Stock Market, GDX Rally Expected, Now What?

Stock-Markets / Stock Markets 2015 Aug 30, 2015 - 05:51 PM GMTBy: Brad_Gudgeon

Last time I wrote, I was expecting an important top in the stock market by the 28th and a minimum of 1985 SPX. We closed at 1988 Friday after tagging 1993. Gold stocks began to rally strongly Thursday into Friday as we hit the 8 TD/3 week low Wednesday at new lows. Now what?

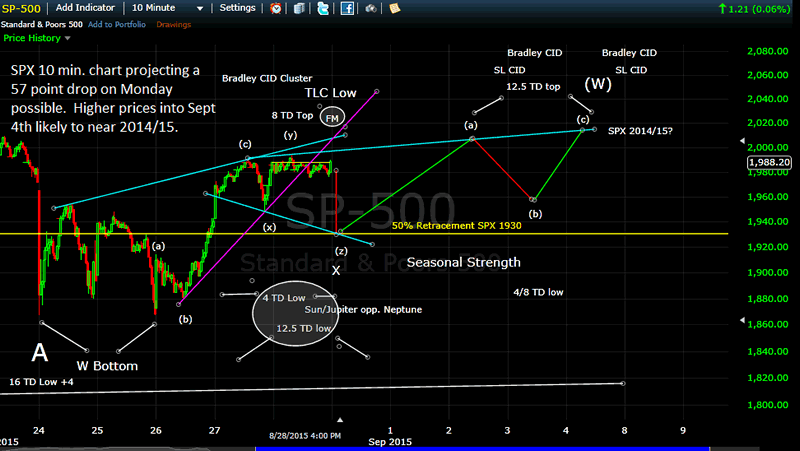

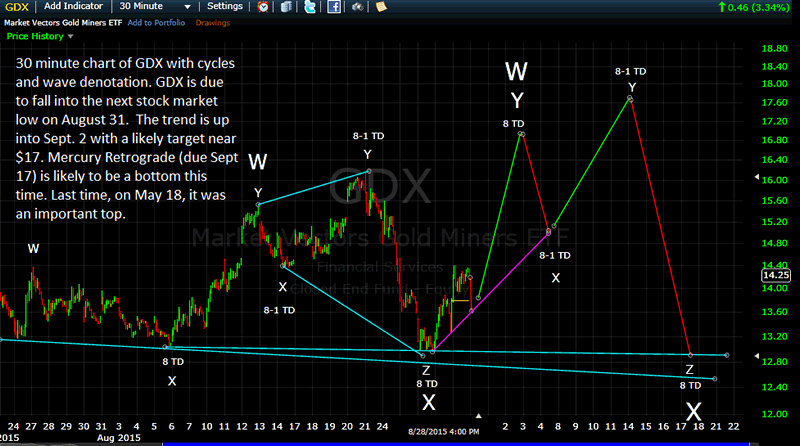

We have the 12/13 TD low due Monday along with a 4 TD 1 TD low max; also a TLC low due then. My expectation is for a quick 57 point SPX drop possible early Monday down to 1930 (see chart below). This should bring down the mining stocks with it, but it should all be temporary. GDX could come down into the mid $13 area, but I expect we may see $17 by Sept 2. As for the stock market, I believe we may have one more up wave left to perhaps the 2014 SPX area pre-Labor Day.

Monday's astro has the conj. with Jupiter and the Sun opposing Neptune and this is a negative. The seasonal bias, as well as the 12/13 TD low should launch the stock market higher into Sept. 4 to complete wave (w) of B.

After that, I believe we fall into mid month to lower lows around Sept 17 to finish wave X. The mining sector looks to be especially great for trading up and down in the coming weeks too. We have done well, despite being a little early in some of our trades. Our new mining stock sector signal trading via NUGT and DUST is already +32% in just 2 weeks; our SPXL/SPXS stock market signals are +80% since April 15, all 2015 verifiable at Collective 2.

I believe we are still in the midst of a 20% bear market that should terminate in early October near SPX 1700. Meanwhile, I believe we are in the gyrations of a B Wave flat flag that should complete itself somewhere near Sept 30/October 1 before turning down hard in Wave C.

S&P500 10-Minute Chart

GDX 30-Minute Chart

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.