The Stocks Bull Market is Over

Stock-Markets / Stocks Bear Market Sep 24, 2015 - 02:02 PM GMTBy: Casey_Research

By Justin Spittler

By Justin Spittler

Stocks had a horrible day Tuesday…

The S&P 500 lost 1.23%. The Dow Jones Industrial Average lost 1.09%.

Indices around the world also fell…

The Euro Stoxx 600, which tracks 600 of Europe’s biggest companies, lost 3.12%. Germany’s DAX lost 3.80%. Japan’s Nikkei 225 lost 1.96%.

• Casey Report readers know this is part of our “script”…

The S&P 500 plunged into its first correction since 2011 on August 23. A correction is when an index falls 10% or more from its last high. In total, the S&P 500 plunged 11% in 6 days.

In the latest issue of The Casey Report, E.B. Tucker told his readers that this big drop marked the end of the 6-year bull market in U.S. stocks. He wrote:

We believe the era of asset prices soaring on a wave of easy credit is over. Last month’s major stock market decline is the start of a very tough time for stocks and the economy…

This bull market is unraveling because it was built on easy money. E.B. explains how the Federal Reserve’s easy money policy has propped up the price of almost everything.

The Fed’s easy money policy has lifted the price of just about every asset over the past six years. Cars, luxury watches, art, boats…just about everything that’s for sale costs more than it did a couple years ago. That’s especially true of the stock market.

The Fed cut its key interest rate to effectively zero during the last financial crisis. And it’s kept it there ever since. Low interest rates were supposed to boost the economy. But they’ve also pushed up the price of stocks and encouraged reckless borrowing, as E.B. explains:

By making enormous amounts of credit available, the Fed stoked the economy, stocks, and the housing market. Stocks tripled from their 2009 lows. Average U.S. home prices climbed 50% from their previous lows. Companies with poor credit ratings borrowed record amounts of money...far more than they did before the 2008 crisis.

E.B. went on to explain how high stock and home prices were masking a huge problem:

In 2015, the total net worth of American households reached $85 trillion, an all-time high. On the surface, things look good. But the long period of low interest rates has created an extremely dangerous situation…

By taking interest rates to zero and holding them there for nearly seven years and counting, the Fed has created bad investments and reckless speculation on an epic scale. Not billions...but trillions.

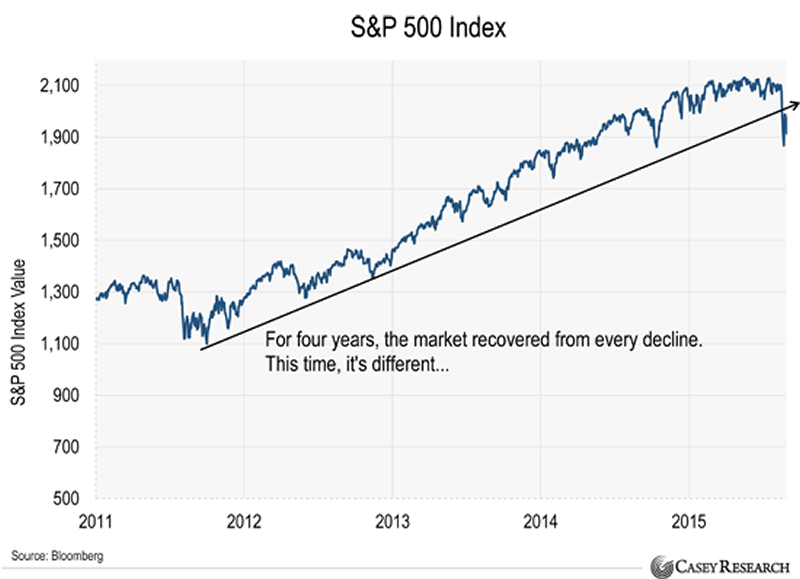

• The crash last month pushed U.S. stocks below an important long-term trend line…

E.B. explains why this is such a big deal:

A long-term trend line shows the general direction the market is heading. Many professional traders use it to separate normal market gyrations from something bigger. Think of it as a “line in the sand.”

As you can see from the chart below, there have been a few “normal” selloffs since 2011. On Friday, August 21, however, the S&P dropped below its long-term trend line for the first time in about four years.

• U.S. stocks rebounded after last month’s crash…

But E.B. told his readers the rebound was only temporary. He said the market was in the middle of a “dead cat bounce.”

E.B. thinks U.S stocks will keep falling, in part because they’re so expensive.

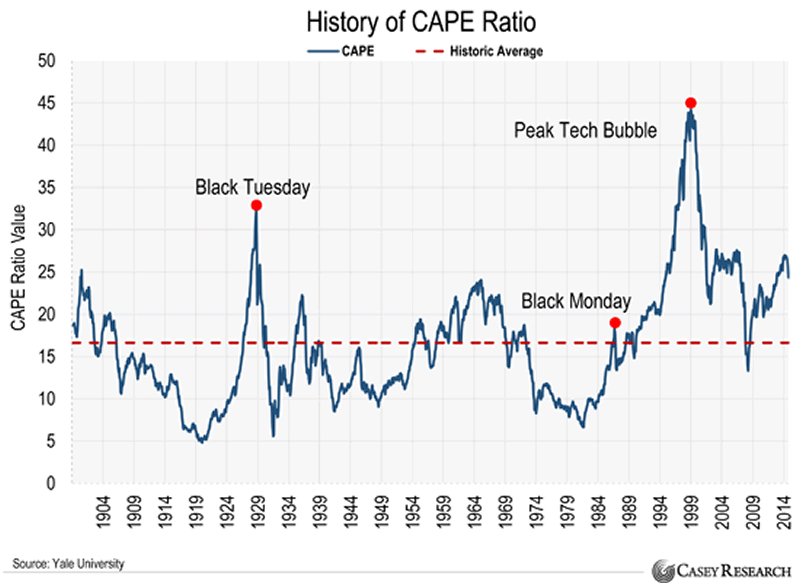

Right now, the S&P’s CAPE ratio is 24.6…about 48% more expensive than its average since 1881.

The S&P has only been more expensive a handful of times since 1881. That includes the years around the 1929, 2000, and 2007 market peaks.

CAPE is a popular valuation metric. It’s the price-to-earnings (P/E) ratio with one adjustment. Instead of using one year of earnings, it uses earnings from the past 10 years. This smooths out the effects of booms and recessions and provides a useful, long-term view of the market.

The chart below shows that the market eventually collapsed after the high-CAPE periods around the 1929, 2000 and 2007 market peaks:

• The Fed’s easy money policies have fueled a reckless debt binge...

And debt acts like dynamite when a financial crisis hits.

We’re in a very fragile situation. E.B. thinks last month’s brutal selloff in U.S. stocks was just the beginning. Things are likely to get much worse from here. But they don’t have to get worse for you…

E.B. can be your “personal guide” as this 6-year bull market continues to unravel. He’s recently shown readers how to profit from crashing oil prices and the digital revolution in money. You can read all about E.B.’s favorite investing opportunities every month in The Casey Report…

Right now we’ll send you a FREE 30-day subscription to The Casey Report when you order Going Global 2015…one of the most important books we’ve ever published. Going Global shows you how to move your wealth outside the “blast radius” of any financial crisis.

We usually sell Going Global for $99. But we’re virtually giving away a very limited number of hard copies…all we ask is that you pay $4.95 to cover our processing costs.

Why are we practically giving away so much of our best research? Because we hope that after trying what is essentially a free sample of some of our best and most valuable work, you’ll want to do business with us again.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.