U.S. Stocks: End of the Complacent Era?

Stock-Markets / Stock Markets 2015 Sep 15, 2015 - 07:55 PM GMTBy: EWI

Stock market bears have been conspicuously absent

Stock market bears have been conspicuously absent

August 20 was the third consecutive down day for the Dow Industrials as the index tumbled 358 points.

The U.S. stock market had managed to hover near record highs, even as other markets (oil, precious metals, housing) had long since fallen from old highs. The 34-year bull market in 30-year U.S. government bonds ended months ago.

Editor's note: You'll find the text version of the story below the video.

The prolonged optimism that created the Dow's biggest triple top in 150 years may finally be flagging. The just-published August Elliott Wave Theorist says "an era of complacency is about to come to an end."

Theorist subscribers are also reading about Fibonacci time and price relationships that appear to spell trouble for the Dow's six-plus year uptrend.

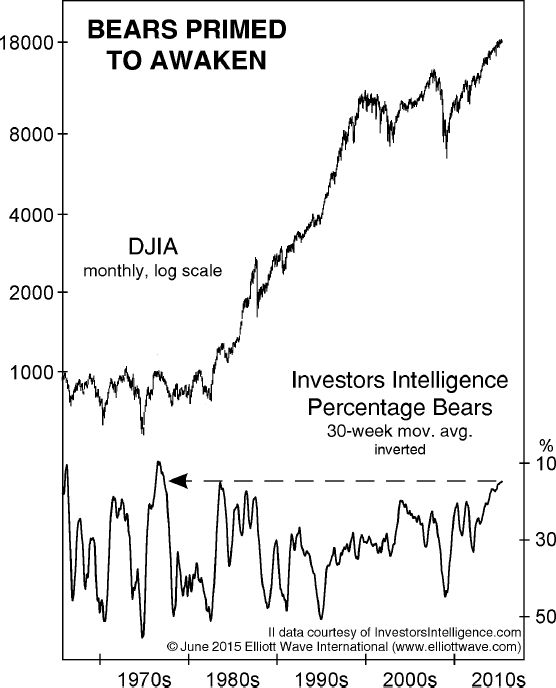

This chart from the June Elliott Wave Financial Forecast [wave labels available to subscribers] also anticipated the stock market's recent weakness:

Long-term bearishness is virtually absent. The chart shows a 30-week average of Investors Intelligence bears (inverted to align with prices) plotted beneath the Dow Jones Industrials back through 1966. Bearish advisors contracted to just 14.9% in late May, which is the lowest percentage of long-term bears since early 1977 ... .

In April, total assets in Rydex bear funds fell to $130.9 million, the lowest monthly level in 15 years.

Other indicators had reflected the market's deep complacency. The S&P 500 recently went 129 days without a single-session decline of 2% or more. And on June 19, the VIX open interest put / call ratio (indicates the ratio of investors' open option contracts betting on a VIX move) dropped to 0.248, its second lowest level since February 16, 2007.

On July 15, this headline published on NASDAQ.com:

Huge Second Half Rally Coming for Stocks

The August Financial Forecast provides another perspective on investor complacency:

In July, it reached a remarkable new extreme as bulls used complacency itself as another excuse to buy stocks. "The failure of the Greek standoff or the China stock market tumble to rupture global markets or drag down economic expectations has led to a rapid draining away of anxiety," says a major news site.

Sentiment extremes are important because markets tend to turn when most investors least expect it.

Read Prechter's entire August Theorist -- FREEIf you invest in U.S. stocks, please stop what you're doing, sit down and pick up Robert Prechter's Aug. 19 investment forecast. Prechter published one of the most widely read investment letters of the 1980s, and he remains one of the most widely known market technicians in the world. On Aug. 19, before the latest spike in volatility, he warned of "pandemonium in the stock market" and a "stunning decline in US stock prices." Now you can read his complete, subscriber-level report that predicted what you see today. Click Here to Download Prechter's 10-Page Report Now - It's FREE >> |

This article was syndicated by Elliott Wave International and was originally published under the headline (Video, 3:11 min.) U.S. Stocks: End of the Complacent Era?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.