China FX Reserves and CNY Implications

Currencies / China Currency Yuan Sep 07, 2015 - 12:56 PM GMTBy: Ashraf_Laidi

China FX reserves fell $94 bn to $3.56 tn in August, posting the biggest decline on record, tell us a little more than just China is slowing.

We already know that a key reason to the decline in reserves is China's selling of reserves, such as US treasuries, in order to support the CNY, preventing it from falling rapidly after last month's devaluation announcement.

We also know Beijing has allocated as much as $90 bn from reserves to recapitalize local banks.

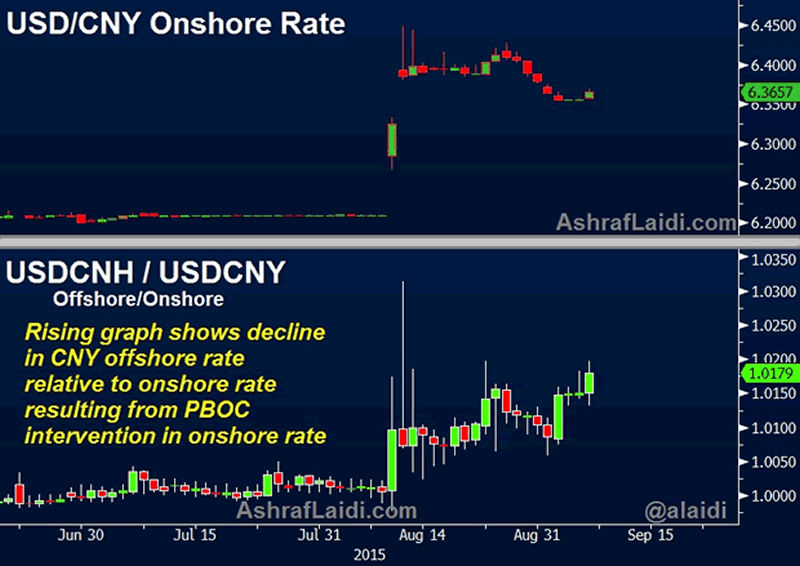

Thus, the policy of selling reserves aimed at stabilizing the CNY is unsustainable, which highlights our expectation for the currency's long term direction to be downwards. This is already shown in the chart below, illustrating that yuan's offshore rate (traded in Hong Kong) is lower than then onshore rate due to PBOC intervention in the latter and growing capital outflows impacting the former.

Back to the Fed & Yields

We mentioned last week the uncharacteristically high level of US 10-year yields relative to the recent declines in US equity indices, asking "If China were not selling treasuries to prevent CNY declines, then how low could yields be?"

The declining SPX/Yields ratio, suggesting that it's a matter of time before yields catch-down with stocks, regardless of whether the Fed raises rates or not.

And so we reiterate it's a question of time before Beijing's seizes its currency manoeuvres and lets its currency depreciate. This time, instead of reversing the rise of the currency, it becomes, slowing its decline.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.