"Interest Rates Drive Stocks"? See 4 Charts That Tell You the Truth

Stock-Markets / Stock Markets 2015 Sep 22, 2015 - 09:42 AM GMTBy: EWI

These 4 charts show why you should be careful with this common investment "wisdom"

These 4 charts show why you should be careful with this common investment "wisdom"

Robert Prechter's monthly Elliott Wave Theorist once published a ten-part study explaining why traditional financial models failed to foresee the 2007-2009 financial crisis -- and, more importantly, why they are doomed to fail again (and again).

On Thursday (Sept. 17), the Fed decided to keep interest rates unchanged. On Friday, stocks opened down big. But before you join those who blame it on the Fed, please read this excerpt from Prechter's eye-opening study.

***************

Economic theory holds that bonds compete with stocks for investment funds. The higher the income that investors can get from safe bonds, the less attractive is a set rate of dividend payout from stocks; conversely, the less income that investors can get from safe bonds, the more attractive is a set rate of dividend payout from stocks. A statement of this construction appears to be sensible.

And it would be, if it were made in the field of economics. For example, "Rising prices for beef make chicken a more attractive purchase." This statement is simple and true. But in the field of finance such statements fly directly in the face of the evidence.

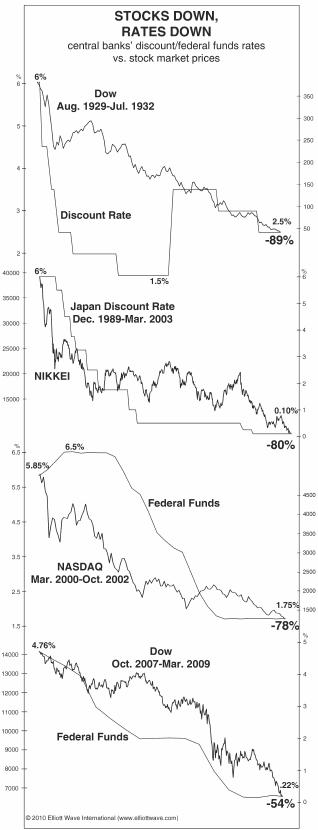

Figure 3 shows a history of the four biggest stock market declines of the past hundred years. They display routs of 54% to 89%.

Figure 3:

In all these cases, interest rates fell, and in two of those cases they went all the way to zero! In those cases, investors should have traded all their bonds for stocks. But they didn't; instead, they sold stocks and bought bonds. What is it about the value of dividends that investors fail to understand? Don't they get it?

As in most arguments from exogenous cause...one can argue just as effectively the opposite side of the claim. It is just as easy to sound rational and objective when saying this:

"When an economy implodes, corporate values fall, depressing the stock market. At the same time, demand for loans falls, depressing interest rates. In other words, when the economy contracts, both of these trends move down together. Conversely, when the economy expands, both of these trends move up together. This thesis explains why interest rates and stock prices go in the same direction."

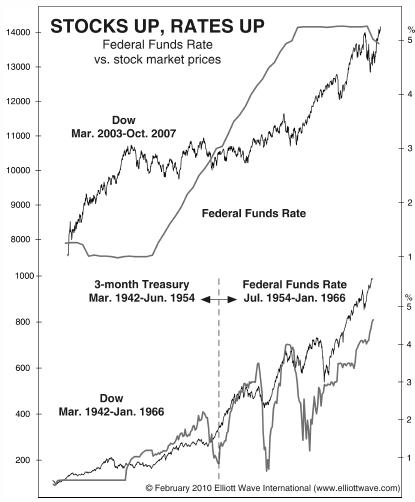

See? Just as rational and sensible. On this basis, suddenly the examples in Figure 3 are explained. And so are the examples in Figure 4. Right?

Figure 4:

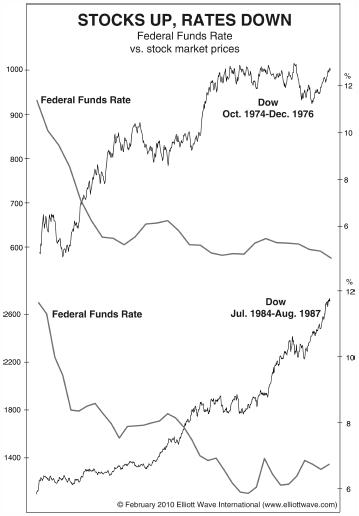

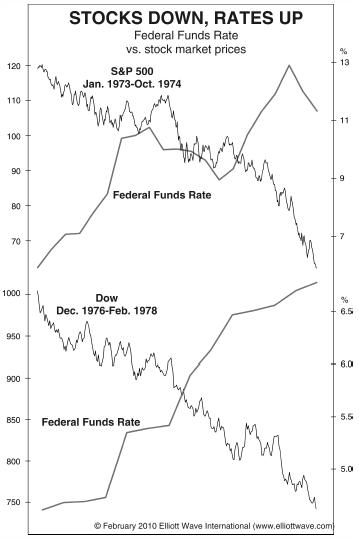

No, they're not, because, as the first version of the claim would have it, there in fact have been plenty of times when the stock prices rose and interest rates fell. This was true, for example, from 1984 to 1987, when stock prices more than doubled. And there have been plenty of times when stock prices fell and interest rates rose, as in 1973-1974 when stock prices were cut nearly in half. Figures 5 and 6 show examples.

Figure 5:

Figure 6:

At this point, conventional theorists might try formulating a complex web of interrelationships to explain these changing, contradictory correlations. But I have yet to read that any such approach has given any economist an edge in forecasting interest rates, stock prices or the relationship between them.

Download Your Free eBook: Market Myths ExposedRead about more common investment "wisdom" you should avoid in this free 33-page eBook. It takes the 10 most dangerous investment myths head on and exposes the truth about each in a way every investor can understand. |

This article was syndicated by Elliott Wave International and was originally published under the headline "Interest Rates Drive Stocks"? See 4 Charts That Tell You the Truth. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.