Dow Theory Stock Market Sell Signal Examined

Stock-Markets / Dow Theory Sep 03, 2015 - 11:04 AM GMTBy: Brian_Bloom

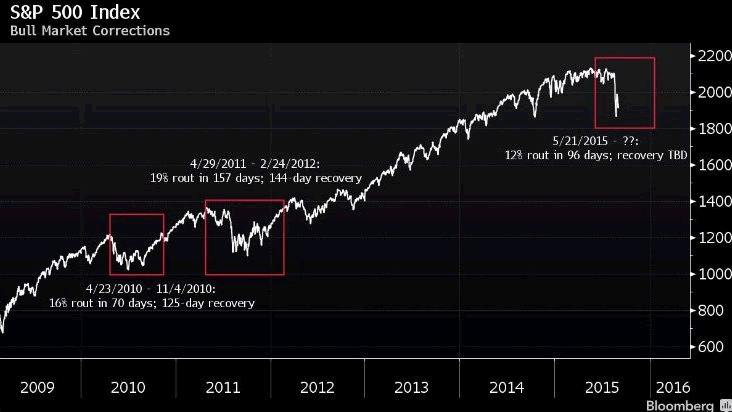

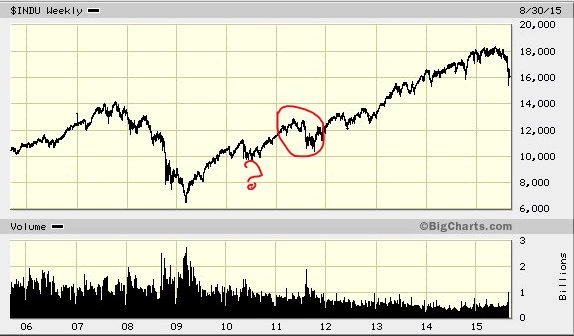

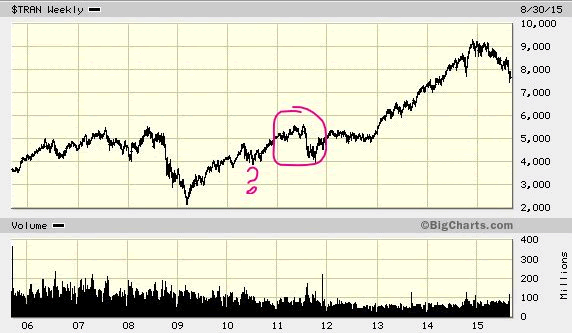

The article below argues that the Dow will rise after its current “correction” because it rose following the two previous corrections. But this time around both Industrials and Transports have fallen to lower lows. On those previous two occasions this did not happen.

The article below argues that the Dow will rise after its current “correction” because it rose following the two previous corrections. But this time around both Industrials and Transports have fallen to lower lows. On those previous two occasions this did not happen.

Neither Industrials nor Transports reached lower lows in 2011

In 2010 Industrials hit lower lows but transports did not confirm

In 2015, both Industrials and Transports fell to lower lows from which they are now bouncing up

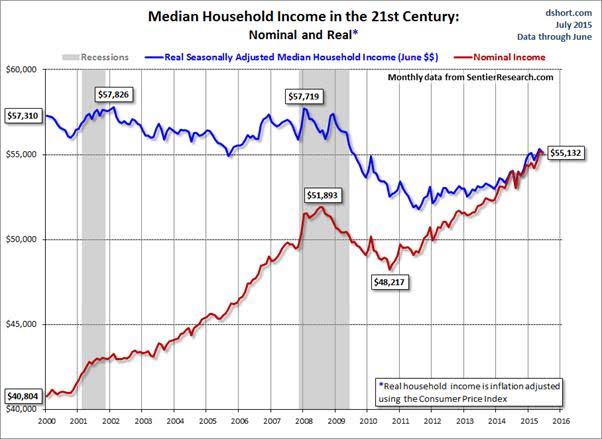

Fundamentally, the primary reason the US economy is growing has been the explosive growth of shale oil production, but the reality is that the US consumer is no better off than in 2008.

Also, the “booming” shale oil situation (and the resulting low oil price) is tenuous given the following quote:

At a time when the oil price is languishing at its lowest level in six years, producers need to find half a trillion dollars to repay debt. Some might not make it.

The number of oil and gas company bonds with yields of 10 percent or more, a sign of distress, tripled in the past year, leaving 168 firms in North America, Europe and Asia holding this debt, data compiled by Bloomberg show. The ratio of net debt to earnings is the highest in two decades.

If oil stays at about $40 a barrel, the shakeout could be profound, according to Kimberley Wood, a partner for oil mergers and acquisitions at Norton Rose Fulbright LLP in London. West Texas Intermediate crude was up 2.8 percent at $39.68 a barrel at 8:10 a.m. in London.

http://geab.eu/en/oil-industry-needs-half-a-trillion-dollars-to-endure-price-slump/

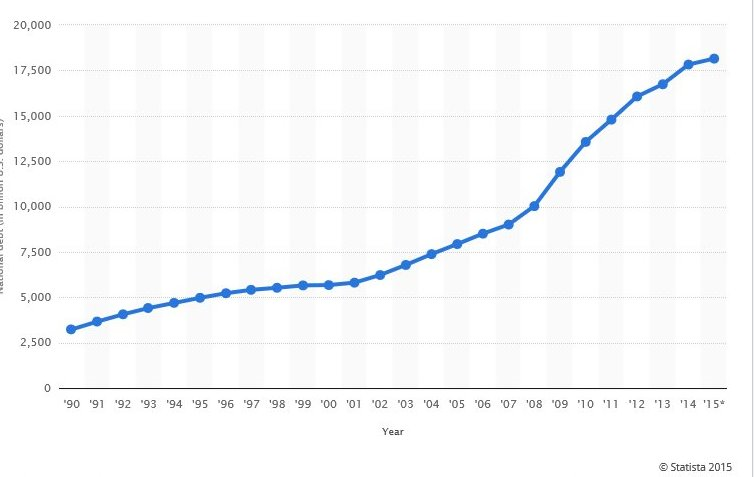

And National Debt has doubled since the Global Financial Crisis emerged:

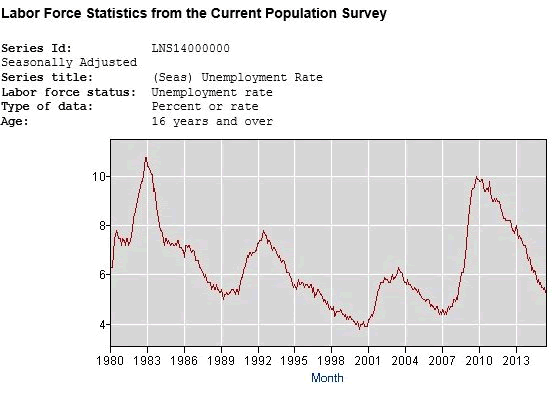

Finally, if we add back the number of people who left the labour force (decline in participation) to the current number of unemployed, then the ratio of the combined number is 7.65%, which is the highest number it has been since 1992, excluding the 2010 high

Conclusion

The equity market giving an important technical sell signal in the face of weak fundamentals

Author, Beyond Neanderthal and The Last Finesse

Links to Amazon reader reviews of Brian Bloom’s fact-based novels:

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2015 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.