Stock Market Investors Destined to Lose; What you can do to improve your odds

Stock-Markets / Stock Markets 2015 Sep 05, 2015 - 04:50 PM GMTBy: Sol_Palha

Uncertainty and mystery are energies of life. Don't let them scare you unduly, for they keep boredom at bay and spark creativity. - R. I. Fitzhenry

Uncertainty and mystery are energies of life. Don't let them scare you unduly, for they keep boredom at bay and spark creativity. - R. I. Fitzhenry

The average person regardless of their education or lack off usually is on the receiving end of the stick when it comes to investing in the markets. The reason for this quandary is really very simple and predicated upon the fact that the average person’s decision-making process is driven by their emotional state. Successful investing and emotions do not go together; it’s an awful mix, and the outcome is always the same; stress and loss.

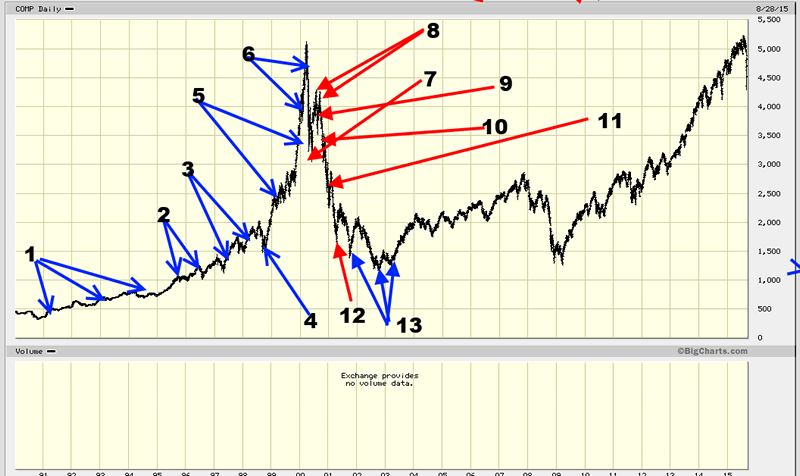

For this example, we are going to use a chart of the NASDAQ to provide an illustration of how emotions drive the average investor when it comes to trading and investing in the stock market. The same principles described below apply to all the other major indices such as the Dow, SPX or major stocks such as GOOG, AAPL, WMT, etc. The diagram below clearly and effectively illustrates the dilemma and uncertainty the average investor inflicts upon themselves. The solution is dangerously simple, but its simplicity is what makes it so hard for the crowd to implement. One needs to throw one’s emotions out of the window when it comes to investing. Emotions should have no seat at the discussion table when it comes to buying or selling a stock. Successful investing entails doing the opposite of what your useless emotions are so dramatically prompting you to do. There is simply no place for any extreme deviation from the norm when it comes to investing and euphoria and panic are extreme deviations from the norm.

Riches come to those who seek it and not chase it. To those who chase it, rags are the only reward. The world can be your oyster, or you can be an oyster in the world.

- This stock is going nowhere; it is hardly moving, and the fundamentals are weak. I need to find a high flyer one that can really move and not this laggard.

- Pure luck, the fools who jumped in, will regret it. This is a false breakout. This stock is going drop to new lows. I am definitely not going to waste my hard-earned money on this junk. .

- Holy smokes, the stock is still going up. Earnings are terrible, long-term fundamentals are not great and the technical outlook is far from perfect. I think I will pass, as I am sure, it’s going to crash and burn. I am sure is the secret code word for knowing nothing. Moreover, it is impossible to use technical indicators effectively if you are looking through an emotional lens.

- Thank goodness I did not buy; I knew it was going to crash. Instead of focusing upon the fact that the stock is letting out some steam and building momentum for the next leg up, the mass mindset see’s only what it wants to see. Governed by useless emotions, it is unable to recognise opportunity, as it has an almost unstoppable affinity for embracing the opposite. In this instance, the market did pull back, but a close examination reveals that the pullback is just the market letting out some well-deserved steam. In fact, the market ends up putting in a higher low, which is a very bullish development. The horde has an impeccable record at jumping into an investment when euphoria is the air, and out of them when blood is flowing through the streets.

- Wait a minute, what’s going on here? The market was supposed to crash. Maybe I made a mistake in not buying. Well, it’s not too late; the picture looks good, and analysts are upbeat about earnings, so I think it is still not too late to get in. The masses need reassurances that all is well, but reassurances come only towards the end of the game. Finally, this chap musters the courage to jump in. Wow, it actually went up, great; I'm making money.

- I was really smart to wait until things improved before getting in; it looks like the markets are going to take off……….. Let me call all my friends and tell them to jump in before it’s too late. Remember when everyone is happy, it is usually time to hit the road.

- What is going on; why is the market dropping? It’s only a pullback; I am not going to fall for this game again (look at reason number 4). It’s time to average down and load up.

- There you go; I knew it was going to turn around. I should have put more into in the market. Next time, I will really load up as this is the way to make money. Now the secret desire to lose syndrome kicks in. This guy is trapped in a euphoric mood and fails to recognise that the market did not trade to new highs. It actually put in a lower high, which should have construed as a warning signal. The mass mindset as we stated before only detects what it wants to spot. For this guy, the only thing that matter is that he made some extra money.

- It’s going down again. Opportunity is knocking, and it’s time to load up. Earnings continue to improve; all the analysts on CNBC are bullish, and therefore, it must be a good time to put even more money into the markets. It’s time to back the truck and load up. I need to call everyone and tell them not to miss this opportunity. When you are sure about something, it’s better to sit out and wait. Overconfidence is a sure sign that you are missing something.

- The market is hit with a dose of bad news and pulls back very strongly. Ah, this is just a temporary development. The market will recoup and trend higher. I am going to buy more and average down. Gamblers always think of averaging down and hardly think of averaging upwards. All of a sudden, this chap has become an expert on the timing the markets. Blind faith is one of the main ingredients the masses seem to have an endless amount of. If you trade the markets on faith, there is only one thing waiting for you at the end of the cycle; loss and despair.

- Now panic and dread start to set in. He questions himself. Did I do the right thing by buying more? Perhaps, I should have sold when I was in the black and booked those small gains I had. Maybe it is time to bail out and cut my losses. Things don’t look so good now. You know what; let me hold for a bit longer, maybe things could suddenly change. The outlook has to change; things were great, and how could they change so suddenly. The worst is over; it has to go up.

- Damn it, the market is dead. I am getting the hell out of the stock market. I should have never jumped in. I will never invest in the stock market. Ironically, around this time is when the markets start to give hints that a bottom is not too far in the marking. This individual is a bailing out when, in fact, he should be holding on. He is selling close to the bottom and allowing fear and anguish to direct his actions, just as he allowed joy to guide him into the markets.

- The market is going through a slow bottoming phase. Once this phase ends a new uptrend will begin. This guy bailed out very close to the bottom. At this point, of the game he should have considered holding onto the positions, as he had taken on an inordinate amount of pain hoping for a recovery. Instead he opt's for even more pain and suffering by selling very close to the bottom.

Conclusion

One has to remember that letting emotions have their way is a recipe for disaster. “Misery loves company, but stupidity simply demands it." All emotions are based on perceptions. Perception is based on what one assumes to be real. The key ingredient to mastering mass psychology is to have control over your emotions. The Goal should never be to identify the exact top or exact bottom. Your objective should be to discern subtle telltale signs that indicate when a market is topping or bottoming. When you identify this, the prudent thing is to take the necessary action, even though you will end up opening a long or short position significantly earlier than the masses; feel happy when you are not in sync with the masses and fearful when you are.

Confusion is a word we have invented for an order which is not yet understood.

Henry Miller

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.