Chinese Medicine not Impressing Dr Copper

Commodities / Copper Aug 27, 2015 - 12:22 PM GMTBy: Dan_Norcini

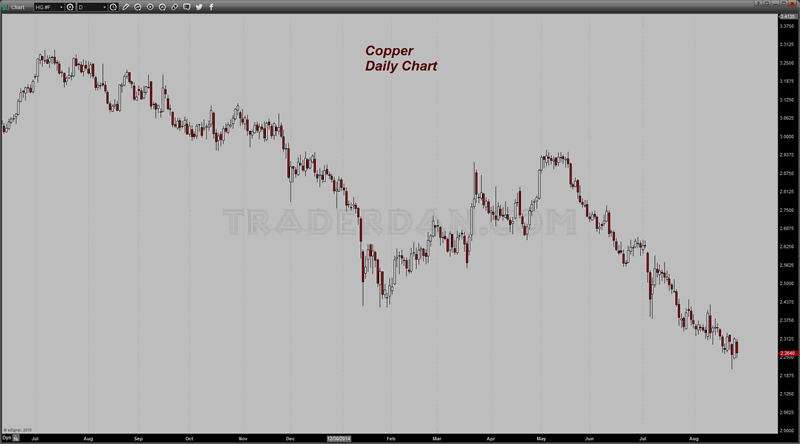

Dr. Copper apparently does not approve of the prescription ordered by the Chinese authorities to stem the slowdown in that nation, namely another 25 basis point interest rate reduction and a lowering of bank reserve requirements.

Dr. Copper apparently does not approve of the prescription ordered by the Chinese authorities to stem the slowdown in that nation, namely another 25 basis point interest rate reduction and a lowering of bank reserve requirements.

The red metal cannot sustain any upside action for long before sellers emerge to whack it again.

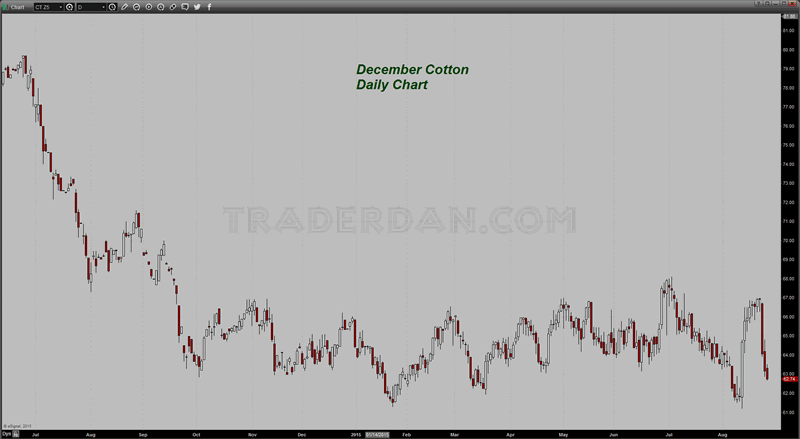

This is number one of my THREE BIG C’s, Copper, Crude oil and Cotton.

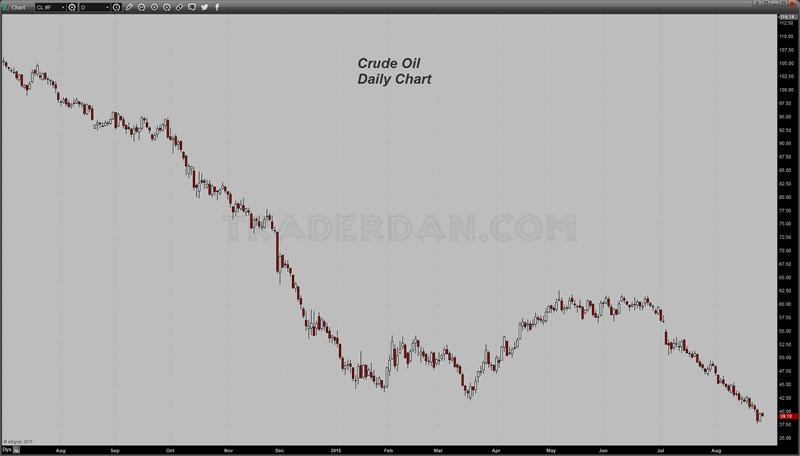

So what exactly are the other two C’s telling us?

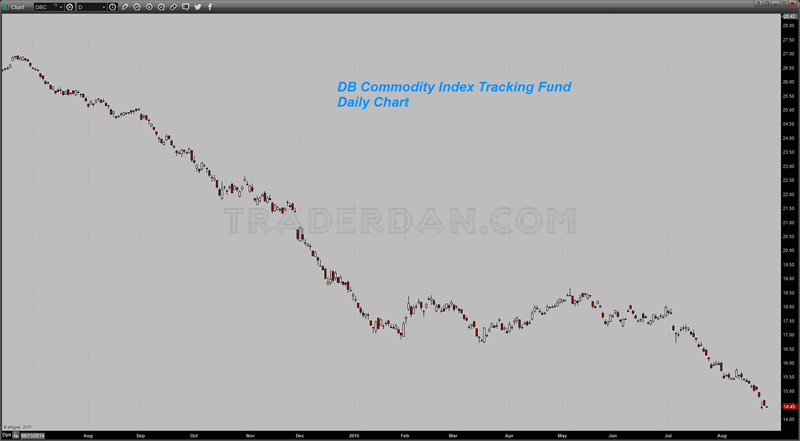

Here is a look at the overall commodity sector. I have chosen to use Invesco’s DB Commodity Index Tracking Fund for charting the sector today ( you can use any one of these funds – I typically use the GSCI) just because it has a lot of liquidity.

No matter how one slices or dices it, this sector is signaling slowing growth due to a combination of excess supply and lagging demand. Remember, back during the hey-day of the commodity sector, prices soared leading to massive ramp ups in production. That new supply came onto the market at the same time that global growth began slowing. The combination was lethal for prices.

Lastly, at the risk of boring some of my readers, I cannot help but to express bewilderment at the claims that continue to come out of the gold cult in regards to silver being a safe haven. That an otherwise rational person would string the two objects together ( silver/safe haven) in a single breath defies all rational analysis. Notice I am using the word, “rational”.

There is nothing the least bit “rational” about those who continue to propagate this myth.

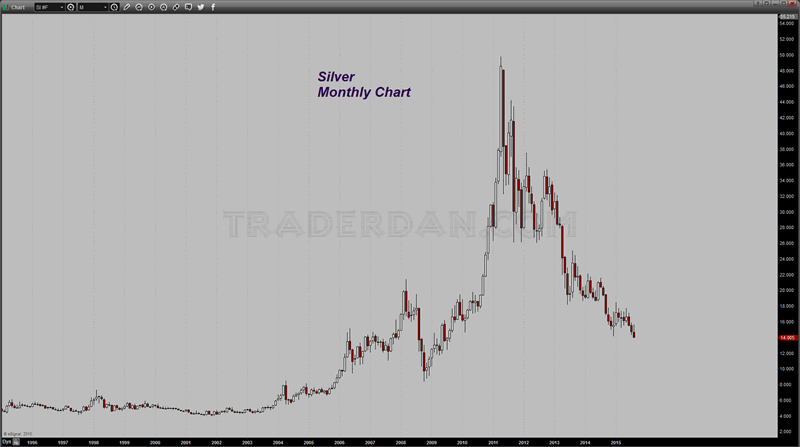

To those who at least make an effort to remain objective and open-minded when it comes to investing or trading, here is a simple long term chart of silver.

Can anyone say with a straight face, that this remotely resembles anything that looks like a “safe haven”?

Silver will follow the rest of the broader commodity sector around. There is nothing else that one needs to know. Anything to the contrary is pure propaganda and wishful thinking. Follow it at your own financial peril.

This “safe haven” now has a “13”handle in front of it at the moment. How many more poor victims of this pestilential gold cult ( and silver cult) must be claimed before this lesson is learned?

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.