Stocks Plunge on Greece Euro-Zone Financial Armageddon Blackmail

News_Letter / Stock Markets 2015 Sep 15, 2015 - 04:35 AM GMTBy: NewsLetter

The Market Oracle Newsletter June 30th, 2015

The Market Oracle Newsletter June 30th, 2015

Issue # 11 Vol. 9

Stocks Plunge on Greece Euro-Zone Financial Armageddon Blackmail

Dear Reader, The Syriza government that like a spoilt child keeps throwing its toys out of the euro-zone pram has been pushing Greece towards economic and financial collapse since its January election win, as Syriza continues to blackmail the euro-zone that if Greece does not get its way then they will take the euro-zone down with them, prompting markets to discount the potential contagion effect of the Greece debt default, bank run saga being replicated amongst other larger Euro-zone member states that has prompted stock markets to slide across europe and the wider world as illustrated by yesterdays Dow and FTSE plunges that have galvanised the bears into action to once more proclaim the stocks bull market end is nigh.

The reason that Tsipras is able to run his mouth with misinformation and propaganda is that the Troika has avoided telling the truth to euro-zone tax payers. The truth that Greece has made NO debt repayments, NO interest repayments, and even its banks have NOT paid a single of their own euros out to withdrawing customers for ALL of these funds have been paid for by the Euro-zone tax payers and ECB that totals over Euro 360 billion. If euro-zone tax payers were presented with the reality of what the Troika has done in their name could prompt much anger as why are much poorer people than Greeks, on lower wages, working longer hours, retiring much later than Greeks are financing the Greek relatively laid back life style in perpetuity. Not only that but Greece demands MORE, MORE, MORE bailouts without conditions, periodic 50% debt writedown's. Today's Greece operates more like Mafia crime syndicate that holds a gun to the head of euro-zone tax payers to pay up their monthly 2% VIG or else! Today's 11pm IMF Euro 1.6 billion loan repayment deadline that Syriza are busy milking to maximum propaganda extent masks the truth that Syriza is also seeking a Euro 7.2 billion VIG from the Euro-zone BEFORE Syriza Greece pays back Euro 1.6 billion to the IMF. However, the cracks are starting to show as warns EU President Juncker, that Syriza is lying to its people on the truth of Greece's proposed bailout conditions and that he has no trust left in Tsipras. Juncker in blunt language made it clear that a NO vote on the 5th July referendum (that may not even be held) would mean that Greece will be kicked out of the euro-zone. “’No’ would mean, regardless of the final question, that Greece is saying no to Europe,” European Stock Markets The UK FTSE index closed 2% lower yesterday, with worse for the German Dax off by 3.5%. Which might not sound like much but represents the latest dip in a month long slide as illustrated by the FTSE chart.

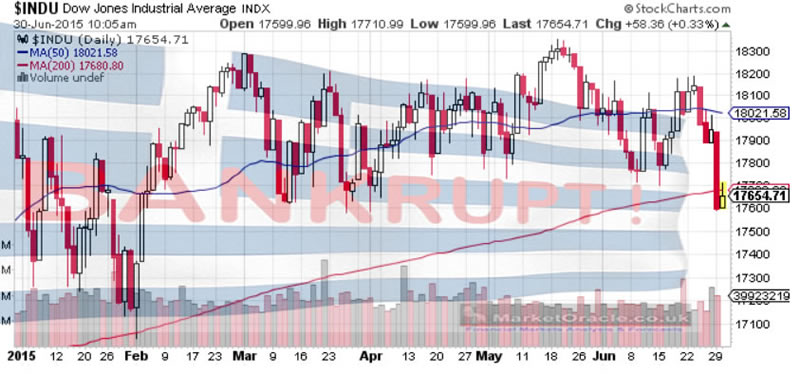

As of writing the FTSE has continued its slide today though not at such a rate of decent as yesterday which suggests a bottom of sorts is in the making. Dow Stock Market Trend Forecast 2015 The Dow matched the FTSE by also falling 2% yesterday. However today there appears to be some divergence as the Dow trades higher, though it is doubtful that the Dow will actually manage to close higher today ahead of the 11pm IMF Greek debt default deadline.

The break of the 17,700 lows has prompted much bearish commentary such as concluding that it marks the 'right shoulder' of a bearish 'head and shoulders' price pattern with many pointing to China's 20% slide for End Time signs, despite the fact that China remains a highly volatile and easily corruptible market for stocks and virtually every other asset which is why wealthy Chinese have been sending their money abroad to buy assets in the UK and US including stocks and housing. In terms of the prospects for the stock market for 2015, I turn to my in-depth analysis of 3rd February that concluded in a detailed trend forecast expectations for a volatile trading range for the first half of the year, that in the first instance targeted a new all time high before the end of March which was achieved early March. Followed by a volatile trend to culminate in a late June low at around 17,500 before the Dow resumes its bull market trend to a series of new all time highs into the end of the year. 03 Feb 2015 - Dow Stock Market Trend Forecast 2015 by Nadeem Walayat The Dow resolves to a bullish Elliott Wave pattern i.e. implies that the Dow should now embark on a trend to a new all time high, probably before the end of March! So contrary to much of the building picture so far. Thereafter suggests a summer ABC correction back down to around 17,500 to coincide with "Sell in May and Go Away". Dow Stock Market Forecast 2015 Conclusion My final conclusion is for the Dow to spend the first half of 2015 in a wide volatile trading range as it continues to unwind the 2014 bull run and sets the scene for the next series of bull runs to new all time highs. I expect the Dow to have started its bull run by early August off of an summer low and then continue into the end of the year, punctuated by an October correction low. I further expect the Dow to be trading well above 19,000 during December 2015 and probably above 19,500, before closing at around Dow 19,150 for a 7.5% gain for the year as illustrated by the following trend forecast graph for 2015.

The bottom line is don't be frightened by first half weakness, yes it may look grim if we see the Dow trading under 16k, but all it would represent is a deeper buying opportunity before the market resolves to above Dow 19k. My more recent Mid May update reinforced expectations of the Dow to target a correction during June ahead of the resumption of its bull trend and warned that this trend could sucker in many bears who would swallow the GREXIT koolaid, and convince themselves the end is nigh, 19 May 2015 - Stock Market Continues Defying Gravity, Dow New All Time High In terms of my forecast and current technical state then the stock market is due a correction for which it has a month or so to get out of the way. However, stock market corrections are just that stock market corrections and should be viewed as BUY OPPORTUNITIES and not the start of bear markets as I have often reminded the readers of my articles over the past 6 years - 03 Oct 2013 - Stocks Bull Market, Bears Will be Crucified Again UNDERSTAND THIS - THIS stocks stealth bull market is one of the GREATEST bull markets in HISTORY! I have to reiterate what I have voiced for the duration of the stocks stealth bull market in over 200 articles (Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ), my strategy has been very, very simple, no black box voodoo to sell garbage to the unsuspecting masses but simply this - " The Greater the deviation from the stock market high then the Greater the Buying Opportunity Presented". And, you can't get any simpler than that ! Stock Market - What Next ? According to my analysis and trend forecast of 3rd Feb (above chart), then the Dow after a volatile first half trading range should by now be working its way towards making a bottom at around 17,500 which compares against yesterdays trading low of 17,600 that implies little deviation from the trend forecast of 5 months ago! Therefore I see no reason to conduct a more in-depth analysis as probability clearly favours an imminent Dow bottom i.e. we could see a lower low at around 17,500 over the next few days. This will then set the scene to propel the Dow higher during its 2015 second half bull run all the way towards Dow 20k before year end. Therefore I expect ALL of today's BEARS to be once more be CRUCIFIED, just as they have been during EVERY correction of the past 6 YEARS! Greece Becoming Scotland The latest in a string of 'final' deadlines is today at 11pm when Greece is expected to default on its debt repayment due to the IMF, though as expected the IMF is already backing away from its implications by changing its rhetoric to imply that Greece would just be in arrears rather than default which once more pushes the final deadline further down the road to now the 5th of July referendum when Greece, 3% of the euro-zone electorate profess the right to decide the fate of the Euro-zone much as 4% of the UK electorate in Scotland decided on the fate of the United Kingdom in Scotland's referendum of September 2014. However, just like the Scottish SNP Government, the Syriza government paints a bogus picture of Greece's predicament, one of blatant lies as Greece has made NO debt and interest repayments, nor has Greek banks paid a single euro to withdrawing customers as all of which including billions to finance Greek public spending has been financed by Euro-zone tax payers and the ECB as Greece attempts to make its subsidy permanent Scotland style as I have covered at length over the past few weeks with key points excerpted below. The bottom line is that SYRIZA GREECE is blackmailing europe, where 3% of the euro-zones electorate profess the right to decide the fate of the whole euro-zone just as SNP SCOTLAND blackmailed the rest of the UK, and similarly Greece WILL vote to STAY in the Euro-zone just as Scotland had voted to stay in the UK. Though it remains to be seen if that will be possible given the delusion in Greece that expects the euro-zone member states, many of whom are far poorer than Greece to finance the Greek life style in perpetuity. If Greece Votes YES to staying in the euro-zone, then what? Political chaos in Greece, as Syriza will refuse to implement the referendum decision thus prompting another decision delaying election. However all of this could be mute, as things could come to a head BEFORE the 5th July referendum. More on the Greece saga: 29 Jun 2015 - Greece BANKRUPT! Financial and Economic Collapse to Follow IMF Debt Default Greece is Bankrupt - Market Reaction Finally its official Greece is bankrupt! Greece is set to default tomorrow on an IMF loan repayment of Euro 1.6 billion that actually would not have been a 'real' loan repayment as Greece was at the same time trying to pries Euro 7.2 billion out of the Troika to both finance debt repayments AND PUBLIC Spending, which despite already having enjoyed a 50% debt write down has once more seen its debt mountain mushroom to over Euro 240 billion with an additional Euro 120 billion thrown into Greek banks by the ECB. The financial markets have reacted by marking down Greece 10 year bonds to HALF face value i.e. a certainty of default with bond holders currently facing a 50% loss that increases on a DAILY basis as bond holders continue to try to dump the illiquid bonds all the way towards a 100% loss, desperately attempting to recover a few percent from a total loss.. The athens stocks market is of course CLOSED, so there is no market reaction to show but if open would probably have experienced an opening crash of at least 15% i.e. the ATG index would probably have plunged towards 650 before bouncing. Unintended Consequences of GrExit Whilst the mainstream press focus is on the financial and economic consequences what seems to be missed is the ISIS consequences of an GrExit as Greece's northern borders would become open to hundreds of thousands of migrants, including several hundred ISIS terrorists to wreck havoc right across Europe, let alone the consequences of Russia and China seeking to use Greece to their geopolitical advantage. 28 Jun 2015 - Greece Banking System Collapse Monday as ECB Pulls the Plug, Capital Controls Ahead of GrExit GrExit Beckons The mainstream press has once more been caught off guard as regurgitated euro-zone propaganda had resulted in the consensus view that a last minute deal would be done that would prevent Greece from leaving the euro-zone, which was the primary strategy of the Syriza government to black mail the euro-zone with the threat of a GrExit in exchange for a permanent subsidy from Euro-zone tax payers coupled with 50% debt write offs every few years. However, it is finally starting to dawn on the 'herd journalists' that a GrExit in the wake of the ECB announcement is actually the most probable outcome and so have finally begun writing streams and streams of mostly nonsense on the ramifications of a GrExit. My consistent view for sometime has been that a GrExit was a near certainty (see excerpts below) for the fundamental fact that Greece within the Euro-zone CANNOT PRINT MONEY AND DEBT AND INFLATE TO PAY FOR its bloated public sector and voter bribes. Greece for the duration of the 'crisis' has had NO CHOICE but to leave the Euro-zone and all that the ECB, and the IMF have done is to throw good money after bad that totals some Euro 320 billion of Euro-zone tax payers money flushed down the Greek toilet. It should be noted that this follows a decade long spending binge on the back of GERMAN LOW INTEREST RATES, when the Greek government wracked up debts that it HID from the markets, which it could do because the debts were denominated in EUROS. The lied, they stole and then they wanted a perpetual euro-zone subsidy just like Scotland enjoys in the UK. What's going to happen Monday? Well, without ECB financing of every single euro withdrawn then the Greek banks do not have the euros in their vaults to pay out to withdrawing customers that were already in a building panic of withdrawing 2-3 billion euros per day. This means that many if not most Greek banks will not open Monday, as it is probable that the Greek government will before Monday's open announce a Bank Holiday that could run from days to weeks to months, that will likely be coupled with the announcement for capital controls as the Greek government effectively attempts to steal the remaining Euro 100 billion or so of Greek customer bank deposits just as Cyprus did last year. Unfortunately for Greek depositors ITS ALREADY TOO LATE, their money is now gone! As temporary capital controls translate into permanently frozen bank deposits only to be released once their purchasing power has been eroded away to nothing i.e. by means of Greece printing its own currency as I have often written of over the years as what would eventually take place in Greece. 26 Jan 2015 - Greece Votes for Syriza Hyperinflation - Threatening Euro-zone Collapse or Perpetual Free Lunch Grexit - Greece Euro-zone Exit A Syriza majority government will embolden the radical left to embark on a suicide mission to demand freshly printed ECB Euros to finance an ever expanding socialist spending binge where the price expected to be paid will be by the rest of the euro-zone in terms of printing money to finance unproductive activities such as the public sector and the life styles of corrupt politicians. This puts Greece ultimately on the track towards being ejected out of the Eurozone with the consequences of there being high inflation (at least 30%) if not an hyperinflationary panic event for Greece and its new currency. New Greek Currency The Greek central bank will likely have already made contingency plans to launch a new currency in the wake of an GrExit details of which now could be made public within a matter of days in an attempt to reduce the instability that Greece now faces. The bottom line is that this is mostly Tsipras and Varoufakis doing, the so called 'Game Theory' experts who attempted to black mail Europe just got their bluff called. So do not buy into the propaganda that will spew from their mouths over the coming hours, days and weeks attempting to lay the blame elsewhere when the truth is that Greece has stolen Euro 320 billion from the euro-zone. 25 Jun 2015 - European Empire Strikes Back Against Greek Debt Fantasy, Counting Down to GREXIT The bottom line is that Greeks whole heartedly believe in their fantasy economy, one that promises affluence without work, retirement without work, public services without paying for them, life after death, no wait that is a different fantasy. However, Greece is a MIRROR for ALL euro-zone members, for the Greeks are human, and therefore ALL of the other euro-zone members are also delusional INCLUDING GERMANY because the Euro-zone is built on a delusional construct of a single currency. Well all currencies are pure fantasy where someone believes in the currency because they have been repeatedly told that it has value which I will cover in detail in my next in-depth analysis so ensure you are subscribed to my always free newsletters. My long standing view is that the best thing for the Greek people to do would be to leave the euro-zone. As of writing Greece apparently is counting down to yet another deadline today (Thursday) which will pass just as surely had Wednesdays 11am deadline passed without event and so will probably Fridays deadline as Greece remains firmly on the path towards a GREXIT. Some times I have to wonder is the Greece debt crisis real or is it a never ending soap opera that ends each days episode with a cliff hanger. JUST GET ON WITH IT AND EJECT GREECE, then Spain, Portugal and Italy out of the Eurozone! And as GREXIT appears probable then expect much huffing and puffing from Alexis Tsipras laying the blame at the feet of the Euro-zone rather than looking in the mirror at the power hungry mad marxist staring back, who delusionally sees it as the right of Greece that like a vampire sucks the blood of the euro-zone forever. 19 Jun 2015 - Big Fat Greek Bank Run - Greece Banking System Could Collapse Monday 22nd June Greece Bank Run Going Exponential The Greek banking system has been bleeding deposits all year, having seen at least Euro 40 billion withdrawn this year, leaving behind approx Euro 120 billion. However, as the end game approaches (Varoufakis is apparently an expert on Game Theory) the rate of withdrawal has accelerated to over Euro 1 billion per day, up from approx Euro 200 million a day of a week ago, and could keep doubling every other day, which is despite ECB support on a DAILY basis without which Greece's banking system would have collapsed 5 years ago! Which means Greek banks are paying withdrawing depositors with funds from the ECB that to date totals approx Euro 120 billion because the Greek banks have been bankrupt for some time! Even Greece's central bank panicked by opening warning the Syriza government that Greece was heading for a catastrophic crash out of the euro-zone. 18 Jun 2015 - GREXIT - Greece Wants to Become Scotland, Seeks Permanent Subsidy from Euro Tax Payers The Big Problem is PorExit, SpaExit and ItaExit. Greece in economic terms is a flea on the back of the Euro-zone elephant that could easily survive a GREXIT. But the real problem is who would be next, for soon the pressure would mount on the other PIIGS, with Portugal, Spain and Italy vying for who would be next to EXIT the euro-zone, something which the Euro-zone would not survive. Therefore that remains Greece's 'Ace in the hole', which is why they are still in the eurozone, so probably suggests that some sort of fudge will be arrived at that would only DELAY GREXIT for the fundamental reason Greece is BANKRUPT! A GrExit would also make a BrExit more probable, whilst Putin would be dancing in the Kremlin. Future Newsletters / Analysis Ensure you are subscribed to my always free newsletter for ongoing in-depth analysis and detailed trend forecasts that includes the following planned newsletter -

Source and Comments: http://www.marketoracle.co.uk/Article51271.html By Nadeem Walayat Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.