Stock Market Primary Wave IV Inflection Point

Stock-Markets / Stock Markets 2015 Sep 27, 2015 - 11:16 AM GMTBy: Tony_Caldaro

The market started the week at SPX 1958. After a short-lived gap up opening on Monday to SPX 1980 the market headed lower into Thursday when hitting SPX 1909. Then after a morning low the market rallied into Thursday’s close and gapped up on Friday to hit SPX 1953. If that wasn’t enough, the market then dropped to SPX 1922 before rallying to close the week at 1932. For the week the SPX/DOW were -0.9%, the NDX/NAZ were -2.6%, and the DJ World index was -2.3%. On the economic front, reports for the week were mixed. On the uptick: Q2 GDP, consumer sentiment, the WLEI, new home sales and the FHFA. On the downtick: GDPN, durable goods, existing home sales and weekly jobless claims were higher. Next week, a busy schedule, will be highlighted by monthly Payrolls, the PCE and the Chicago PMI.

The market started the week at SPX 1958. After a short-lived gap up opening on Monday to SPX 1980 the market headed lower into Thursday when hitting SPX 1909. Then after a morning low the market rallied into Thursday’s close and gapped up on Friday to hit SPX 1953. If that wasn’t enough, the market then dropped to SPX 1922 before rallying to close the week at 1932. For the week the SPX/DOW were -0.9%, the NDX/NAZ were -2.6%, and the DJ World index was -2.3%. On the economic front, reports for the week were mixed. On the uptick: Q2 GDP, consumer sentiment, the WLEI, new home sales and the FHFA. On the downtick: GDPN, durable goods, existing home sales and weekly jobless claims were higher. Next week, a busy schedule, will be highlighted by monthly Payrolls, the PCE and the Chicago PMI.

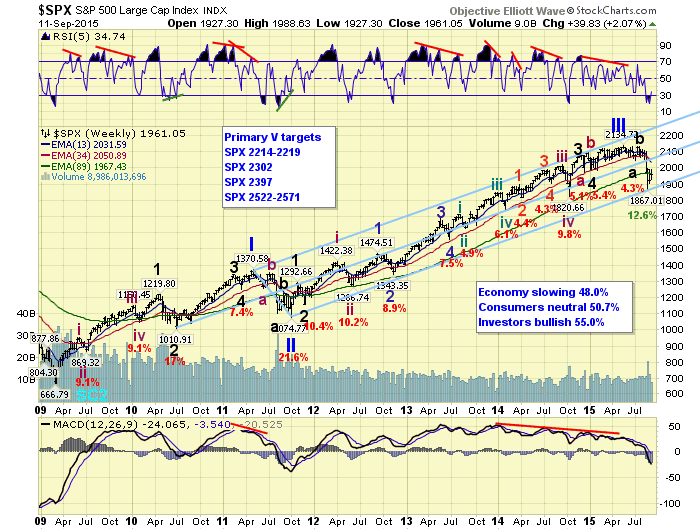

LONG TERM: bull market

Typically, during a bull market, the significant second and fourth waves, along with many others, alternate in wave structure. Alternation can occur between simple flats and zigzags, and even triangles and complex corrections. While this bull market has had many waves, what has been lacking to a great degree is alternation between those waves. This has added to making this bull market somewhat difficult to track, especially during Primary wave III.

Historically there has always been alternation between the significant second and fourth waves of a bull market. In the current bull market there should be alternation at least between Primary II and Primary IV. There was alternation between Major waves 2 and 4 of both Primary I and Primary III. In Primary I they were complex and simple, and in Primary III it was a zigzag and a flat. With this in mind Primary IV should alternate with the elongated flat of Primary II.

In recent history elongated flats have occurred twice before: in 1987 and 1998. The 1987 flat alternated with the complex double flat of 1984. The 1998 flat alternated with the simple zigzag of 1990. Since the current Primary IV correction has already had a significant decline in the DOW/NAZ/NDX we have been favoring a simple zigzag scenario. This is one of the main reasons we have been expecting Primary IV to end, with a slightly lower low, this month. A simple zigzag is already present with three major waves: A 2044, B 2133 and C 1867. Should the market not make a lower low this month we are left with two options. First, Primary IV will continue for several more months to complete a more complex correction, i.e. a double three with a zigzag and flat. Second, Primary IV already completed at the August SPX 1867 low despite the choppy advance since that low.

While the current situation is being worked out by the market we continue to see this bull market as a Cycle wave [1] consisting of five primary waves. Primary waves I and II completed in 2011, Primary III completed in mid-2015 and Primary IV either completed or is still underway. Eventually, Primary V will kick in to the upside carrying the market to all time new highs. We worked out some potential targets using SPX 1867 as the low, and have had then posted on the weekly chart above.

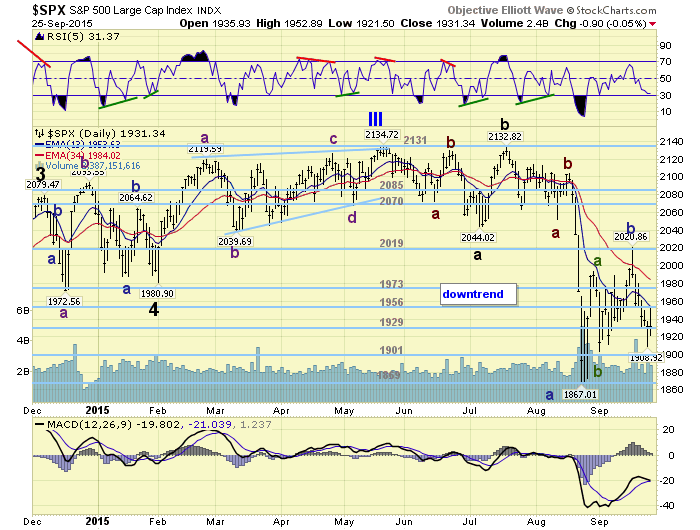

MEDIUM TERM: Primary IV reaches inflection point

As noted above, if the downtrend does not end this month it has; (1) already ended or (2) Primary IV will be more complex than originally anticipated. Let’s cover the three options.

First, downtrend ends this month. This is has been our ongoing preferred scenario. With Major waves A (2044) and B (2133) already completed we have been waiting for Major C to complete. Thus far we have had Intermediate waves A and B end by mid-August with Intermediate C underway. Minor A was the drop to SPX 1867, and Minor B the rally to SPX 2021. To complete this pattern we have been expecting an impulse wave down to the 1869 pivot range or slightly lower. Thus far it looks like the market has completed Minute waves i-ii-iii-iv with Minute v now underway. This decline from [2021] counts as follows: 1953-1980-1909-1953-1922 thus far. Since Minute iii (1980-1909) is larger than Minute i (2021-1953), Minute v can be any length.

Second, the downtrend already ended at SPX 1867. Bill C in our OEW group has been tracking a count that suggests the market is already in Primary V. If we count the SPX 1867 low as the end of Primary IV. We can count the rally to SPX 1993 as Major wave 1, then the recent decline to SPX 1909 as the end of an irregular Major wave 2 failed flat: 1903-2021-1911. Then Thursday’s/Friday’s rally to SPX 1953 would be the first wave of Major wave 3.

Third, Primary IV will extend for a few more months. If the downtrend does not end this month, (just three days to go), and August’s SPX 1867 was not the final low, then to maintain the alternation concept the correction will need to stretch out a few more months and become a complex three. Medium term support is at the 1929 and 1901 pivots, with resistance at the 1956 and 1973 pivots.

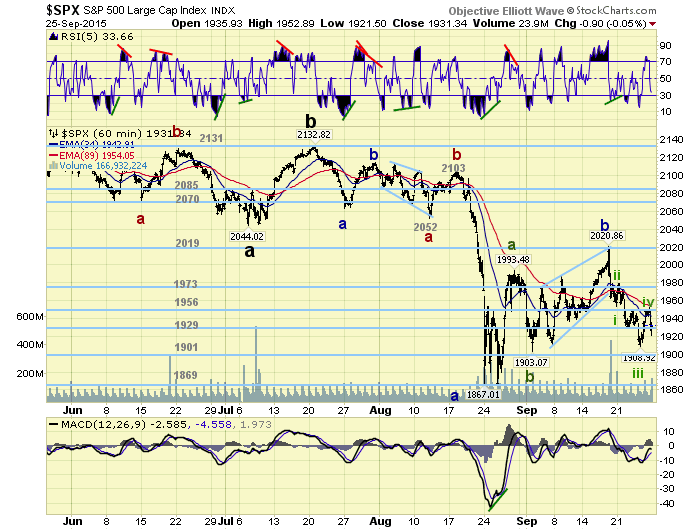

SHORT TERM

In an attempt to clarify the three potential scenarios, this week the market set up some nice parameters. The market appears to be impulsing to the downside from SPX 2021: 1953-1980-1909-1953-1922 so far. Four waves complete and the fifth wave underway from SPX 1953: 1922-1935. To keep the impulse wave going the market can not rally back to SPX 1953. If it does this would turn the SPX 2021-1909 decline into an a-b-c, which would likely support the more bullish Major 1 – 2 scenario #2 noted above. Should the market not impulse lower and enter another period of choppy activity, then scenario #3 would likely be underway. So the key level going forward is simply SPX 1953. Impulse lower, breakout above it, or go into chop mode.

Short term support is at the 1929 and 1901 pivots, with resistance at the 1956 and 1973 pivots. Short term momentum ended the week below neutral.

FOREIGN MARKETS

The Asian markets were all lower for a net loss of 2.2%.

The European markets were mostly lower for a net loss of 1.8%.

The Commodity equity group were all lower for a loss of 3.9%.

The DJ World index is still in a downtrend and lost 2.3%.

COMMODITIES

Bonds are trying to establish an uptrend but lost 0.1% on the week.

Crude is trying to establish an uptrend and gained 0.8% on the week.

Gold is also trying to establish an uptrend and gained 0.6% on the week.

The USD is trying to establish an uptrend too, this must mean something, and gained 1.4% on the week.

NEXT WEEK

Monday: FED governor Tarullo gives a speech at 5:15AM, Personal income/spending and PCE prices at 8:30, then Pending home sales at 10am. Tuesday: Case-Shiller and Consumer confidence. Wednesday: the ADP, Chicago PMI, and a speech from FED chair Yellen and FED governor Brainard. Thursday: weekly Jobless claims, ISM manufacturing, Construction spending and Auto sales. Friday: monthly Payrolls, Factory orders, and a speech from FED vice chair Fischer. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2015 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.