The Stocks You Should Be Buying After the Market Drop

Companies / Investing 2015 Aug 29, 2015 - 07:56 AM GMTBy: Investment_U

Sean Brodrick writes: If you’re looking for bargains after Monday’s market sell-off, take a look at cybersecurity. Few industries got sold as hard - and yet it has the best growth prospects.

Sean Brodrick writes: If you’re looking for bargains after Monday’s market sell-off, take a look at cybersecurity. Few industries got sold as hard - and yet it has the best growth prospects.

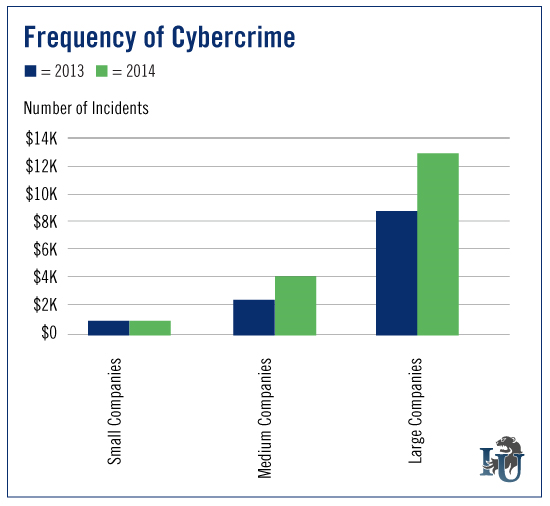

That’s due to a worldwide surge in hacking from criminals and terrorists. After all, when it’s so easy to be a hacker and get away with it, anyone who wants to will be a hacker.

But it isn’t hopeless. America is going to fight back. In fact, U.S. companies have been told they MUST fight back - or else.

Uncle Sam Steps In

A federal court ruled Monday that the Federal Trade Commission (FTC) now has the power to go after corporations that fail to take adequate measures to protect customer information from hackers. (You’d be forgiven for missing the news... there was a lot going on that day.)

The ruling came about because Wyndham (NYSE: WYN) had major data breaches in 2008 and 2009. Hackers stole credit card numbers and other personal information from 619,000 customers. This resulted in more than $10.6 million worth of fraudulent charges. Now the FTC wants to make sure Wyndham pays for its lack of preparedness.

And it’s just a taste of what’s to come. The FTC is also considering a case against Target (NYSE: TGT) over the hack that exposed data for as many as 40 million customers.

Home Depot (NYSE: HD)... Apple (Nasdaq: AAPL)... EBay (Nasdaq: EBAY)... Bank of America (NYSE: BAC)...

Home Depot (NYSE: HD)... Apple (Nasdaq: AAPL)... EBay (Nasdaq: EBAY)... Bank of America (NYSE: BAC)...

All of these companies have experienced high-profile cyberbreaches in recent years. Now, which do you think they would rather spend money on - cybersecurity measures or huge court settlements?

I know how I’ll bet.

Some more frightening stats...

- A whopping 91% of U.S. companies have been targeted by a cyberthreat within the past year.

- There were 118,000 attempted attacks PER DAY in 2014. Successful hacks on Anthem (NYSE: ANTM), JPMorgan (NYSE: JPM) and Sony (NYSE: SNE) show no industry or company is truly safe.

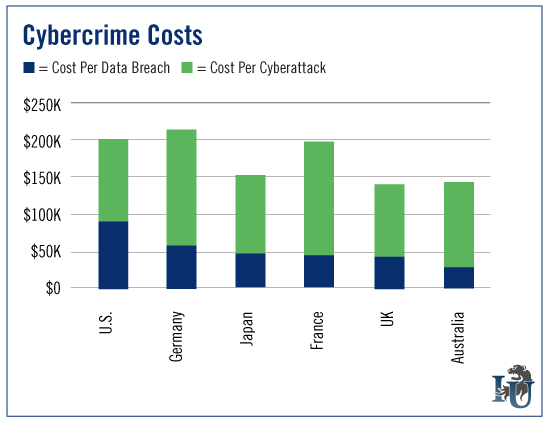

- Last year, each successful cyberattack in the U.S. cost the affected company an average of $12 million. The amount of damages per incident has doubled in the past five years.

- According to the AARP Fraud Watch Network, cybercrime cost ordinary Americans $800 million in 2014.

I could pummel you with hack attack facts until you’re curled under your desk, cradling your hard drive. But I don’t want you to get scared. Instead, I want you to (a) protect yourself - starting with the five simple steps I outlined here - and (b) profit.

That second part should be easy since spending on cybersecurity is expected to grow 20% this year alone. And now that the FTC is stepping in, plenty more companies and government agencies will be seeking professional anti-hacking services.

Plus, as I mentioned at the top of today’s column, this is the perfect week to jump into this trend.

An Easy Way to Play Cybersecurity Now

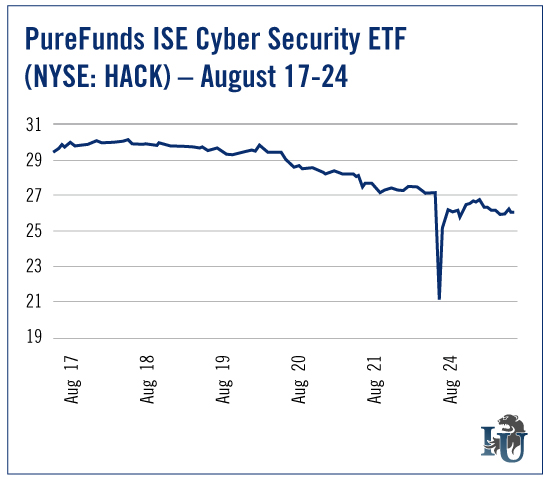

When the market panicked on Monday, nobody got hit harder than the PureFunds ISE Cyber Security ETF (NYSE: HACK). It’s a basket of 32 cybersecurity stocks, including industry leaders Trend Micro, Fortinet (Nasdaq: FTNT) and Juniper Networks (NYSE: JNPR).

Check out the chart...

You can see that the PureFunds ETF swooned more than 30% upon opening. Then it clawed its way back the rest of the day and closed above its open. This shows that the smarter money knew panic was the only thing dumping the PureFunds ETF on the curb. Once the market turned, buyers came in.

The funny thing is, we may not have seen a bottom in the market or the PureFunds ETF. Not if the market gets another whiff of panic. I’m not saying you’ll be able to buy it under $19 - but if fear sweeps through the market again, you might be able to pick up the PureFunds ETF or its components for dimes on the dollar.

I expect the fund will do well. The individual companies it contains have real potential for extraordinary outperformance.

The cyberwar against America is raging. And the tsunami of spending in cybersecurity hasn’t crested yet.

Don’t get mad... get rich. It’s the best kind of revenge.

Good investing,

Sean

Editorial Note: The FBI and NSA are sounding the alarm... Hackers now have the capability to mount devastating sabotage operations against our electric grid. For tens of millions of Americans, this would mean a sudden and frightful return to the Stone Age.

But there is hope! A handful of publicly traded companies are working to make sure this NEVER happens - and making a killing for shareholders in the process. Click here for more information.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.