Economic Destabilization, Financial Meltdown and the Rigging of the Shanghai Stock Market?

Stock-Markets / Chinese Stock Market Aug 29, 2015 - 03:40 PM GMT The dramatic collapse of the Shanghai stock exchange has been presented to public opinion as the result of a spontaneous “market mechanism”, triggered by weaknesses in China’s economy.

The dramatic collapse of the Shanghai stock exchange has been presented to public opinion as the result of a spontaneous “market mechanism”, triggered by weaknesses in China’s economy.

The Western media consensus in chorus (WSJ, Bloomberg, Financial Times) portend that Chinese stocks tumbled due to “uncertainty” in response to recent data “suggesting a downturn in the world’s second-largest economy”.

This interpretation is erroneous. It distorts the workings of stock markets which are the object of routine speculative operations. An engineered decline in the Dow Jones, for instance, can be precipitated in various ways: e.g. short selling, betting on the decline of the Dow Jones Industrial Average in the options market, etc. 1

Amply documented, financial markets are rigged by the megabanks. Powerful financial institutions including JP Morgan Chase, HSBC, Goldman Sachs, Citigroup, et al and their affiliated hedge funds have the ability of “pushing up” the stock market and then “pulling it down”. They make windfall gains on the upturn as well as on the downturn. This procedure also applies to the oil, metals and commodity markets.

It’s financial fraud or what former high-level Wall Street insider and former Assistant HUD Secretary Catherine Austin Fitts calls “pump and dump,” defined as “artificially inflating the price of a stock or other security through promotion, in order to sell at the inflated price,” then profit more on the downside by short-selling. “This practice is illegal under securities law, yet it is particularly common,” (See Stephen Lendman, Manipulation: How Financial Markets Really Work, Global Research, March 20, 2009

The Shanghai Stock Exchange Collapse

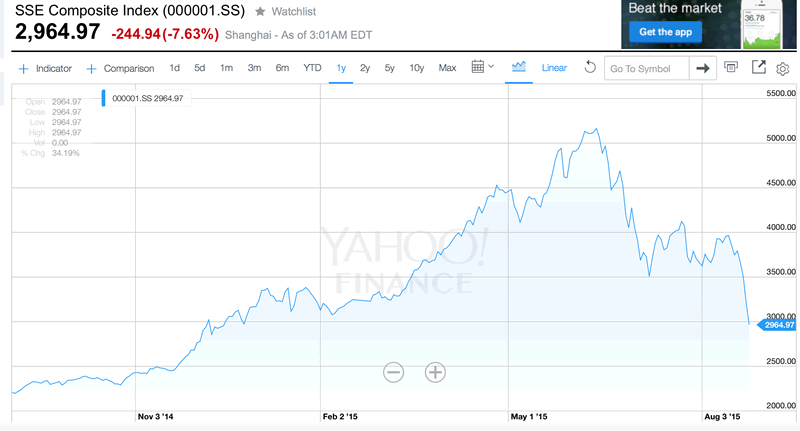

The Shanghai SSE Composite Index progressed over the last year from approximately 2209 on August 27, 2014 to more than 5166 on June 21st, 2015 (circa 140% increase); then from June 21st it collapsed by more than 30 percent in a matter of two weeks to 3507 (July 8).

A further collapse occurred starting on August 19, in the week immediately following the Tianjin explosions (August 12, 2015) culminating on Black Monday August 24th (with a dramatic 7.63 percent decline in one day).

Did the Tianjin Explosion contribute to exacerbating “uncertainty” with regard to the Chinese equity market?

Shanghai SSE Composite index.2015-08-25 at 14.08.58

The evolution of the SSE over that one year period has nothing to do with spontaneous market forces or real economy benchmarks. It has all the appearances of a carefully engineered speculative onslaught, an upward push and a downward pull.

The possibility of market rigging was investigated by the Chinese authorities in July 2015 following the June 21 meltdown of the Shanghai Stock Exchange (see graph above):

The regulator said [Report July 3] that it would be looking into whether parties were mis-selling financial products. ….

The China Securities Regulatory Commission (CSRC) said it would base its investigation on reports of abnormal market movements from the stock market and futures exchanges.

…. Some reports have accused overseas investors of driving prices down by short-selling stocks on Chinese bourses, meaning they were betting on stocks falling.

… Any criminal cases will be transferred to the police, the regulator said.

The China Financial Futures Exchange (CFFEX) has suspended 19 accounts from short-selling for a month, reports Reuters news agency, citing unnamed sources. (BBC, August 25, 2015, emphasis added)

The media consensus (as well as statements emanating from the Chinese authorities) was that Chinese financial actors rather than foreign banks could have been behind the process of stock market rigging: “Overseas investors have limited access to Chinese markets”. Market manipulation did not emanate from foreign sources, according to the Global Times.

This assessment, however, does not take into consideration that Goldman Sachs, JP Morgan Chase, HSBC et al are major financial actors within China, operating in Shanghai through Chinese financial proxies in partner joint ventures.

Moreover, these Western financial institutions are known to have played an overriding role in manipulating stock markets as well foreign exchange markets:

Regulators fined six major banks a total of $4.3 billion for failing to stop traders from trying to manipulate the foreign exchange market, following a yearlong global investigation.

HSBC Holdings Plc, Royal Bank of Scotland Group Plc, JPMorgan Chase & Co, Citigroup Inc, UBS AG and Bank of America Corp all faced penalties resulting from the inquiry, which has put the largely unregulated $5-trillion-a-day market on a tighter leash, accelerated the push to automate trading and ensnared the Bank of England.

…

Dealers used code names to identify clients without naming them and swapped information in online chatrooms with pseudonyms such as “the players”, “the 3 musketeers” and “1 team, 1 dream.” Those who were not involved were belittled, and traders used obscene language to congratulate themselves on quick profits made from their scams, authorities said. (Reuters, November 11, 2014).

Goldman Sachs among other major financial institutions operates out of Shanghai since 2004 under a joint venture arrangement with the Beijing Gao Hua Securities Company.

Goldman is known to use so-called “high frequency trading programs” in stock market transactions:

“Markets can be rigged with computers using high-frequency trading programs (HFT), which now compose 70% of market trading; and Goldman Sachs is the undisputed leader in this new gaming technique. (See Ellen Brown, Stock Market Collapse: More Goldman Market Rigging, Global Research, May 8, 2010)

Another factor which has facilitated speculative operations on the Shanghai Stock Exchange has been the integration of the Hong Kong and Shanghai stock markets in 2014 under the so-called “Stock Connect” link. The procedure enables foreigners to buy Chinese A shares listed on the Shanghai exchange out of Hong Kong, with “limited restrictions”, namely full access to China’s equity market.

Financial Warfare

These engineered upward and downward swings of the Shanghai Composite Index ultimately result in the confiscation of billions of dollars of money wealth including Chinese State funds provided by the People’s Bank of China to prop up the Shanghai Stock Market. Where does the money go. Who are the recipients of this multi-billion dollar trade?

In response to the August meltdown, the People’s Bank of China “offered 150 billion yuan ($23.43 billion) worth of seven-day reverse repurchase agreements, a form of short-term loans to commercial lenders.”. This money was wasted. It did not result in reversing the meltdown of the Shanghai stock exchange.

Geopolitics

Geopolitical considerations are also relevant. While the Pentagon and NATO coordinate military operations against sovereign countries, Wall Street carries out concurrent destabilizing actions on financial markets including the rigging of the oil, gold and foreign exchange markets directed against Russia and China.

Is the “possible” rigging of the Shanghai Stock Exchange part of a broader package of US actions against China which consists in weakening China’s economy and financial system?

Does China’s financial collapse serve broader US foreign policy interests which include routine threats directed against China, not to mention US military deployments in the South China Sea?

Are we dealing with “financial warfare” directed against a competing World economic power?

It is worth noting that speculative procedures (rigging) have also been used in the oil and foreign exchange markets against the Russian Federation. Combined with the sanctions regime, the objective was to push down the price of crude oil (as well as the value of the Russian rouble), with a view to weakening the Russian economy.

“Obama’s ‘Pivot to Asia’ directed against China is reinforced through concurrent destabilizing actions on the Shanghai stock exchange. The ultimate intent is to undermine –through non-military means– the national economy of the People’s Republic of China.” (Michel Chossudovsky, US-NATO Military Deployments, Economic Warfare, Goldman Sachs and the Next Financial Meltdown, Global Research, August 8, 2015

Note

1. The latter is one among several instruments used by speculators. There is no buy sell transaction of shares of company listed on the stock exchange: a bet is placed on an upward or downward movement of the DJIA. It’s an index fund: ask and put options.

Global Research Articles by Michel Chossudovsky

© Copyright Michel Chossudovsky, Global Research, 2015

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.