Stock Market 50% Retracement

Stock-Markets / Stock Markets 2015 Aug 31, 2015 - 08:15 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market?

Intermediate trend - SPX has started an intermediate correction (at least).

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

A FIFTY PERCENT RETRACEMENT

Market Overview

After a 100+-point opening debacle last Monday, SPX finally found support, rallied 87 points in the next three hours, and remained wildly volatile for the next three days. By week's end it had rallied 50% of its decline. Friday's action was in sharp contrast with the rest of the week as volatility was practically non-existent while the index traced a lengthy congestion pattern in a narrow range. Is it accumulation or distribution? The 50% retrace suggests that it is the latter, but we'll need to wait until Monday to find out for sure.

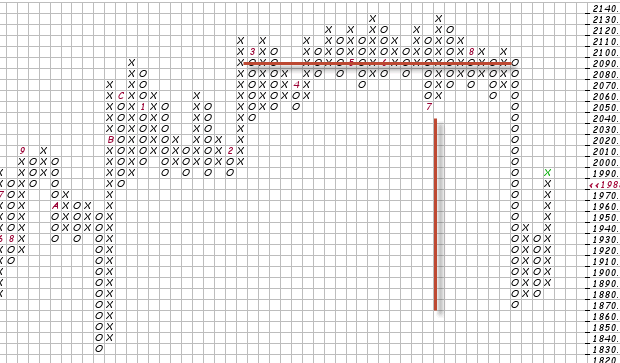

And speaking of congestion patterns, a strong case for a total decline of about 800 points can be made when we look at the following (3X10) P&F chart of the SPX. The area covered by the red horizontal line represents the topping formation from March to the beginning of the recent decline. The area between the vertical red line and the line of zeros represents the first phase of the total distribution pattern which has already been used up and which has given us a 240-point downdraft. That's equivalent to a little more than one fourth of the total top formation count. Tight patterns like this normally give a fairly accurate count, but there is no guarantee that this one will play out. However, if we continue to decline below the October low (left of chart) the odds of its happening will increase significantly.

Indicators Survey

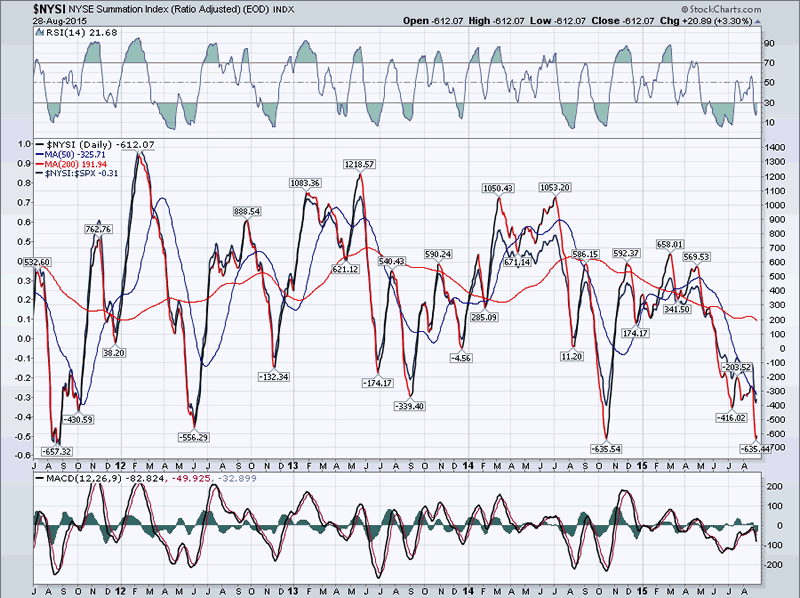

The weekly MACD is now fully negative and continues to drop. Even its histogram is still making lower lows.

The daily MACD went beyond the October low by a good margin and remains well below after barely turning up in the rally.

Last week, the McClellan Summation Index missed matching its October drop by .10 and has also just barely turned up. Its indicators do show some positive divergence. (The NYSI chart is Courtesy of MarketCharts.com)

On Friday, the 1X1 P&F chart filled the count established by the base pattern after the SPX re-tested its low. A significant congestion pattern which formed on Friday is more likely to be distribution, but this needs to be confirmed.

Chart Analysis

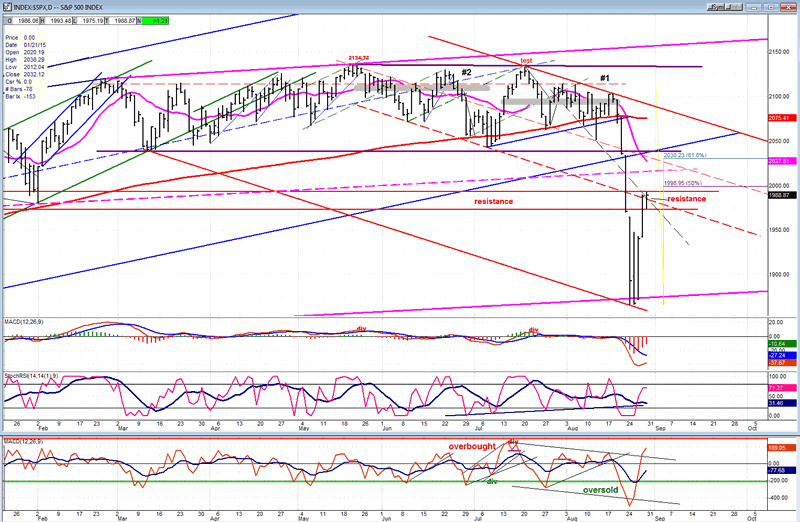

On the following chart of the Daily SPX (chart courtesy of QCharts.com as others below), I show that the index found support at the junction of the red and pink bottom channel lines. It has now rallied to the middle of the red channel which is roughly a 50% retracement of the decline. It is also meeting with resistance at the lower level of the congestion pattern established on the far left of the chart, and from the declining mid-channel (dashed) line. Everything considered, it would not be a bad place to end the oversold rally. The only thing is that having broken out of its (blue) intermediate channel, if it can find the strength, it could rally all the way to back-test the bottom of the blue channel line over the next few days -- which would also cross the broken 2040 support. There, it would also find resistance from a parallel red channel line, and retrace a full .618% of the decline.

The price momentum of the rally was supported by strong breadth figures which is understandable considering the unusually extreme oversold condition and volatility, but that could mean that the (bear market?) rally has more to go before dissipating. And then, there is Friday's congestion area which could turn out to be re-accumulation. If we are to carry this rally higher, it will have to be done quickly because September is expected to be a weak month toward the end of which some of the cycles which are causing the market correction are scheduled to make their lows.

I should also point out that the oscillators show no sign of turning, yet.

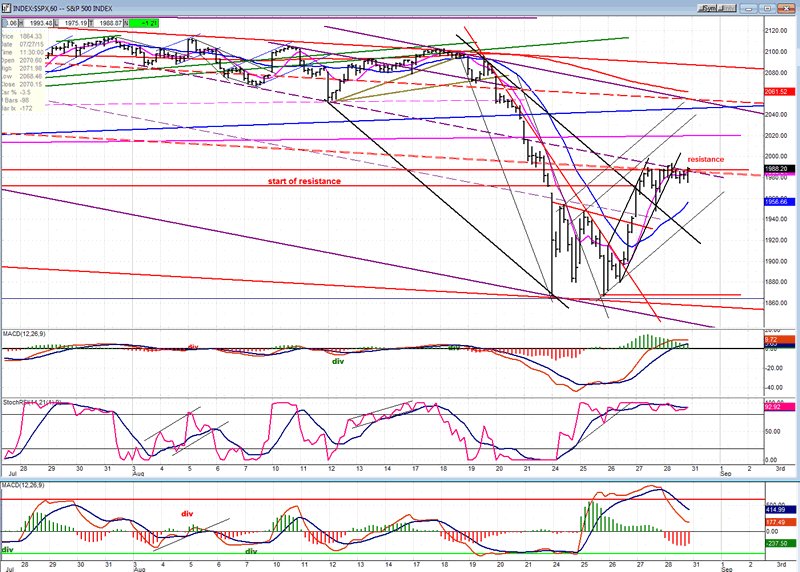

I have drawn some additional channels on the Hourly chart to show how the angle of the decline has already changed. There are also up-channels which will give us a chance to evaluate the rally if it progresses further.

The reason that the rally stopped where it did is obvious. It has run into some resistance caused by various trend lines as well as the bottom of the lows which occurred in December and January. But in spite of these obstacles, it has only had a brief pull-back while continuing to challenge them all day Friday. A quick continuation of the oversold rally would not be surprising.

The only oscillator which has turned down is the A/D, and that is because it was extremely overbought; but since neither of the momentum oscillators is showing negative divergence, the advance could resume to the higher level for a couple of days.

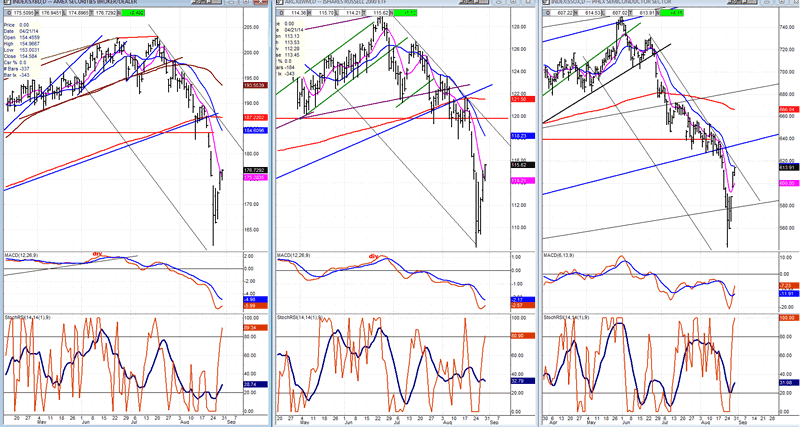

XBD -- IWM -- SOX

All three participated in the decline and in the subsequent rally. It's evident, however, that none has recovered anything close to 50% of its decline which, from that standpoint, makes them all relatively weaker than the SPX. Like in the SPX, the MACD is weak, but the SRSI looks as if it could continue a few more days before rolling over.

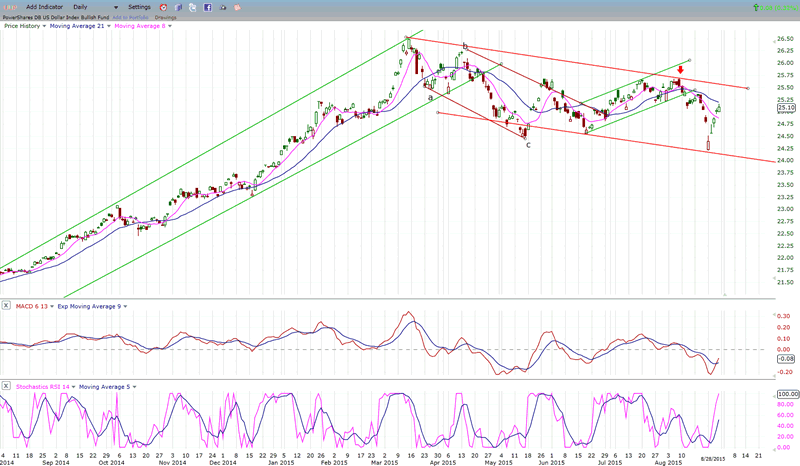

UUP (dollar ETF)

UUP had a strong rebound after touching the low of its correction channel. The next challenge will be the top of that channel. If it goes through it with momentum, it will be in a position to make a new high. If not, additional consolidation is likely.

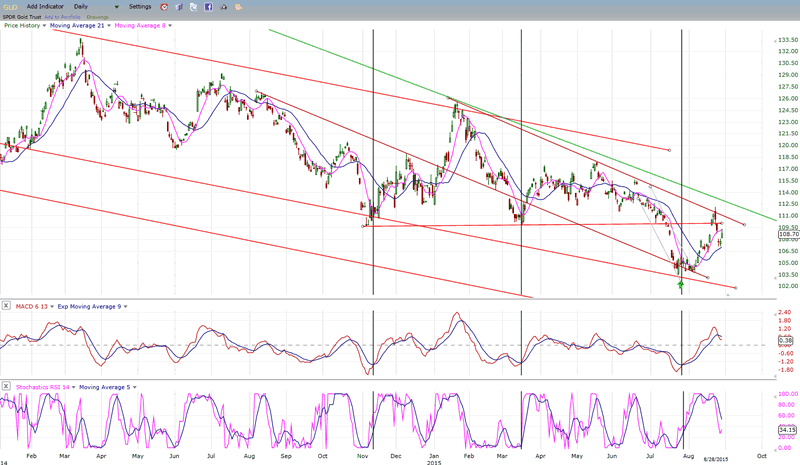

GLD (Gold trust)

As you would expect, GLD did the reverse of UUP. It found resistance at the top of its correction channel (which is still steep) and the overhead supply of the former lows. The last short-term decline in gold showed increased downside momentum and strongly suggests that the longer-term pressure is still negative. I still believe that GLD could decline to about 100 before finding good enough support for a meaningful reversal.

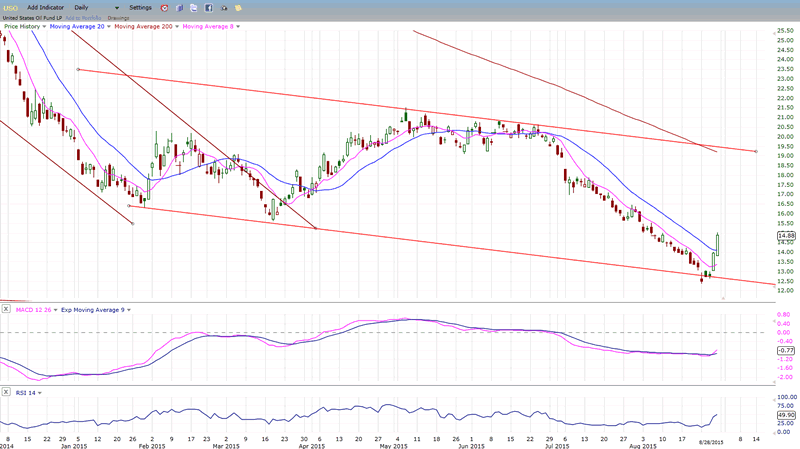

USO (US Oil Fund)

USO and the whole energy complex is benefiting from an oversold rally, but I would not expect this to turn into a major change of trend. It would make more sense for the index to stabilize in a base formation making an attempt at establishing an uptrend.

Summary

Cyclical pressure which finally broke the resistance of the indices appeared to lift this week as traders and bargain hunters took advantage of a sharply oversold market. Whether or not the relief rally ended with a 50% retracement remains to be seen, but even it is has not, stock prices face serious challenges ahead. Over the short-term, the month of September should bring no respite since some cycles will continue to bottom until the end of the month. On the longer term, the degree of distribution exhibited by the P&F chart above suggests that there is still plenty of water that needs to be drained from the reservoir before the flood comes to an end.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.