Liquidity May be Leaving the Markets

Stock-Markets / Stock Markets 2015 Sep 21, 2015 - 05:07 PM GMT Good Morning!

Good Morning!

SPX appears to have completed its first impulse from the high on Thursday. This morning’s Premarket shows SPX up about 12 points, and may go as high as the lower trendline of the Flag or Wedge formation at 1980.00. That would constitute a 34% retracement, which would be average for this position. But the futures are already showing weakness, so there are no assurances of that target being met.

Bloomberg leads the cheerleaders, “Investors hate stocks-- again.

Amid a six-year bull market that’s notable mainly for how little conviction there is in it, equity sentiment is plunging at a historic rate, falling by some measures at the fastest pace since Federal Reserve Chairman Paul Volcker had just finished pushing up interest rates in the 1980s. The cost to hedge against stock losses is soaring, valuations are contracting, and bearishness among professional stock handicappers is rising the most in three decades.”

While Bullard slams the same group, “When The Fed's own cheerleader-in-chief (see October 2014)slams you for cheerleading, you know it's gone too far. In a stunning 30 second clip on CNBC this morning, St. Louis Fed head Jim Bullard sent a message to "your friend Cramer", saying "The Fed cannot permanently raise stock prices, "adding, rather astonishingly to the anchors, "to have [Cramer] cheerleading for lower rates 24 hours a day is unsavory."

Meanwhile, TNX is also challenging the 2-hour mid-Cycle resistance at 21.74, in harmony with SPX.

Bloomberg opines, “Global markets don’t know what to make of the Federal Reserve anymore.

Treasuries and emerging-markets stocks fell as three Fed policy makers argued that interest rates may rise this year, days after a September increase was rejected amid financial-market volatility.”

One of the relationships that I noticed while updating my Cycles Model this weekend is that the Liquidity Cycle is now in sync with Treasury yields. Note the last Cycle low in Yields also corresponded with a lack of liquidity in stocks and bonds on August 24. We may be about to see a self-fulfilling death spiral, where stocks sell off, driving rates down, reducing liquidity even further.

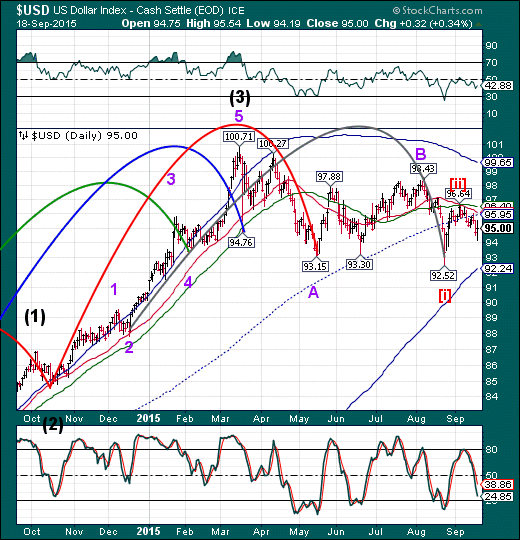

USD is probing higher at 95.64 this morning. Whether it is able to reach mid-Cycle resistance at 95.95 is in question. Along with declining liquidity, we may see a declining US Dollar through mid-October.

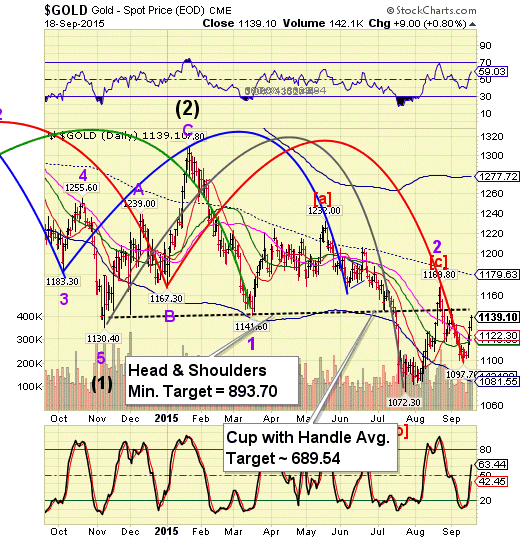

Gold futures reversed down to 1129.30 this morning. It has retraced nearly 50% of that decline in the past hour and appears capable of resuming the plunge momentarily.

Crude oil also appears to have completed a retracement bounce and may also resume its decline.

STOXX made a 30-point bounce this morning after challenging its Cycle Bottom support at 3147.29. That bounce now appears to be over and a resumption of the decline in EuroStoxx may begin later this morning.

What we may be watching is liquidity bleeding out of the patient. It appears to be on the verge of being critical again.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.