U.S. Real Wealth Weaker than GDP Stats Show

Economics / Economic Statistics Sep 07, 2015 - 06:44 PM GMTBy: Frank_Shostak

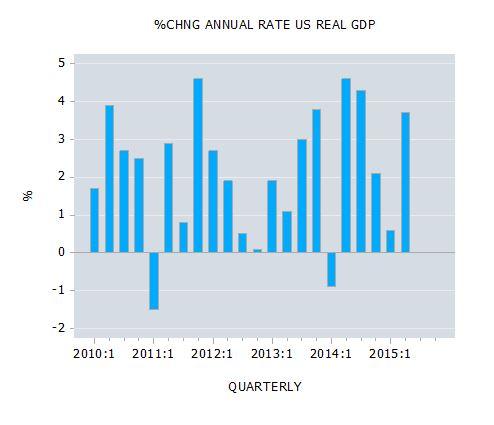

US real gross domestic product (GDP) grew faster than initially thought in Q2. GDP expanded at a 3.7 percent annual rate instead of the 2.3 percent rate reported last month and 0.6 percent in Q1. Most experts, in response to this figure, are now arguing that the US economy is strengthening visibly.

US real gross domestic product (GDP) grew faster than initially thought in Q2. GDP expanded at a 3.7 percent annual rate instead of the 2.3 percent rate reported last month and 0.6 percent in Q1. Most experts, in response to this figure, are now arguing that the US economy is strengthening visibly.

This, coupled with a relatively stable price level, raises the likelihood that the economy is approaching the path of healthy economic growth with stable price inflation.

Percent Change in Annual Rate US Real GDP

When we talk about economic strength on an individual level by this we mean an individual’s real wealth. On a national level, one could talk about overall real wealth by adding up the real wealth of individuals.

GDP Can’t Measure Real Wealth

As simple as it sounds however, this cannot be done since we cannot add up potatoes to tomatoes to obtain a meaningful total. So from this perspective we cannot ascertain the total real wealth in an economy:

[T]here are serious problems regarding the calculation of the GDP statistic. To calculate a total, several things must be added together. To add things together, they must have some unit in common. It is not possible to add refrigerators to cars and shirts to obtain the total of final goods. Since the total real output cannot be meaningfully defined, obviously it cannot be quantified …

It is interesting to note that in commodity markets, prices are quoted as Dollars/barrel of oil, Dollars/ounce of gold, Dollars/tonne of copper, etc. Obviously, it wouldn’t make much sense to establish an average of these prices. On this Rothbard wrote, “Thus, any concept of average price level involves adding or multiplying quantities of completely different units of goods, such as butter, hats, sugar, etc., and is therefore meaningless and illegitimate.”

The employment of various sophisticated methods to calculate the average price level cannot bypass the essential issue that it is not possible to establish an average price of various goods and services …

So what are we to make out of the periodical pronouncements that the economy, as depicted by real GDP, grew by a particular percentage? All we can say is that this percentage has nothing to do with real economic growth and that it most likely mirrors the pace of monetary pumping.

As a rule, the more money created by the central bank and the banking sector, the larger the monetary spending will be. This in turn means that the rate of growth of what is labeled as the real economy will closely mirror rises in money supply.

GDP Follows Money Supply

Thus, real GDP doesn’t measure the real strength of an economy, but rather reflects monetary turnover adjusted by a dubious statistic called the price deflator.

Obviously then, the more money is pumped, all other things being equal, the stronger the economy appears to be.

In this framework of thinking one is not surprised that the Fed can drive the economy since by means of monetary pumping the central bank can influence the GDP rate of growth.

While we cannot establish total real wealth we can, however, ascertain factors that undermine the real wealth formation.

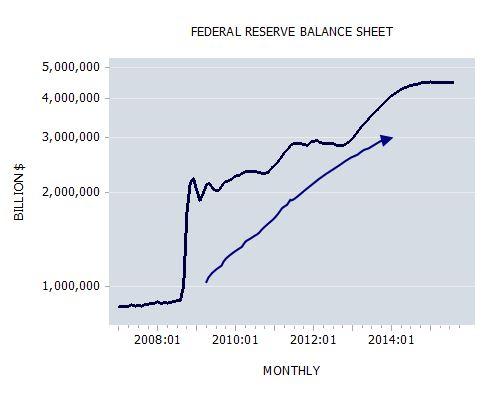

Malinvestment: The Fed’s Balance Sheet Jumped 421 Percent

One of the key factors here, apart from government outlays, is the monetary policy of the Fed.

On this, the Fed’s balance sheet jumped from $861 billion in January 2007 to $4,484 billion by August this year — an increase of 421 percent or an average increase of 55 percent per annum during this period.

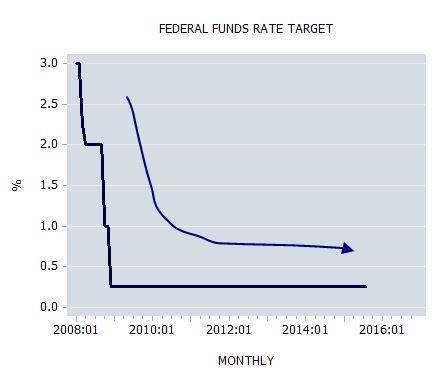

Furthermore, since December 2008 the Federal Reserve interest rate target was kept at 0.25 percent.

Federal Reserve Balance Sheet

Federal Funds Rate Target

This aggressive monetary pumping coupled with an almost-zero interest rate must have severely misallocated real resources and thereby severely undermined the process of real wealth generation.

So, from this perspective, a strengthening in GDP doesn’t reflect an economic strengthening but actually the exact opposite.

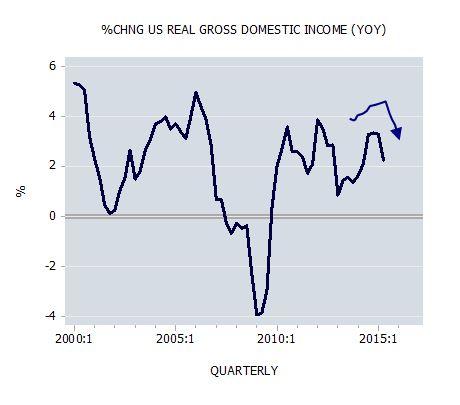

Now, even in terms of the government’s own data such as real income, economic activity doesn’t look that great, with the growth momentum of real income actually showing a visible softening.

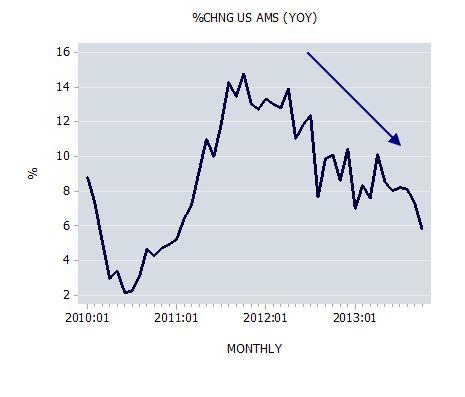

The yearly rate of growth fell to 2.2 percent in Q2 from 3.3 percent in Q1. The key factor behind this emerging softening is a fall in the growth momentum of money supply during October 2011 to October 2013.

It is likely, however, that this fall is positive for the health of the economy since it puts pressure on various bubble activities that undermine the wealth generation process.

© 2015 Copyright Frank Shostak - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.