No Recession, But…

Economics / Recession 2015 Sep 14, 2015 - 05:03 PM GMTBy: Gary_Tanashian

I am personally not yet convinced an ultimate bull market top is in despite the obvious similarities of the recent interim top to 2007 [the first sign in this regard would be a loss of the October 2014 and August 2015 lows]. It could also be a 1998 clone, as we have noted by chart similarities and by global financial similarities (China/Asia). However, in 2007 the stock market did a good job of forecasting the coming “Great Recession” (a sanitized way of saying ‘impulsive unwinding of leverage’). Here is what economists think today (ref. Bloomberg article): http://www.bloomberg.com/news/articles/2015-09-11/here-s-when-economists-expect-to-see-the-next-u-s-recession. 2018 it is, according to a majority of buttoned down dart throwers.

I am personally not yet convinced an ultimate bull market top is in despite the obvious similarities of the recent interim top to 2007 [the first sign in this regard would be a loss of the October 2014 and August 2015 lows]. It could also be a 1998 clone, as we have noted by chart similarities and by global financial similarities (China/Asia). However, in 2007 the stock market did a good job of forecasting the coming “Great Recession” (a sanitized way of saying ‘impulsive unwinding of leverage’). Here is what economists think today (ref. Bloomberg article): http://www.bloomberg.com/news/articles/2015-09-11/here-s-when-economists-expect-to-see-the-next-u-s-recession. 2018 it is, according to a majority of buttoned down dart throwers.

Source: Bloomberg News Survey

What were they saying in December 2007? Let’s take a look, also from Bloomberg…

(Dec. 17, 2007): No Recession, But… http://www.bloomberg.com/bw/stories/2007-12-19/no-recession-but.

“The bottom line looks like this: The economists project, on average, that the economy will grow 2.1% from the fourth quarter of 2007 to the end of 2008, vs. 2.6% in 2007. Only two of the forecasters expect a recession, although it might feel like one if there’s sluggish growth over the next couple of quarters, as many predict. Almost all think the risk of a downturn has risen substantially in recent months.”

A year later came (December 1, 2008): US Recession Started in 2007, Longest Since 1980’s http://www.bloomberg.com/apps/news?pid=newsarchive&sid=al4iyIoRhvao.

The point is that the majority of experts usually do not (maybe even never) see recessions coming in advance. That is why they are economists. They will tell us all about its factors and elements after the fact. They will jargon us to death with all the why’s and what for’s after the fact.

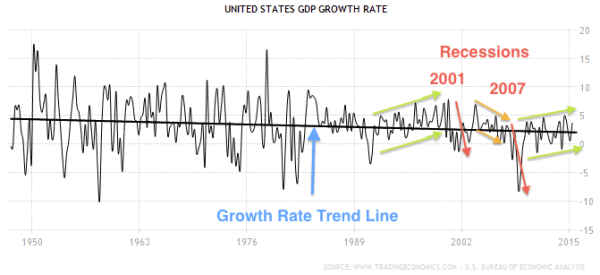

Our job is to track events in real time, protect and deploy capital and most definitely not be part of the herd. In service to that, let’s look at one more graph (courtesy of TradingEconomics.com, mark ups mine) and go on our merry way, having fully put in context the opinions of experts like Bloomberg’s recent survey of 31 economists.

Despite already having the hindsight benefit of a readily quantifiable deceleration in economic activity (orange arrows) by December 2007, economists surveyed cautiously predicted 2.1% economic growth on average by the end of 2008. They were only off by about a million miles.

Today, with an uptrend in the GDP growth rate most economist do not see trouble until 2018 or later. Of course they don’t, because all they do is extrapolate trends in good times, as with a similar uptrend leading into the 2001 recession (green arrows) and put their heads in the sand in questionable times (fading GDP into 2007).

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.