Why Stock Investors Should Be Praying for a Interest Rate Hike

Stock-Markets / Stock Markets 2015 Sep 27, 2015 - 11:47 AM GMTBy: Investment_U

Bob Creed writes: A little over a week ago, the Fed announced it wasn’t raising rates. Our next chance of a hike is October... more likely, December.

Bob Creed writes: A little over a week ago, the Fed announced it wasn’t raising rates. Our next chance of a hike is October... more likely, December.

Perhaps you breathed a sigh of relief when you heard the news. But we ask... Would an increase be so awful?

Most people think a hike is bad news. It will kill our sluggish economy, they argue. But if and when rates get lifted, these folks will miss out on a big opportunity to profit. You only have to look at the past to see why.

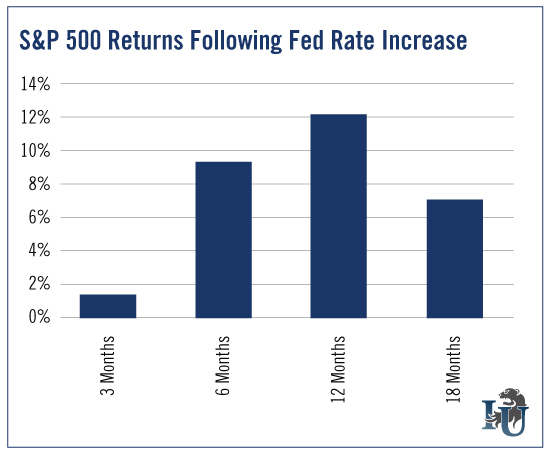

This week’s chart takes a look at how the market reacted the last six times the Fed increased rates. To make this comparison as accurate as possible, we only looked at increases that came after a rate decrease.

As you can see, history shows that the anxiety surrounding higher rates - and its supposed negative impact on the markets - is unwarranted.

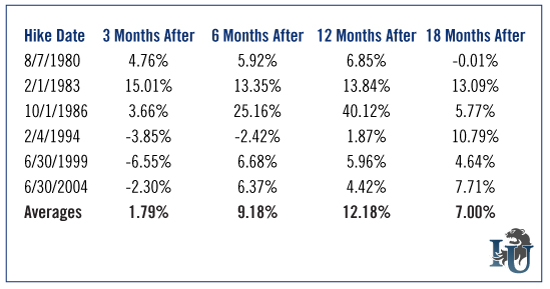

The numbers are broken out in the table below.

In the three-, six-, 12- and 18-month periods after a rate hike, the S&P has averaged positive returns. In fact, a year out, the index is showing more than a 12% gain. So while the initial market drop may seem unnerving, history has shown that it’s followed by a strong rebound.

Assuming Yellen is serious about raising rates before year’s end, now is the time to create your shopping list of stocks to buy if there’s a dip. We crunched the numbers, and it looks like small caps may provide the most bang for your buck.

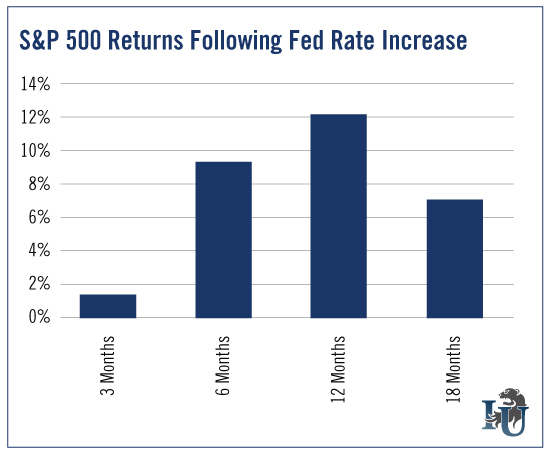

To illustrate our point, we present - you guessed it - another chart.

This one shows the performance of the Russell 2000, which tracks the performance of small cap stocks following a rate hike. You can play it directly through the Vanguard Russell 2000 ETF (Nasdaq: VTWO). Amazingly, one year after a Fed increase, you’re looking at an average return of 15.60%.

Of course, no one can know for sure what the next rate hike will bring. But at Investment U, we prefer to use history as our guide. And right now, history tells us a rate hike wouldn’t be all that bad - especially if you know how to play it.

Have thoughts on this article? Leave a comment below.

Editorial Note: If you’ve watched the mainstream press, you’ve heard all sorts of speculation about the Fed. We don’t pay attention to it. When we do wish to consult the market’s sharpest minds, we don’t turn on the TV. Instead, we turn to famed investors like Jim Rogers, Bill Gross and John Templeton. The time-tested strategies used by these titans have generated tens of billions over the years - through rate increase after rate increase.

Not long ago, we compiled their top-yielding strategies - plus those used by Jesse Livermore, Leon Levy, Jeremy Grantham and more - all in one place. We call it Secrets of the Masters. It’s available here in the Investment U Bookstore.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.