Saudis Could Face An Open Revolt At Next OPEC Oil Meeting

Commodities / Crude Oil Aug 25, 2015 - 11:57 AM GMTBy: OilPrice_Com

OPEC next gathers December 4 in Vienna, just over a year since Saudi Oil Minister Ali Al-Naimi announced at the previous OPEC winter meeting the Saudi decision to let the oil market determine oil prices rather than to continue Saudi Arabia’s role of guarantor of $100+/bbl oil.

OPEC next gathers December 4 in Vienna, just over a year since Saudi Oil Minister Ali Al-Naimi announced at the previous OPEC winter meeting the Saudi decision to let the oil market determine oil prices rather than to continue Saudi Arabia’s role of guarantor of $100+/bbl oil.

Despite the intense financial and economic pain this decision has inflicted on Saudi Arabia, its fellow OPEC members, and other oil producers, the Saudis have given no indication they plan to alter course. In fact, Saudis have downplayed the impact of lower prices on their country, asserting that the kingdom has the financial wherewithal to withstand lower oil prices.

Presumably swayed by Saudi equanimity, financial markets do not see the Saudis abandoning their current policy before, during, or after the upcoming OPEC meeting. CME Brent oil futures project continuity: as of August 18, 2015, CME Brent futures projected the price remaining below $60/bbl until June 2017. A CNBC poll of oil traders, analysts, and major fund investors, aired on CNBC August 17, showed 95 percent believing the Saudis will not alter course.

Are the futures market, CNBC’s oil traders, analysts, and major fund investors, and others, being lulled into an unjustified consensus?

The damage the Saudi decision has inflicted on Saudi Arabia itself provides reasons for the Saudis to change course.

Saudi Policy: OPEC-centric or Self-Serving?

Stresses within OPEC should add to the pressure on the Saudis to rethink their strategy. The Saudis sold their change to their fellow OPEC members as being in OPEC’s general interest. They asserted that the their traditional method of stabilizing the oil market, production cuts, would not work since non-OPEC producers would increase output; second, that “market” forces would reduce investment and therefore increase prices in the medium and longer term and ultimately benefit all OPEC members; and third, that any Saudi increase in output was aimed at defending its market share, not reducing theirs.

As the first anniversary of the Saudi decision approaches, it would be reasonable for OPEC outsiders–OPEC members, other than the Saudis and their Gulf Arab allies, Kuwait, UAE, and Qatar—to interpret Saudi policy shift as designed to serve Saudi interests and those of its Gulf Arab allies rather than their interests and those of OPEC in general.

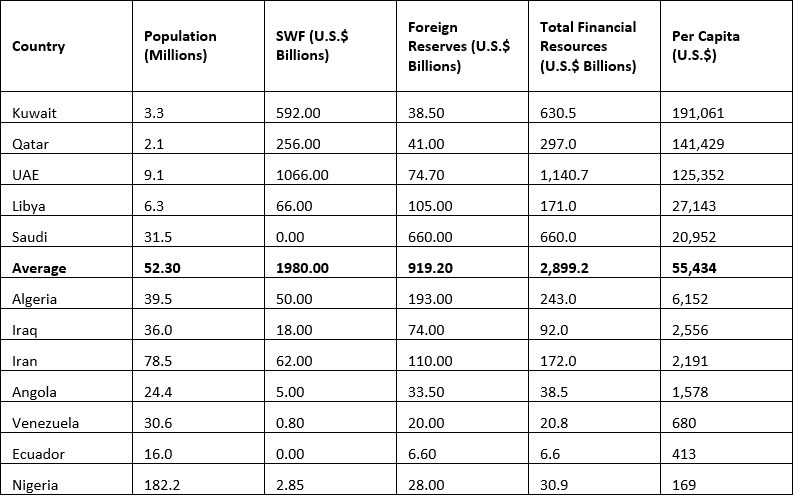

“Market” forces include many components. A key component—perhaps the key component—is a country’s capability, at a minimum, to maintain output, and better yet, to increase output. Financial wherewithal is the foundation of this component. Saudi and Gulf Arab OPEC members’ foreign currency reserves and sovereign wealth funds (SWF) comprise approximately 78 percent of total OPEC member holdings, $2.73 trillion of $3.05 trillion.

As the following table shows, their advantage is particularly large on a per capita basis. Of the non-Saudi, non-Gulf Arab ally OPEC members, only Libyan per capita resources exceed the average. (The UAE includes data for three SWF funds only: Abu Dhabi Investment Authority ($773 billion), Abu Dhabi Investment Council ($110 billion), and Investment Corporation of Dubai ($183 billion)).

Given the other budgetary demands on their oil revenues, $50/bbl or $60/bbl oil leaves these OPEC outsiders with little to invest in maintaining oil output, much less expanding output. Budgetary pressures and limited financial resources, for example, have forced the Iraqi government to request its foreign partners, BP in the Rumaila field and Exxon in the West Gurna-1 field, to reduce spending to cut 2015 investment by $500 million ($1.1 billion vs. $1.6 billion) and $1 billion ($2.5 billion to $3.5) respectively.

Related: Oil Prices Must Rebound. Here’s Why

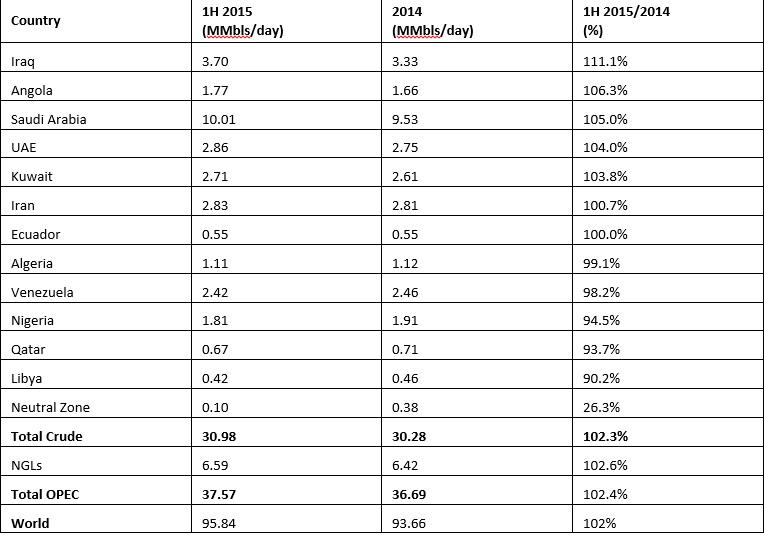

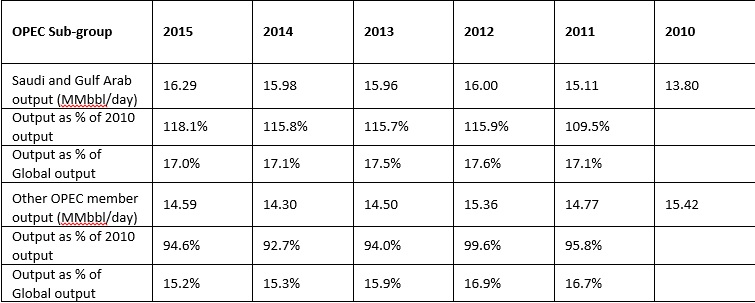

While all OPEC members, including Saudi Arabia, have suffered from the Saudi decision, they have not shared the pain equally. Saudi Arabia and its Gulf Arab allies, except Qatar, have increased output, while the output of other OPEC members, other than Iraq and Angola, has either flat-lined or decreased, compared to 2014:

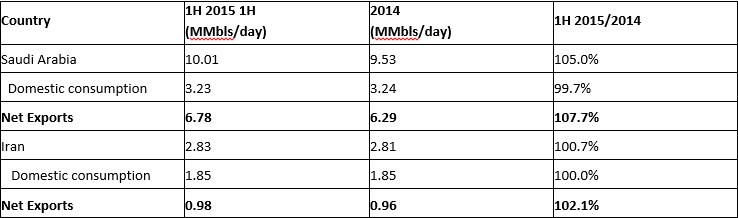

Given Saudi determination to defend its export markets, it is interesting that the percentage gain in their crude exports exceeded the percentage gain in crude output in 1H 2015, by 2.7 percentage points. For Iran, the only other OPEC country for which the IEA provides domestic demand data, the increase in exports, 0.7 percent, matched the increased domestic output.

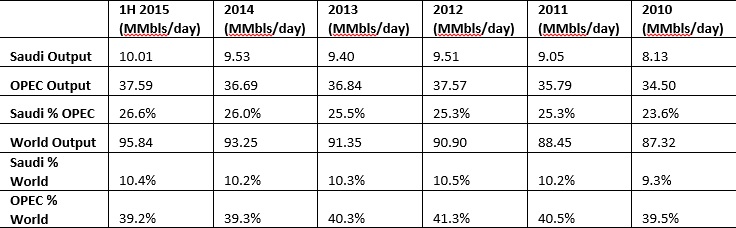

Interestingly, also, the Saudis increased their share of OPEC average daily output in the first half of 2015 over 2014 average daily volume—and their share of average daily global output. Their share of OPEC output increased to 26.6 percent in 1H 2015, from 26 percent on average in 2014, while their share of world output increased to 10.4 percent from 10.2 percent.

For the OPEC outsiders, this should be particularly distressing, since the increase in output likely deepened the decline in prices the Saudi decision to abandon its role as guarantor precipitated.

Related: Is This The Best Play In U.S. Oil?

Both results continue trends seen since 2010. Saudi share of OPEC output increased three percentage points, from 23.6 percent in 2010 to 26.6 percent in 1H 2015. At the same time, the Saudi share of world output increased 1.1 percentage points, from 9.3 percent to 10.4 percent, during the same period; during the same period, OPEC output as a share of global output declined slightly, from 39.5 percent to 39.2 percent.

In fact, over this period, Saudi Arabia and its Gulf Arab allies increased their total output 18.1 percent while the output from the other OPEC members decreased 5.4 percent. During this period, the Saudi and Gulf Arab share of global output was flat, declining only 0.1 percentage point, while the share of the other members declined 1.5 percentage points, from 16.7 percent to 15.2 percent.

Impact on Non-OPEC Producers as Advertised?

In defense of their policy, the Saudis could point to IEA projections that show the rate of growth in output from major non-OPEC producers slowing substantially in 2016, particularly in North America, a major Saudi target, and Brazil:

However, it is reasonable for the OPEC outsiders to question the actual efficacy of Saudi policy on non-OPEC producers and the benefit it will bring them. In both the United States and Russia, each of which produces roughly as much as Saudi Arabia, output increased in 2015 rather than decreasing, and will continue to increase in 2016 in the U.S.

Related: U.S.-Mexico Energy Partnership Could Expand Into Renewables

The IEA projects Brazil’s output, despite Brazilian political turmoil, growing 6.45 percent in 2016. Moreover, Saudi policy, combined with the impact of U.S. and EU sanctions on Russia, led to the undesirable result for OPEC (and other oil exporters) that Russian exports have increased, from 7.21 million barrels/day in 2014 to 7.55 million barrels per day in 1H 2015, in part because as Russia’s economy contracted, reducing domestic crude demand to 3.47 MMbbls/day in 1H 2015 from 3.65 MMbbls/day, while crude output increased to 11.025 MMbbls/day from 10.86 MMbbls/day.

Moreover, any comfort the OPEC outsiders gain at best may be cold comfort. While the IEA projects surplus production will begin to recede in 2H 2016, they are suffering now (and in any case, it is a projection). As we have pointed out, RBC Capital’s fragile five, Algeria, Libya, Nigeria, Iraq and Venezuela, the pain is intense. Also, it is wealthy Saudi Arabia and its Gulf Arab allies and non-OPEC members, in particular the U.S., Canada, Mexico (foreign investment), and also Russia (Chinese investment), that will have the financial wherewithal to grow output to satisfy the 18 million barrel per day increase in demand that OPEC sees by 2040.

The December 2015 OPEC Meeting

Given the Saudi decision’s positive impact on their and their Gulf Arab allies’ relative position within OPEC and its negative impact on OPEC outsiders, it is possible, perhaps even likely, the Saudis will face an OPEC outsider revolt at the December 4 OPEC meeting.

The Saudis and their Gulf Arab allies would seem to have three possible approaches, should a revolt occur:

Reconciliation, as Saudi Arabia acquiesces in the wishes of OPEC’s weaker members to bring price increases forward through OPEC production cuts, Saudi Arabia bearing the brunt;

Separation, as the Saudis and their Gulf Arab allies ignore their fellow members’ entreaties and force them to wait for “market” forces to balance supply and demand; or

Divorce, as the Saudis and their Gulf Arab allies decide to exploit their financial wealth and go their own way, therefore forcing their fellow OPEC members, unable to finance their domestic oil industries, unwillingly to bear the brunt of global production cuts.

In October 2014, the Saudis began signaling their intention to abandon their role as guarantor. It is unlikely however, that whatever Saudi decision makers are now considering, they will show their hand in advance of the December meeting, since this would reduce pressure on the non-OPEC producers that the Saudis claim to be targeting, before necessary.

By Dalan McEndree for Oilprice.com

© 2015 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.