The Student Loan Crisis Is Mounting

Interest-Rates / Student Finances Sep 03, 2015 - 04:16 PM GMTBy: Peter_Schiff

Addison Quale writes: "You need a college degree to succeed in America." This idea has become so commonplace that the right to higher education is now a core issue in most political platforms. What if a young person cannot afford a college degree? The "obvious" answer from politicians on both sides of the aisle is that the government should subsidize them. Very few are brave enough to ask the far more important question: "At what cost?"

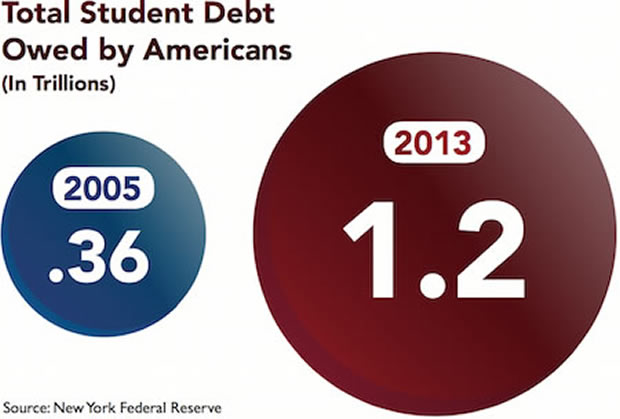

The answer is simple: as of today, the cost is $1.2 trillion. That is the current level of student loan debt in the United States, which represents the second largest category of consumer debt after home mortgages. It has grown by leaps and bounds since the financial crisis of 2008 and now surpasses even car loans and credit card debt.

The American Dream used to be simple: the ability to shape one's own destiny and wealth without interference from the king, the government, or other powerful interests - the right to "life, liberty, and property." Over generations, this dream has been coopted by politicians and bankers to gather votes and riches. In the 20th century, the idea of owning a home became an integral part of the Dream, which led to the disastrous idea that even unqualified borrowers deserve the opportunity to buy a house. We are all familiar with the fallout - the subprime mortgage crisis and ultimately the Great Recession.

Today, ten years later, politicians are now claiming that a college education is part of the American Dream and also a right of all Americans - regardless of their credit rating and SAT scores. Spurred on by even lower interest rates and the implicit promise that John Q. Taxpayer will once again come to the rescue should anyone happen to default, we now have a growing student loan bubble on our hands.

Since 2003, student loan debt has more than quadrupled - rising from $250 billion to well over $1 trillion. It has increased over $500 billion (a 75% increase) since the beginning of President Obama's first term, when it sat at $660 billion. Furthermore, at the end of 2008, the default rate was 7.9%, but now stands at 11.3% - a huge increase that is most assuredly an underestimation.

Perhaps the most alarming element of this trend is that there is no collateral required for a student loan. Banks can foreclose and repossess the house when a borrower defaults on a home loan. However, what can a bank repossess in the case of a student loan? A diploma? Knowledge? The bottom line is that each dollar of a defaulted student loan will pack much more of an economic punch.

And don't assume for a minute that the students themselves will escape unscathed. Student debt cannot be expunged through bankruptcy. The federal government can garnish up to 15% of gross income for 25 years from defaulters.

Some might say, "What's the big deal? America has already been dealing with massive amounts of debt. Is this really going to make that much of a difference?" The big deal is that the student loan bubble adds significantly to the nation's large debt burden, which at 102% of GDP is clearly unsustainable and doomed to inevitably lead to an economic collapse.

What's more, the current figure of $1.2 trillion is just today's student debt load. This is expected to nearly triple in the next ten years.

Every investor needs to understand how the student debt bubble will impact the US markets. In a newly released white paper, SchiffGold explains how best to prepare for a financial collapse that will dwarf the 2008 financial crisis. Download this exclusive SchiffGold White Paper for free today: The Student Loan Bubble: Gambling with America's Future.

Addison Quale is a Precious Metals Specialist with SchiffGold. He studied economics at Harvard University and earned a Master of Divinity at Gordon-Conwell Theological Seminary. Addison brings a well-rounded perspective to precious metals investing, with work experience at an investment consulting firm in Boston.

Catch Peter's latest thoughts on the U.S. and International markets in the Euro Pacific Capital Spring 2014 Global Investor Newsletter!

Regards,

Peter Schiff

Euro Pacific Capital

http://www.europac.net/

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.