Stock Market Prepares for the Next Decline

Stock-Markets / Stock Markets 2015 Sep 03, 2015 - 03:11 PM GMT Good Morning!

Good Morning!

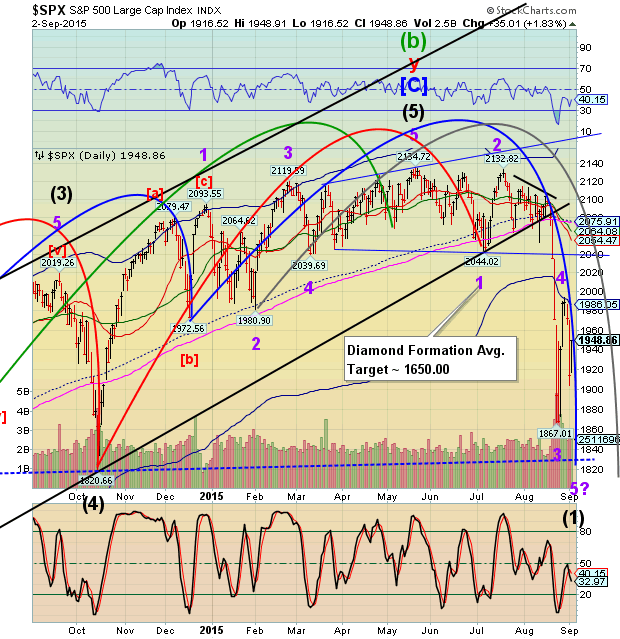

After reviewing the charts, I have come to the conclusion that we may be seeing a Leading Diagonal Wave (1) in the SPX and other major indexes. Note that both Waves 1 and 3 fit the [a]-[b]-[c] pattern better than an impulse because of overlap in Wave 1 and the Triangle [b] in Wave 3. We have already seen Waves [a] and [b] in Wave 5 with a large Wave [c] decline to go.

It would be a fair assumption that the Wave 5 decline may take 30 hours, of which 25 have already passed. If [c] equals [a], then the SPX has another 90 point decline ahead of it to approximately 1858.00. It may go lower, but time is being compressed for Intermediate Wave (1). The most bearish outcome is that it may exceed 1820.66.

Why am I fixated on today? Because today is the 86th anniversary of the peak in the 1929 market. Could the SPX go longer and lower? Yes. We will simply have to be alert to today’s activity and adjust accordingly. The next possible cyclical interval for a low would be 43 hours, which would point to Tuesday at mid-day. Should we have a liquidity event (please read the comments next to USB), the likelihood of reaching the Diamond formation target rises exponentially.

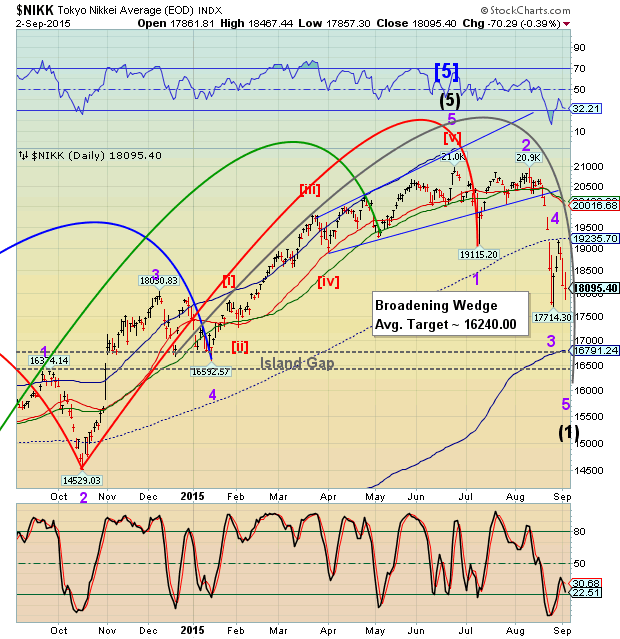

Last night the Nikkei managed a small gain to 18182.39. It appears that the Nikkei is following the SPX lead, so we may not see Leading Diagonal Wave 5 until tomorrow or Monday.

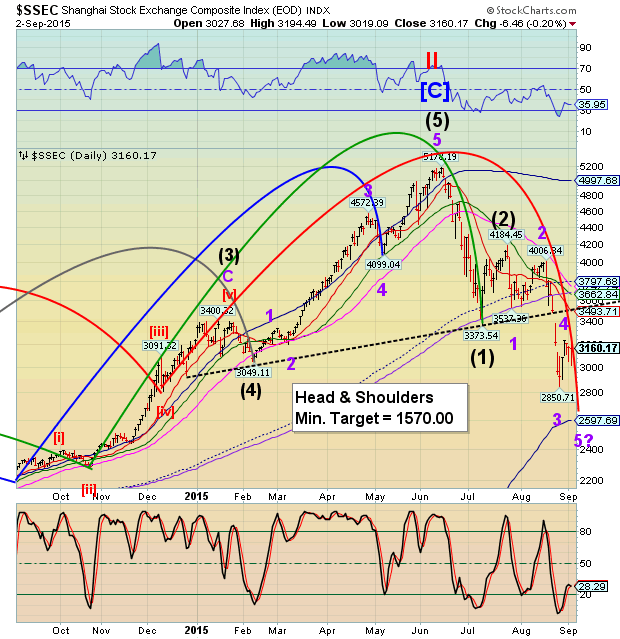

The Shanghai is on holiday for the next two days, so we definitely won’t see the culmination of Wave 5 until Monday, at the earliest.

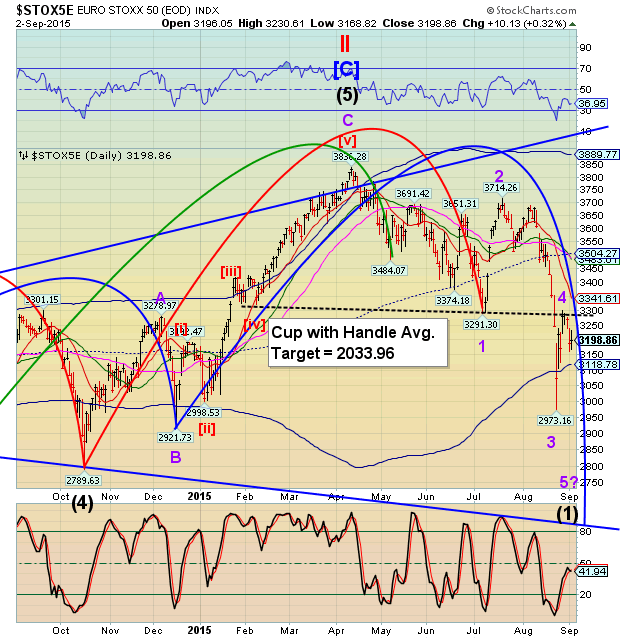

STOXX rose last night to 3236.30, possibly completing its Wave [b] of Wave 5 retracement. It also may not complete its decline until Monday.

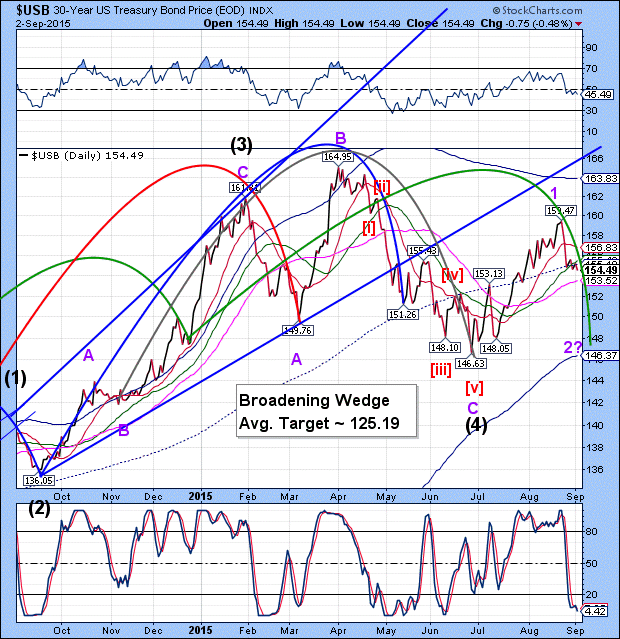

Another piece of the puzzle is USB. I have relabeled the EW structure to better fit the probable ongoing circumstances. It appears that there may be another purge of USB by this weekend. The reason is that USB is due for its Master Cycle low next Tuesday. This would be a liquidity event, since it would take out a lot of cash from our financial system.

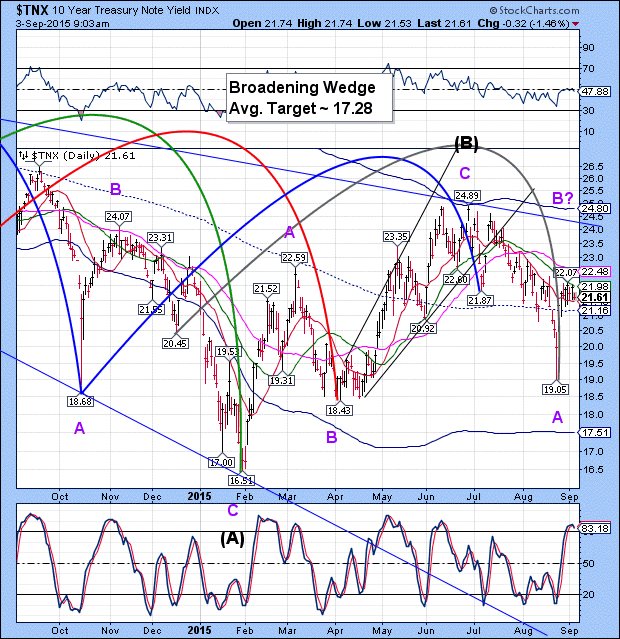

TNX opened down this morning, but it seems to be in a consolidation phase. It appears that the rally to 22.07 may be Wave [a], while Wave [b] may decline to mid-Cycle support at 21.16 or lower. However, Wave [c] has the potential of reaching its upper trendline at 24.00 before its most destructive decline yet.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.