Commodities, CRB,WTIC,Copper - After The Long Dark Night, The Sun Starts to Rise...

Commodities / Commodities Trading Sep 18, 2015 - 01:06 PM GMTBy: Clive_Maund

Commodities and Emerging Markets have been crushed over the past 15 months by the dollar's strong rally. It therefore follows that if the dollar starts down again, they are going to rally, and this will happen regardless of the state of economies. The dollar should start down again if the Fed fails to raise interest rates tomorrow, and maybe even if they do, as the ensuing chain of interest rate rises cannot extend far because of the magnitude of debt.

Commodities and Emerging Markets have been crushed over the past 15 months by the dollar's strong rally. It therefore follows that if the dollar starts down again, they are going to rally, and this will happen regardless of the state of economies. The dollar should start down again if the Fed fails to raise interest rates tomorrow, and maybe even if they do, as the ensuing chain of interest rate rises cannot extend far because of the magnitude of debt.

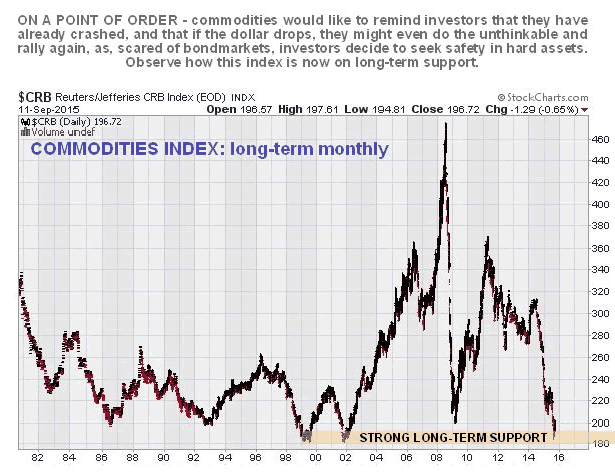

We have already seen how commodities have fallen steeply back to strong long-term support, where a cyclical low is likely to occur...

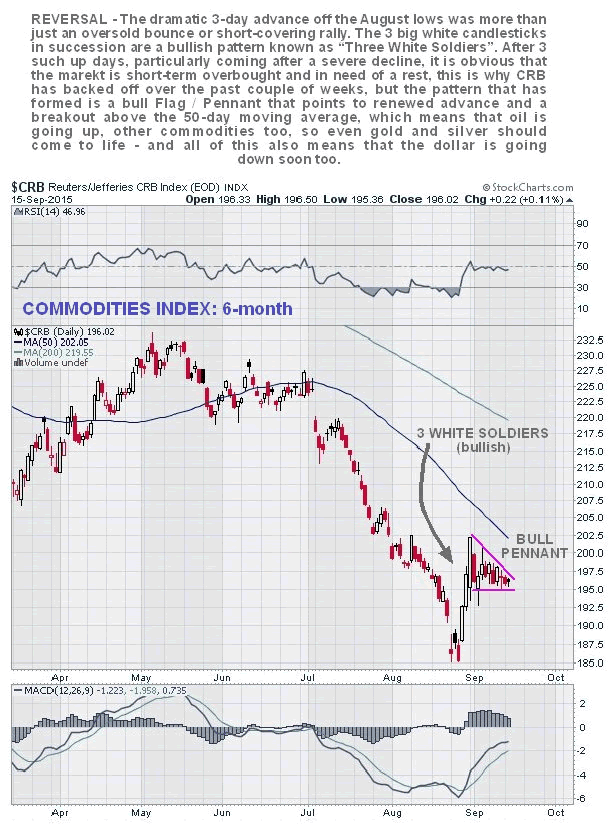

There was a surprise sharp rally in this commodity index late in August which was contained by resistance near to its falling 50-day moving average...

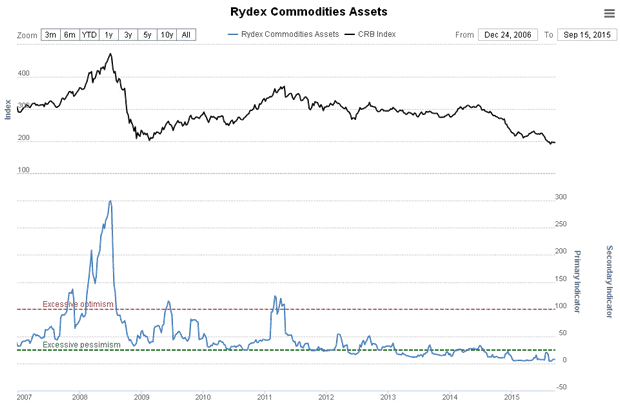

Commodities remain deeply unpopular with the normally wrong Rydex traders, as the following charts makes plain. In itself this is a positive sign for the sector...

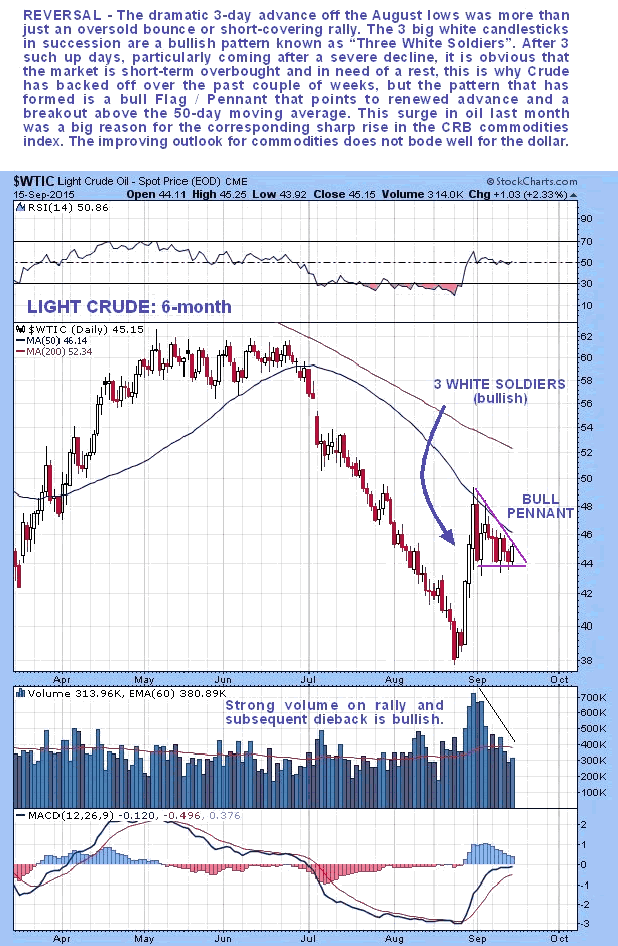

This sharp rise in the commodity index was largely accounted for a sharp $10 rise in the oil price, which seemed to come "out of the blue" but was due to a combination of extreme negative sentiment and an announcement by the Saudis that they will scale back production. Both the commodity index and the oil price look have stalled out in recent weeks and backed off beneath their respective 50-day moving averages, but with the volume dieback in oil, the pattern in both is starting to look like a bull Flag/Pennant.

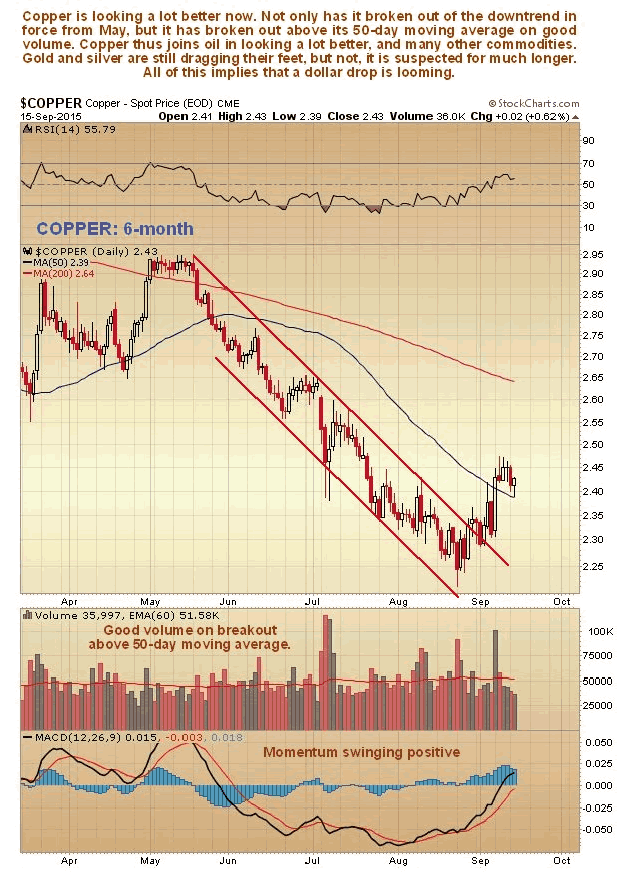

Meanwhile copper has firmed up, broken out of its downtrend and has gone on to break out above its 50-day moving average on strong volume, and is thus looking a lot more positive...

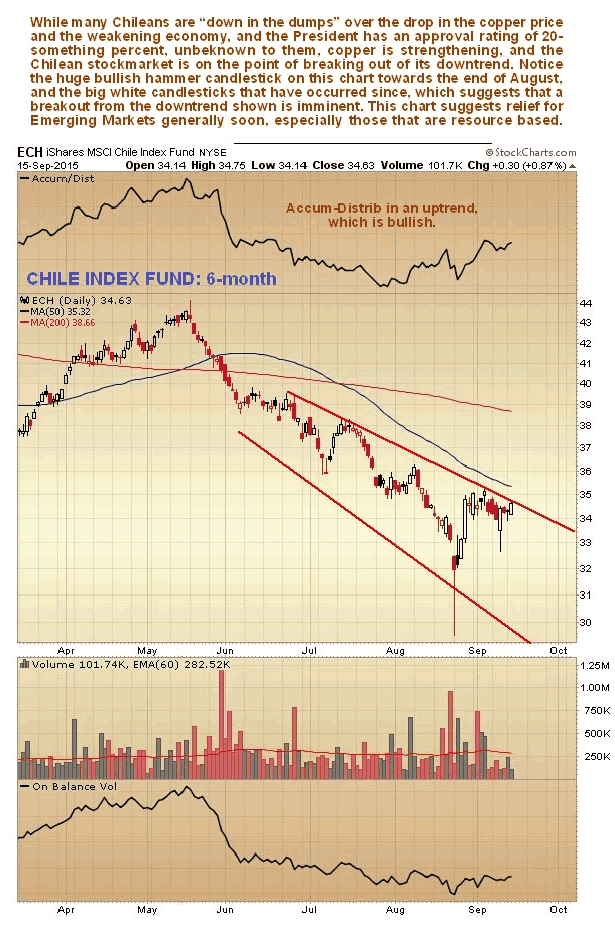

Emerging Market Chile, whose fortunes are highly dependent on the copper price, is showing signs of completing a skewed base pattern beneath its 50-day moving average. On its 6-month chart we can see a possible final low in August when a giant bull hammer occurred, followed by some large white candlesticks, with its Accum-Distrib line shown at the top of the chart advancing. This is positive action that points to a breakout above the 50-day moving average soon. Working this back it implies that copper will continue to improve, and that won't happen unless commodities in general advance, and if they do, it means the dollar is set to drop. Working this in the opposite direction, it further means that gold and silver, which have been dragging their hind quarters along the ground like a dog with a problem, are also going to advance, and since no-one but a few die-hard battle scarred goldbugs expects that to happen, the rally in gold and silver will come out of left field, catch most everyone by surprise and be big and fast.

So we are going to keep a close eye on this in coming days, on the lookout for the first signs of a blistering recovery rally in gold and silver.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.