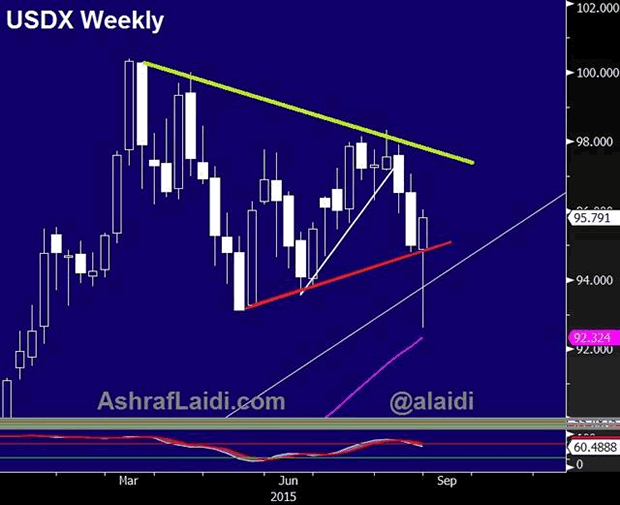

Is this it for U.S. Dollar Bulls?

Currencies / US Dollar Aug 28, 2015 - 03:24 PM GMTBy: Ashraf_Laidi

US dollar bulls couldn't have asked for a better scenario -- Just as the USD index (basket of 6 currencies largely weighed vs EUR) was about to test a 3-month trendline support, the currency recovers. And just as EURUSD had broken above its 200-DMA for the first time in 13 months and above its 55-WMA for the first time in 12 months in a matter of 4 days, the single currency crashes back below these key levels later in the same week. But CAD, AUD, NZD and NOK have all outperformed USD thanks to a broad bounce in energy.

Dollar Sweet Spot?

So is this it? Is this the pause-for-breath that USD bulls have long demanded for their currency before accumulating further gains into the rest of the year? By Monday evening, expectations for a September Fed hike fell to as low as 20% from as high 57% earlier in the month. Today, odds of a September lift-off bounced back to 30%.

We think that in order for the US dollar to accumulate fresh gains and sustain them, the balance between certainty for a 2015 Fed hike and certainty of no Fed hike must be evenly distributed (such as 45%-55% for Sept). The problem with +60% certainty of September move is that it eliminates the probability for a December hike despite what some FOMC members' forecasts have indicated (2 hikes in 2015).

For obvious reasons, USD bulls do not want Sep Hike odds falling below 20%. Therefore, the sweetest spot as far as Sep Fed hike expectations is for them to range roughly between 35% and 50%.

Conventional & unconventional intervention

Readers of my work may not need reminding that I still see no Fed hike in 2015 and any such action would be a policy error, which will trigger more "artificial" interventions from the Chinese, as well as the US authorities (but deemed more conventional) such as "circuit breakers" and "Rule 48".

In fact, China is not only intervening by propping its stock market, but more importantly, selling US treasuries in order to slow the pace of CNY depreciation. A rapid CNY decline has devastating effects on the global markets and economy via renewed decline in commodities and gloomy prospects for emerging markets dependent upon exports from China. The other (more national interest) reason China is slowing the pace of CNY depreciation is to avoid rapid capital outflows. Both aims are to the benefit of global markets and the economy.

Premium subscribers who have questioned our recurring USD shorts vs EUR and GBP since June have obtained their answer this week and the last as our $1.15 and $1.17 targets in EURUSD have both been hit.

Now comes the hard part. Trading the retracement.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.