Economic Channels of Distress - Fourth Turning Crisis of Trust

Economics / US Economy Sep 28, 2015 - 12:39 PM GMTBy: James_Quinn

In Part 1 of this article I discussed the catalyst spark which ignited this Fourth Turning and the seemingly delayed regeneracy. In Part 2 I pondered possible Grey Champion prophet generation leaders who could arise during the regeneracy. In Part 3 I will focus on the economic channel of distress which is likely to be the primary driving force in the next phase of this Crisis.

In Part 1 of this article I discussed the catalyst spark which ignited this Fourth Turning and the seemingly delayed regeneracy. In Part 2 I pondered possible Grey Champion prophet generation leaders who could arise during the regeneracy. In Part 3 I will focus on the economic channel of distress which is likely to be the primary driving force in the next phase of this Crisis.

There are very few people left on this earth who lived through the last Fourth Turning (1929 - 1946). The passing of older generations is a key component in the recurring cycles which propel the world through the seemingly chaotic episodes that paint portraits on the canvas of history. The current alignment of generations is driving this Crisis and will continue to give impetus to the future direction of this Fourth Turning. The alignment during a Fourth Turning is always the same: Old Artists (Silent) die, Prophets (Boomers) enter elderhood, Nomads (Gen X) enter midlife, Heroes (Millennials) enter young adulthood -- and a new generation of child Artists (Gen Y) is born. This is an era in which America's institutional life is torn down and rebuilt from the ground up -- always in response to a perceived threat to the nation's very survival.

For those who understand the theory, there is the potential for impatience and anticipating dire circumstances before the mood of the country turns in response to the 2nd or 3rd perilous incident after the initial catalyst. Neil Howe anticipates the climax of this Crisis arriving in the 2022 to 2025 time frame, with the final resolution happening between 2026 and 2029. Any acceleration in these time frames would likely be catastrophic, bloody, and possibly tragic for mankind. As presented by Strauss and Howe, this Crisis will continue to be driven by the core elements of debt, civic decay, and global disorder, with the volcanic eruption traveling along channels of distress and aggravating problems ignored, neglected, or denied for the last thirty years. Let's examine the channels of distress which will surely sway the direction of this Crisis.

Channels of Distress

"In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability - problem areas where America will have neglected, denied, or delayed needed action." - The Fourth Turning - Strauss & Howe

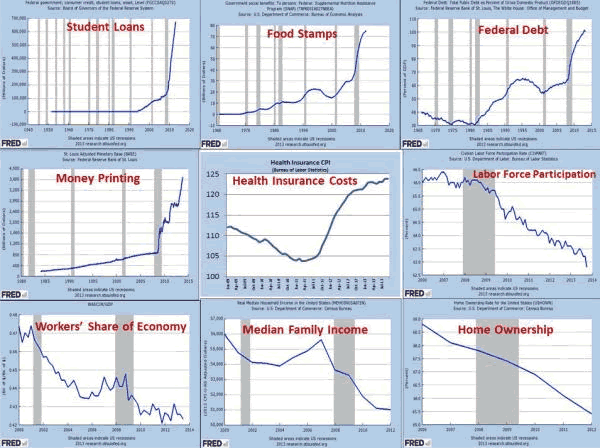

Economic distress

Despite incessant corporate fascist propaganda, disguised as positive government economic data, the economic distress for the majority of Americans and majority of the world is soul crushing. The nine charts in the visual below demolish any happy talk about a recovering economy and return to normalcy. They portray a crisis level economic condition. The financial stress on average American families is at punishing levels, masked by the prodigious amount of debt doled out by the government and their Wall Street co-conspirators.

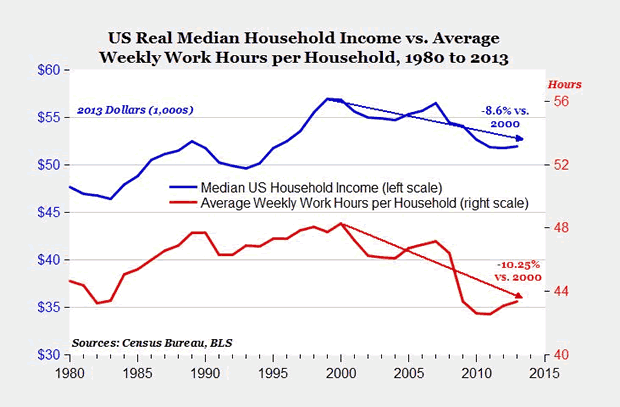

Millennials are buried under $1.3 trillion of student loan debt, with $500 billion of it doled out by the Federal government since 2009 as a ploy to reduce the reported unemployment rate and artificially stimulate spending, to provide the appearance of economic recovery. The falsity of the supposed recovery is borne out in a labor participation rate that is the lowest since 1977, with participation amongst 25 to 54 year olds the lowest in history. With real median household incomes stuck at 1989 levels and far below 2007 peak levels, the stress on middle class families to just pay their monthly bills is intense.

The 2008 Wall Street created fraudulent subprime mortgage debacle which led to millions of foreclosures, non-existent wage growth, young families enslaved in student loan debt, and the Wall Street hedge fund engineered 30% increase in home prices, has resulted in home ownership falling to historic lows and still falling. This is the result of ownership policies, programs and schemes pushed by Democrat and Republican politicians and executed by greedy Wall Street institutions, generating hundreds of billions in fees, interest and profits.

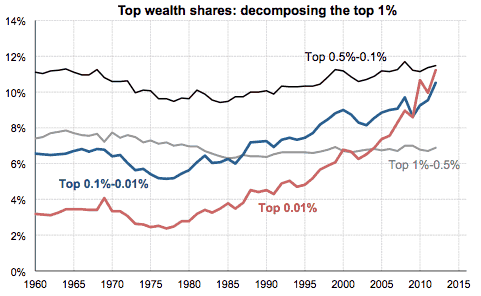

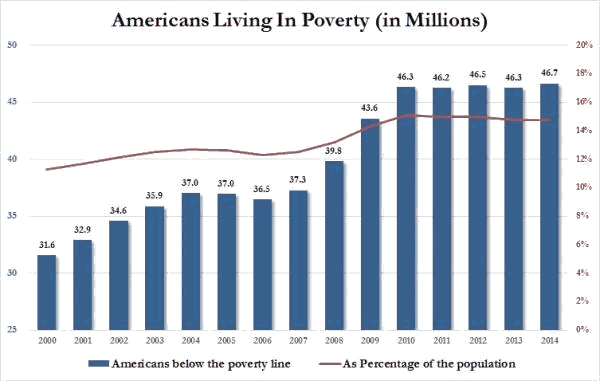

Clearly there is no distress among the .1%, as they summer at their Hamptons beach estates gorging on caviar and toasting their financial brilliance (free Fed money) with $1,000 bottles of Dom Perignone, and bid NYC penthouse real estate prices to astronomical levels. But, as the government apparatchiks at the BLS, BEA, and Census Bureau have reported positive economic data month after month since 2009, the number of people on food stamps has grown from 34 million to 46 million over this same time frame. As the middle class and poor have gotten poorer, the .1% and particularly the .01% have accelerated their capture of the national wealth.

The distress of the lower classes is self-evident and confirmed by a poverty rate of 14.8%, up from 12.5% in 2007, while the middle class has borne the brunt of an Obamacare plan written by paid lobbyists for the health insurance industry, Big Pharma, and hospital corporations. The promised $2,500 per family savings have not materialized, as health insurance premiums have increased by double digits for the last five years and small businesses have stopped covering employees. In reality, since 2008, average family premiums have climbed a total of $4,865. Even the few million Americans added to the health insurance roles are stuck with limited choices and deductibles of $5,000. More people were kicked out of existing employer healthcare plans than were newly added.

The two charts which reveal the true level of economic distress are the Federal Debt and Money Printing charts. We've accumulated more debt as a nation in the last seven years ($8 trillion) than we did in the first 219 years of this once proud Republic. We continue to add $1.6 billion per day to our $18.3 trillion national debt. This doesn't even take into consideration the $200 trillion of unfunded liabilities being left to future generations.

The Fed has printed $3.5 trillion out of thin air in the last six years while keeping interest rates anchored at 0% for their Wall Street owners, with the net impact of punishing senior citizens and other risk averse savers while further enriching their gambling casino owners who dictate the monetary policy for the world. As widowed grandmothers across the land have seen their life sustaining interest income evaporate, even the downwardly manipulated CPI has risen 14% since 2008. Using a real inflation measure, most Americans have seen their daily living expenses rise by more than 30% since 2008, but Yellen and her cronies yammer about deflationary fears.

Economic distress intensifies by the day for average American household as their real income has been falling for 15 years, while the cost of food, energy, healthcare, education, rent, housing, and vehicles have soared. Government imposed property taxes, sales taxes, income taxes, fees, and tolls have risen exponentially over this time frame as the parasite sucks the host dry. Millions of households have been lured into debt by the Wall Street debt machine and their corporate media mouthpieces as consumer debt has grown from $1.5 trillion to $3.4 trillion since 2000, and mortgage debt has grown from $6.5 trillion to $13.5 trillion.

The extreme distress felt by households has been caused by their foolish choice to try and maintain their lifestyles by replacing declining income with debt. They are now enslaved by the chains of $1.3 trillion in student loan debt, $1.1 trillion of auto loan debt, $1 trillion of credit card debt, and $13.5 trillion of mortgage loan debt. Has keeping up with the Joneses been worth it? The stress of meeting the monthly obligations with declining income has become unbearable for many.

The continued decline in real household income reveals the falsity of the unemployment propaganda disguised as legitimate data. The decline in unemployment from 10% in 2009 to 5.1% today is a complete and utter lie. Since 2008 there are 4 million more Americans employed, while 15 million working age Americans have supposedly left the workforce, but the government expects us to believe the unemployment rate is lower today than it was in 2008. Using a consistent labor force participation rate of 66% (where it stayed from 2003 through 2008), the unemployment rate would be over 10%. Using the BLS methodology used prior to 1994, real unemployment exceeds 20%. Those figures support the declining household income story.

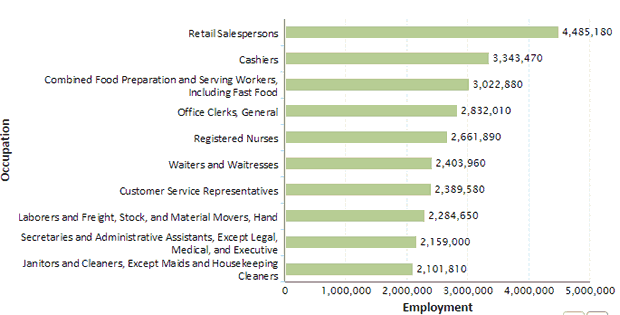

Everyone has heard the president boast about the 10 million jobs added since 2009. The politicians like to talk about quantity, but aren't so keen on discussing quality. The chart below provides the facts regarding jobs added since the recession lows. The top four categories pay less than $10 per hour. This so called economic recovery is being driven by low paying, no benefits, services jobs. These facts also support the declining household income state of affairs.

With a true unemployment rate above 10% and most new jobs paying $10 an hour, it is understandable to an awake, non-delusional citizen why retail sales remain pathetic and national retailers have stopped expanding and begun closing outlets. This is just what the corporate fascist Deep State wants. They want the proletariat, reliant upon debt to sustain their materialistic driven lifestyles and the lower class peasants dependent upon the scraps handed to them by a government, reliant on central bankers to keep the house of cards from collapsing.

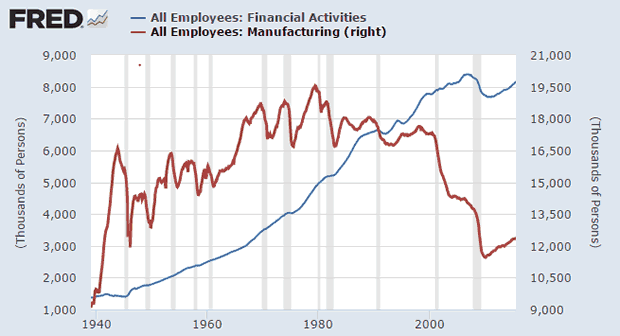

The American economy has been gutted. The financialization of our economy began around 1980 and accelerated after the passage of NAFTA in 1994 and the repeal of Glass Steagall in 1999. There has been a giant sucking sound of manufacturing jobs leaving the U.S., replaced by purveyors of paper, derivatives gamblers, and high frequency traders on Wall Street. Producing goods has been replaced by scamming muppets and peddling debt to the masses so they can consume.

We've been eating our seed corn for the last 35 years and there is nothing left to sow. We allowed American jobs and production to be replaced by cheap foreign labor and cheap foreign produced products, financed by consumer debt. We allowed mega-corporations and Wall Street banks to capture the economic system, financial markets, judicial, legislative, and executive branches, along with the mainstream media, thereby subjugating the best interests of the country to maximizing profits for the .1%.

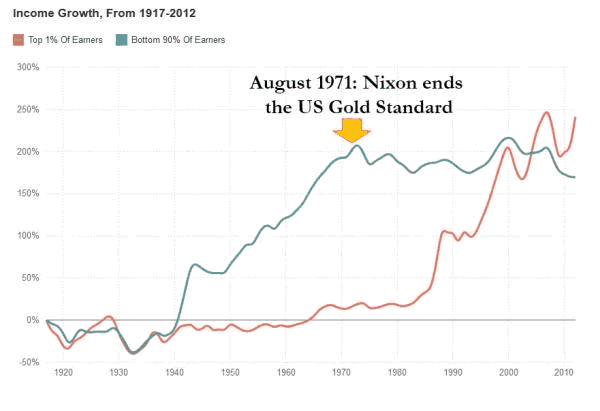

The distress of the working middle class has been growing since the early 1970s after Nixon closed the gold window and allowed central bankers and politicians the freedom to print fiat and make unfunded promises to voters. From the end of World War II until 1971 the working class reaped the income gains as their standard of living steadily increased. Since 1971 the income growth of the working class has declined, while the income growth of the top 1% has soared. This was mainly driven by the .1% in the financial class who produced nothing but misery for the bottom 90%.

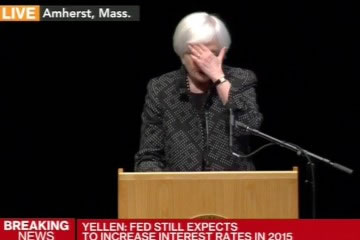

Unbridled greed and an unquenchable thirst for more and more are the hallmarks of the sociopathic oligarchs who are like blood sucking leeches on the dying carcass of a once great nation. Once the dollar was no longer backed by gold, the ultimate death of the American empire became a forgone conclusion. The weight of lies is wearing on the oligarchs. The Federal Reserve Chairwoman physically falters while spreading monetary falsehoods and the speaker of the house suddenly resigns as he knows the end is drawing near.

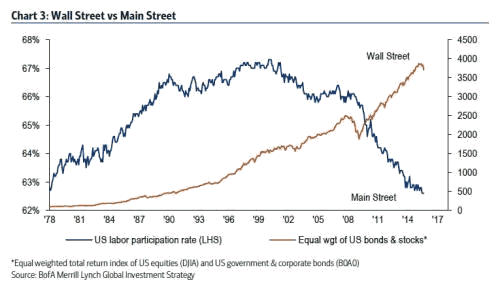

Every "solution" the ruling class has implemented since Wall Street blew up the global financial system in 2008 has been sold to the public as beneficial to the people on Main Street. It has slowly dawned on the inhabitants of Main Street that Bernanke, Yellen, Paulson, Geithner, Dodd, Frank, Obama and all D.C. politicians have screwed them. As Main Street's distress has accelerated, the wealth of anyone associated with Wall Street has soared to obscene levels.

This distress is revealing itself in the poll numbers of Donald Trump and Bernie Sanders. The flaunting of their immense wealth, political influence, and smug superiority has angered a vast swath of the citizenry. The economic distress perpetrated upon the people by the moneyed interests will be the driving force behind the next phase of this Fourth Turning. The current state of affairs has been seen before, during the previous Fourth Turning about 80 years ago.

"It has always seemed strange to me...The things we admire in men, kindness and generosity, openness, honesty, understanding and feeling, are the concomitants of failure in our system. And those traits we detest, sharpness, greed, acquisitiveness, meanness, egotism and self-interest, are the traits of success. And while men admire the quality of the first they love the produce of the second." - John Steinbeck - Cannery Row

The solution is not to let politicians redistribute the wealth from the rich to the poor. Crony capitalism must be replaced by true free market capitalism, practiced with integrity, fairness, principled conduct, intelligence, and high moral standards. Profits generated by corporations are not evil, but seeking profits at any cost to society is reckless, shortsighted and immoral. Capitalism without capital is destined for failure. When corporate CEOs, Wall Street bankers, and shady billionaires exercise undue influence over the financial, political and judicial systems, their short-term quarterly profit mindset and voracious appetite for riches override the best interests of the people and create a sick, warped, repressive society. Today our system is in the grasp of psychopaths whose hubris and myopic focus on enriching themselves will ultimately be their downfall.

"This financial system is sick, and is unfortunately and at an increasing pace approaching terminal. I think the problem is due to a simple failure or 'lack of character.' It is an old story, and a perennial favorite of the madness of the dark powers of this world. Character provides stability and confidence. When character fails, there is uncertainty and fear. This passive-aggressive posture towards equities in general and risk in particular is because of the lack of reform to create a sustainable, stable recovery fueled by organic demand for growth based across a broader participation amongst the consumers. You cannot have it both ways. You cannot subject the great part of a people to fear, repression, and enforced deprivation on one hand, and expect them to flourish and consume freely on the other." - Jesse

In Part 4 I will assess the other channels of distress (social, cultural, technological, ecological, political, military) that are likely to burst forth with the molten ingredients of this Fourth Turning, and potential climaxes to this Winter of our discontent.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.