U.S. Stocks: Volume, Volatility -- and What Should Come Next

Stock-Markets / Stock Markets 2015 Sep 23, 2015 - 10:51 AM GMTBy: EWI

We should soon see more "all or nothing" days in the stock market

We should soon see more "all or nothing" days in the stock market

Bespoke Investment Group uses an interesting term to describe recent stock market action: "all or nothing." In the stock market, "all or nothing" days occur when at least 80% of the stocks in the S&P 500 index advance or decline.

It's typical to see a spike in "all or nothing" days when there's a jump in market volatility. But the recent unrest in the stock market has seen a rare phenomenon:

"The frequency of all or nothing days in the S&P 500 over the last 15 trading days is unheard of," [according to a Bespoke market researcher]. "Using our breadth data going back to 1990, we have never seen a 15-trading day period where the S&P 500 saw as many or more all or nothing days than it has in the current period."

CNBC, September 10

Specifically, there were 11 of these occurrences in the 15 trading sessions.

Also, in a one-month period, the CBOE Volatility Index jumped 120%. Yet -- the panic we saw in the market in late August proves that few traders saw it coming.

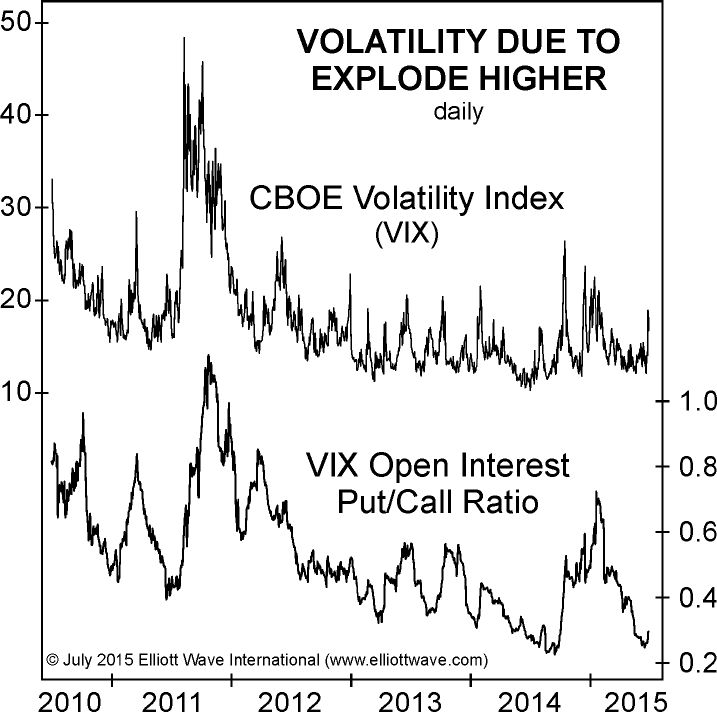

Elliott Wave International's subscribers were prepared better than most. On August 19, EWI's Elliott Wave Theorist called for a "pandemonium" in stocks, and a few weeks before, EWI's July Elliott Wave Financial Forecast offered this chart and commentary:

This chart ... shows the open interest in puts relative to calls on the VIX, which indicates the ratio of investors' open option contracts betting on a VIX move. On June 19, the ratio dropped to 0.248, its second lowest level since February 16, 2007 (0.165). ...

When the stock market's decline kicks into high gear, volatility will spike to record levels as will the p/c ratio. The era of low volatility will be replaced by head-spinning stock market moves that will shake global stock markets to their foundation.

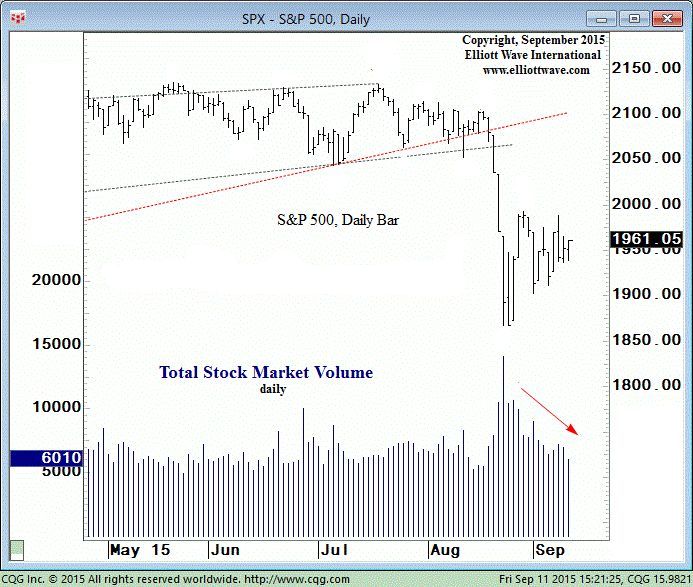

You remember what soon followed: Stocks fell hard, and on August 24, the S&P cash index saw a selloff low of 1867.01.

Since then, as our September 11 Short Term Update chart below shows [wave labels available to subscribers], trading volume has steadily contracted.

Some stock market bulls are bolstered by the lull in trading volume. But know this: Our indicators strongly suggest that now is not the time for such confidence in a continued uptrend. We expect the number of "all or nothing" days, to use Bespoke's term, to increase dramatically when volatility returns.

These are just a few examples of the insights that EWI brings their subscribers every month. See below how you can read the complete August Theorist -- FREE.

Get the full story in Prechter's Theorist -- FREEIf you invest in U.S. stocks, please stop what you're doing, sit down and pick up Robert Prechter's Aug. 19 investment forecast. Prechter published one of the most widely read investment letters of the 1980s, and he remains one of the most widely known market technicians in the world. On Aug. 19, before the latest spike in volatility, he warned of "pandemonium in the stock market" and a "stunning decline in US stock prices." Now you can read his complete, subscriber-level report that predicted what you see today. |

This article was syndicated by Elliott Wave International and was originally published under the headline U.S. Stocks: Volume, Volatility -- and What Should Come Next. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.