Job Quit Rates and Recessions

Economics / Recession 2015 Sep 09, 2015 - 06:34 AM GMTBy: Mike_Shedlock

Looking for Greener Pastures?

Looking for Greener Pastures?

A Chicago Fed report investigates Job Switching and Wage Growth.

People generally switch jobs by quitting (rather than losing) their previous job. Furthermore, the vast majority of people observed quitting their job tend to move directly to a new job, rather than becoming unemployed or exiting the labor force. Therefore, estimates of worker quits provide a good measure of job switching in the U.S. economy.

Data from the Job Openings and Labor Turnover Survey (JOLTS) provide an estimate of the aggregate quit rate each month for the U.S. economy since 2000. Recent research by Steven Davis, R. Jason Faberman, and John Haltiwanger has extended the JOLTS data series back to the early 1990s. Their work shows that quits are highly procyclical. That is, they rise during expansions and fall during recessions.

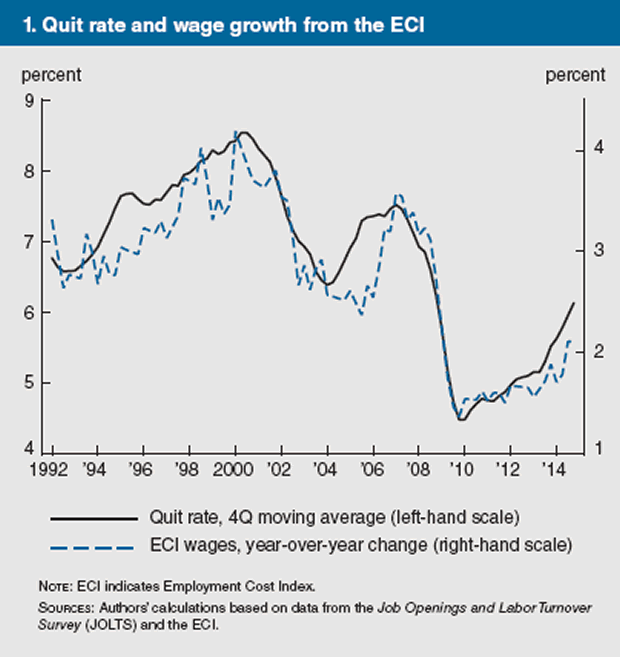

Figure 1 plots the year-over-year percentage change in the wage component of the Employment Compensation Index (ECI, dashed line), together with the quit rate (solid line). Both the quit rate and this measure of wage growth are quite procyclical and exhibit strong co-movement. Moreover, fluctuations in the quit rate seem to precede fluctuations in wage growth by roughly one to two quarters, suggesting that quits may be a useful predictor of future wage growth.

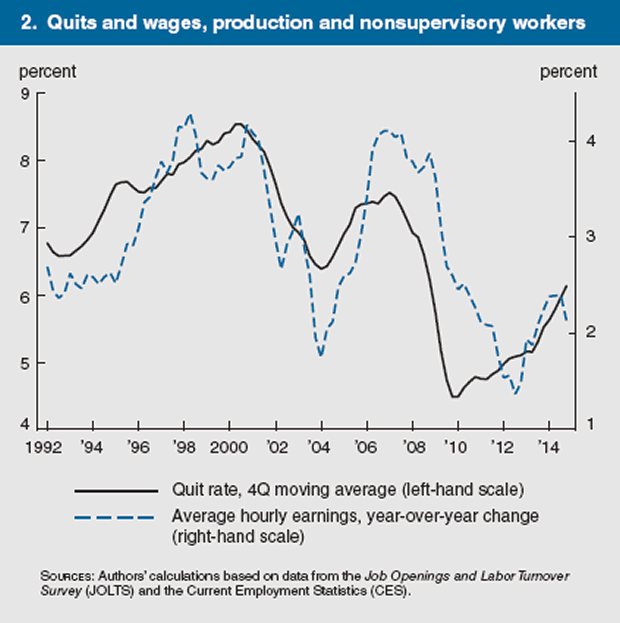

Figure 2 plots the quit rate against an alternative measure of wage growth using the average hourly earnings of production and nonsupervisory workers (dashed line). Wage growth and the quit rate continue to co-move over time, albeit less strongly than in figure 1, and both series exhibit strong procyclical patterns.

Wage Growth vs. Quit Rates

I fail to see evidence of the claim "fluctuations in the quit rate seem to precede fluctuations in wage growth by roughly one to two quarters, suggesting that quits may be a useful predictor of future wage growth."

In 2009, wages turned up before quit rates. In 1992 they appeared at roughly the same time. And in 2003, wages ticked up years after quit rates.

I would like to see data for more years, but Fred (the Federal Reserve Economic Data) repository only dates back to 2000. Somehow the authors have more years of data.

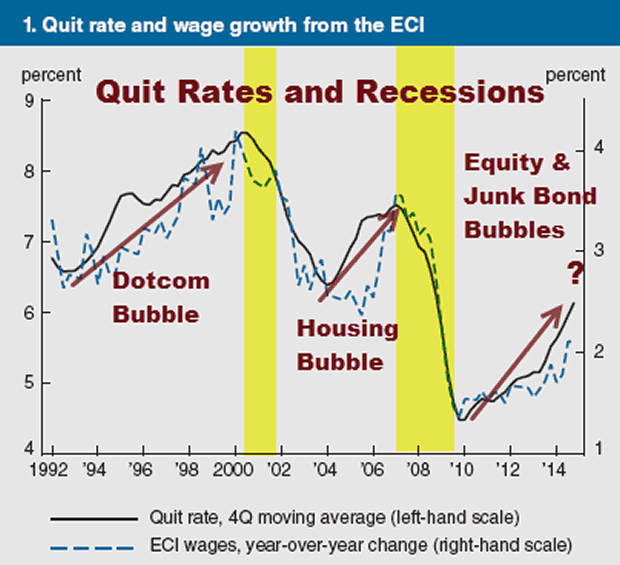

Quit Rates and Recessions

What caught my eye was something missing from the above charts: Recession bars.

Note that between 2002 and 2004, quits fell during an expansion.

Quits tend to peak just before all hell breaks loose. That's certainly something to consider if you are thinking of quitting your job for greener pastures.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.