Expansive Monetary Policy Bullish for Small Cap Stock Performance

Companies / Sector Analysis Jun 25, 2008 - 10:05 AM GMTBy: Joseph_Dancy

Numerous studies have presented evidence investors receive excess returns, or an investment premium, when investing in small and micro capitalization stocks. The findings indicate that even after considering the higher risk associated with investing in the small companies the small cap sector generates excess returns on a risk-adjusted basis.

Numerous studies have presented evidence investors receive excess returns, or an investment premium, when investing in small and micro capitalization stocks. The findings indicate that even after considering the higher risk associated with investing in the small companies the small cap sector generates excess returns on a risk-adjusted basis.

Monetary Conditions

A few studies have extended the market capitalization research by considering the influence of monetary conditions on the small cap premium. Due to limited access to capital markets some researchers have argued that easier monetary policies should have a greater effect on smaller companies. Since we are now in a period of monetary easing by the Federal Reserve, we thought it would be worthwhile to review the findings of this research.

In the last few months the Federal Reserve cut interest rates for the seventh time, and securities lending by financial institutions to the Fed reached an e xtraordinarily high level – setting records the last week of the month. The size of the Fed's biweekly cash auctions to banks was increased by 50%, and the type of securities accepted as collateral by the Fed for loans was expanded to include credit card debt, student loans, and car loans.

The term “accommodative” or “expansive” to describe Fed actions may be an understatement in light of the recent Fed policy initiatives,

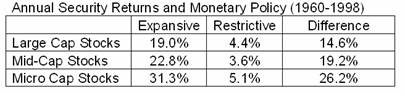

Examining the period between 1960 and 1998, Gerald R. Jensen, Robert R. Johnson, and Jeffrey M. Mercer , authors of “ The Role of Monetary Policy in Investment Management” , found that during accommodative or expansive monetary conditions small cap stocks generated much higher returns than during periods of restrictive monetary conditions. The data was statistically significant.

During accommodative monetary periods smaller companies also tended to perform much better than larger firms. The results of the study are set out in the chart below.

During periods of monetary easing micro cap firms performed 26.2% better than micro cap firms in a restrictive monetary policy environment according to the data.

During periods of monetary easing micro cap firms performed 26.2% better than micro cap firms in a restrictive monetary policy environment according to the data.

The micro cap firms in the Jensen et al. study averaged an annual return of 31.3% during these expansive periods, outperforming large cap stocks in expansive periods by 12.3% per year.

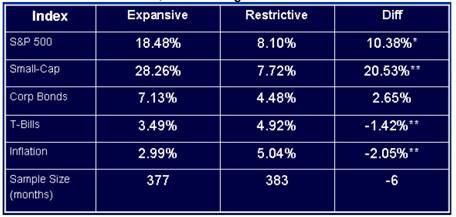

Don Hays of Hays Analytics also discussed this issue last month. He included the following chart by Robert Johnson of the CFA Institute in his commentary. It includes performance comparisons similar to the study above, but over a longer time period (1937 to 2000).

Note that the ‘small cap effect' – the propensity of smaller firms to outperform larger firms – is much more pronounced in periods of expansive monetary policy than in periods of restrictive monetary policy. Data for the chart was collected over a six decade period, so the results are statistically significant.

Note that the ‘small cap effect' – the propensity of smaller firms to outperform larger firms – is much more pronounced in periods of expansive monetary policy than in periods of restrictive monetary policy. Data for the chart was collected over a six decade period, so the results are statistically significant.

As Jensen et al. found, when monetary policy is expansive, as it is now, both the small cap and larger cap sectors perform much better than average.

Hays notes that liquidity, in the form of expansive monetary policy, has historically benefited the performance of smaller companies the most.

Jensen's book sums up the findings well: “These findings indicate that investing in small firms was a much more favorable strategy during expansive monetary periods . . . Furthermore, the small cap premium is quite large during expansive policy periods and virtually non-existent during restrictive periods ”. (emphasis supplied).

Return Persistence

In addition to monetary conditions, several recent studies have focused on r eturn persistence – the tendency for stocks to trend in the same direction. Many academics, and a number of portfolio managers, adhere to the theory that the market is reasonably efficient. As such, historical stock prices should reflect the sum of public knowledge and should have little predictive value of future stock price movements. Many value managers adhere to this theory. The fact that some studies show stocks tend to trend on one direction is therefore a puzzle to these efficient market adherents.

The most recent comprehensive study of this issue was published by Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School . They examined 108 years of market data, looking at markets in 16 different countries, to determine if a stock's historical return has any predictive basis when looking at future stock returns.

The study of 108 years of market data found extensive evidence that returns are persistent. The data was statistically significant across time periods and markets – that is a stock that has performed extremely well in the last year has an increased probability of performing well in the future. Conversely, stocks that have performed poorly have an increased probability of underperforming the market going forward.

For larger capitalization firms the best performing stocks outperformed the worst performing stocks by 10.3% per year in the U.K. markets. Over time such incremental returns compound – delivering substantial excess returns for long term investors.

Significantly, at least from our standpoint, is that the study found the excess returns attributable to return persistence was larger for small cap stocks than large cap stocks. While the best performing U.K. stocks weighted by company size had an annual return of 18.3% for the 1956-2007 period, using an equally weighted portfolio in which smaller companies had the same impact as larger ones resulted in an annual returns of 25.6%. The average market return during these periods was 13.5%.

The study concluded that the inefficiencies of the smaller cap sector apparently compounds the momentum effect.

Volatility

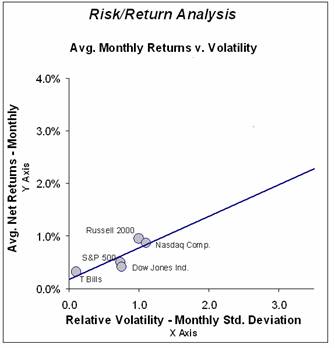

The Russell 2000 Small Capitalization index has always been one of the more volatile major market indexes. It tracks firms that are less liquid, and that trade in the most inefficient part of the market.

The Russell 2000 Small Capitalization index has always been one of the more volatile major market indexes. It tracks firms that are less liquid, and that trade in the most inefficient part of the market.

Negative market news is magnified in the illiquid small cap market. Conversely, positive news is also magnified in this segment.

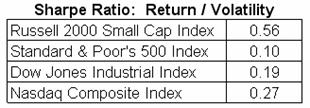

One measure of returns and portfolio volatility is called the Sharpe ratio. It essentially is the return divided by the volatility of the portfolio, measuring the units of return versus the units of risk.

Over the last 72 months the Sharpe ratio indicates that when markets are volatile the Russell 2000 will be disproportionately impacted – both positively and negatively.

Investors in the Russell 2000 index can expect 0.56 units of gain for every unit of volatility, as compared to 0.27 units of gain for every unit of volatility for the Nasdaq Composite index and even lower gains for the other major indexes.

Conclusion

Historical data indicates that current monetary conditions, return persistence, and volatility all point favorably toward firms in the small cap sector.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.