervening 15 years.

Can a secular bear market last 15 years? Yes. Some have lasted even longer, like 1966-1981 and 1901-1920. So this one isn’t unprecedented. And please note that the long-term secular cycles can have cyclical movements inside them. Again, we see secular cycles in terms of valuation and the shorter cyclical cycles in terms of price. (Unless this time is different) long-term secular bear market cycles will always end in a period of low valuations.

Currently, P/E ratios (or any other valuation metric you want to use) are not low enough to provide the boost that typically starts a new bull market. They were closer in 2009 than today, but have never dipped into the area that would mark the end of the bear market and the onset of the new bull. We’re still riding the same bear.

What’s taking so long? Our best guess is that stocks were so richly valued at the 2000 peak that it is taking the better part of a generation to work off that excess. In order for this bear to end – and the new bull cycle to begin – valuations need to tumble. That can happen only if prices drop considerably or earnings rise without pulling prices higher.

Obviously, there can be many trading opportunities within a secular bull or bear cycle, but Ed’s research says we have three long-term options from here.

- If P/E ratios decline toward 10 or below, we will be near the end of this secular bear. A new bull cycle should follow.

- If P/E ratios stay near where they are, we will be in what Ed calls “secular hibernation.” This would mean a lot of sideways price movement, with dividends having to deliver the lion’s share of stock market returns.

- If P/E/ ratios rise further, we will go back into the kind of “secular bubble” that created the Tech Wreck. I recall those years vividly, and I would rather not relive them.

Now, combine this market situation with what appears to be a global economic slowdown. China is a big factor, but not the only one. The entire developed world is in slow-growth mode. At some point it will likely dip into recession territory. Canada is already there. I don’t think they will be alone for long. Japan and Europe are weak.

I think the next true move to lower valuations will be a cyclical bear market combined with a recession. Can the stock market hold on to today’s valuations in a recession? Nothing is impossible, but I wouldn’t bet the farm on it, either. I can’t find an example of stock prices and valuations staying in place in the midst of a recession. Prices can fall slowly or they can fall fast, but I feel confident they will do one or the other.

Our old friend Robert Shiller popped up last week in a Financial Times interview. Shiller is the father of CAPE, the cyclically adjusted price/earnings multiple, which looks back ten years to account for earnings cyclicality. He is also a Yale professor and a Nobel economics laureate.

Shiller’s CAPE has been saying for several years that stocks are seriously overvalued.

In his FT interview, Shiller dropped the “B” word:

It looks to me a bit like a bubble again, with essentially a tripling of stock prices since 2009 in just six years and at the same time people losing confidence in the valuation of the market.

When will the bubble burst? Shiller is less helpful there. He said the recent bout of volatility “shows that people are thinking something, worried thoughts. It suggests to me that many people are re-evaluating their exposure to the stock market. I’m not being very helpful about market timing, but I can easily see aftershocks coming.

Now, if you aren’t very confident about timing, it’s arguably better not to use words like bubble and aftershock. You can be sure the media and analysts will jump all over them, just as I’m doing right now.

In any case, Ed Easterling and Bob Shiller reach similar conclusions (though for different reasons). Neither sees a very bullish future, though both are unsure about timing. So when will we know the end is nigh? Sadly, we probably won’t, unless we begin to see signs that a recession is building in the United States.

As the old proverb goes, no one rings a bell at the top. The same applies at the bottom.

Let’s imagine the stock market as a whole bunch of balloons. One or two can pop loudly and everyone will jump and then laugh it off. You now have deflated debris hanging from your string.

Eventually, enough balloons will pop that the weight of the debris overwhelms the remaining balloons’ ability to keep the string aloft. Then your whole bunch falls down.

The last balloon to pop wasn’t any bigger or smaller than the others; it just happened to be last. In like manner, some kind of catalyst sets off every market collapse. It is usually something that would be survivable by itself. The plunge occurs because of all the previous balloons that bit the dust, but pundits and the media always like to point the finger at the most recent event.

So, if Easterling and Shiller are right, balloons are popping and making investors nervous, but there’s not enough damage yet to drag down the whole bundle. What are some candidates for the last balloon?

A Chinese “hard landing” is probably the biggest, most obvious balloon right now. And actually, China is big enough for multiple balloons. Their stock market downturn produced one pop already. Beijing’s currency adjustment may have been another one.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.