The Stocks Bear Makes a Welcome Return

Stock-Markets / Stock Markets 2015 Sep 11, 2015 - 04:35 PM GMTBy: Clif_Droke

The S&P 500 Index had its worst August since 2001, while the Dow’s 6.6 percent drop was its biggest since declining 15 percent in August 1998. Most investors consider the September-October period to be the witching months for equities, but the past month was a painful reminder to many of them just how bad August can sometimes be.

The S&P 500 Index had its worst August since 2001, while the Dow’s 6.6 percent drop was its biggest since declining 15 percent in August 1998. Most investors consider the September-October period to be the witching months for equities, but the past month was a painful reminder to many of them just how bad August can sometimes be.

Along those lines, Bloomberg has observed that while August ranks in the middle among months based on share performance, it has produced some of the worst returns of the year since 2009. During the week ended August 12, 2011, the S&P 500 alternated between gains and losses of at least 4 percent for four days, something never seen in 88 years of data compiled by Bloomberg. In 2013, the S&P 500 fell 3.1 percent in August, one of only two months of negative returns in a year when the index surged 30 percent.

Since the late August sell-off, there has been a constructive development underway in terms of investor psychology. The market’s sentiment profile has shown vast improvement since the last month before the sell-off. The following magazine headline from a recent issue of Bloomberg Businessweek is a classic example of the magazine cover indicator at work.

That’s right, a cover full of bears! From a contrarian standpoint it doesn’t get any more emphatic than this.

Below is another manifestation of the bear on a recent news magazine cover. The headline questions whether a bear market is imminent, which has definite contrarian implications.

The bear analogy can also be seen in the Sept. 7 issue of The New Yorker. Even The Economist got in on the act with a Sept. 4 reference to China’s market decline (the alleged cause of Wall Street’s plunge) on its front cover.

These are the type of magazine cover that appears at, or very near, important interim lows. While the magazine cover indicator can’t always be used to time the exact location of the bottom, it does provide an important “heads up” that the bottoming process has most likely begun with a confirmed interim bottom to follow in the weeks immediately ahead.

The bigger question confronting investors is whether the August correction was simply a one-off event or the prelude to something much bigger? This is a question that will undoubtedly be given much attention by analysts in the weeks ahead. To proclaim the termination of the 2009-2015 bull market right now would be premature in my opinion. I believe an established long-term uptrend should be given every last benefit of the doubt to prove itself before proclaiming its death. If the bull market is to persist beyond 2015, however, it’s imperative that the internal condition of the stock market relative to the new 52-week highs and lows substantially improve. Otherwise the situation we witnessed in August will only repeat at a later date.

Market episodes like the late August sell-off rarely occur out of a clear blue sky. The market usually provides a preliminary warning to give wary participants a “heads up” that something bigger could be on the horizon. For instance, in the lead-up to the 2008 credit crash there were several early warning signals in the stock market beginning with the February 2007 correction and again in August that year. The preliminary warning to the recent correction was the NYSE electronic outage in early July. NYSE trading screeched to a halt for nearly four hours on July 8, which officials blamed on a “technical glitch.” The event spooked investors, which was a further sign that market psychology was vulnerable to another surprise event.

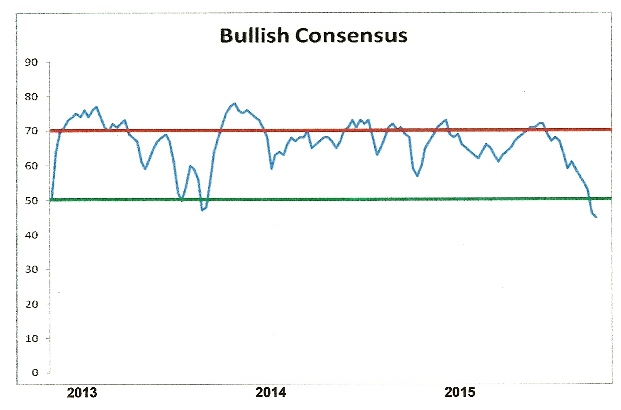

Investor fear seems to have reached a crescendo since early September, however, and any further erosion in fear from this point could serve as a catalyst to short covering rallies, near term. The latest Bullish Consensus indicator (below) has reached its lowest reading of bullish sentiment since 2013. This is also a sign of a healthier market from a contrarian perspective.

By far the most important ingredient needed for a major bottom and re-entry signal is a significant contraction of the number of stocks making new 52-week lows on the NYSE. The number one problem that has plagued the stock market since the beginning of summer has been the persistence of internal weakness. It’s also what made the market vulnerable to the correction that occurred last month. This can be seen in the fact that on most days the number of stocks making new 52-week lows has exceeded 40, which is the historical dividing line between a healthy and an unhealthy market environment.

Only once this month to date has there been fewer than 40 new lows (Sept. 3). Each day this week (Sept. 7-11) has witnessed an expansion in the new 52-week lows, culminating with 131 new lows as of this writing on Sept. 10. This is unacceptably high and tells us that there is still some internal weakness within the broad market. Moreover, this weakness must be resolved before the market launches its next sustained rally.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's also a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies for Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.