Stock Market Blockbuster Right From the Open...

Stock-Markets / Stock Markets 2015 Aug 24, 2015 - 03:32 PM GMT Good Morning!

Good Morning!

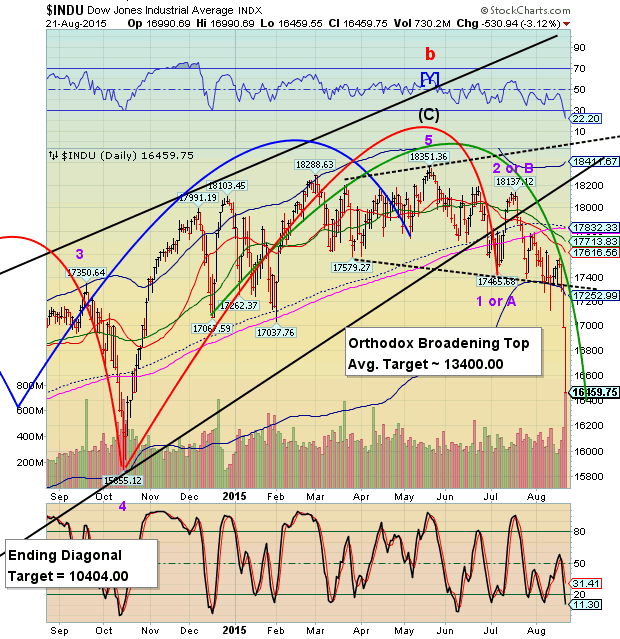

The Dow futures fell to a low of 15762.00 shortly after 8:00 am, more than 4%. Since I cannot imagine any smart buyers out there trying to catch falling knives, I would have to imagine the Fed may be buying at this point, with small success. The Premarket is showing a 60-80 point bounce off the lows. That’s hardly enough to inspire confidence in the markets when they open.

ZeroHedge writes, “Dow futures are now well below the 16,000 level - down a stunning 2500 points from the May highs. The Dow has given up all its gain since December 2013...”

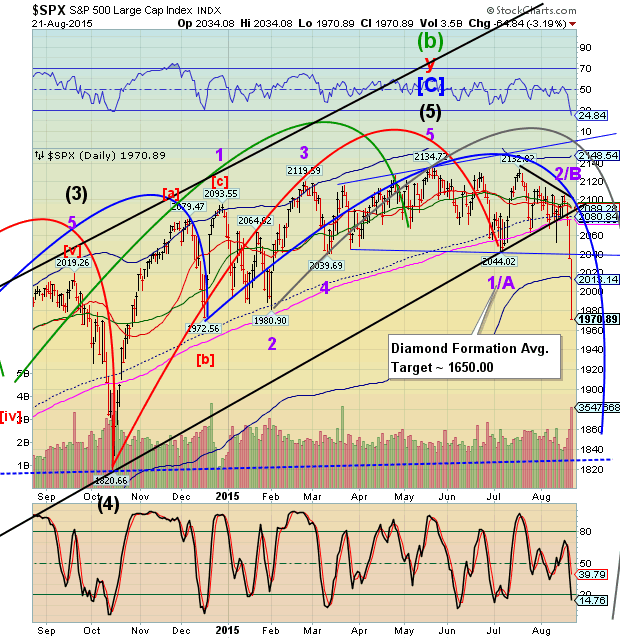

SPX futures plummeted to 1892.00 a little after 8:00 am. The Premarket shows a modest bounce back above 1900.00 at this time.

I have eliminated the Head & Shoulders formation as a valid pattern. It appears that the understanding is not “both,” but either/or. In this case the Diamond Formation is the formation that takes precedence. Both formations are cut from the same cloth, but it appears that the stronger one may be dominant.

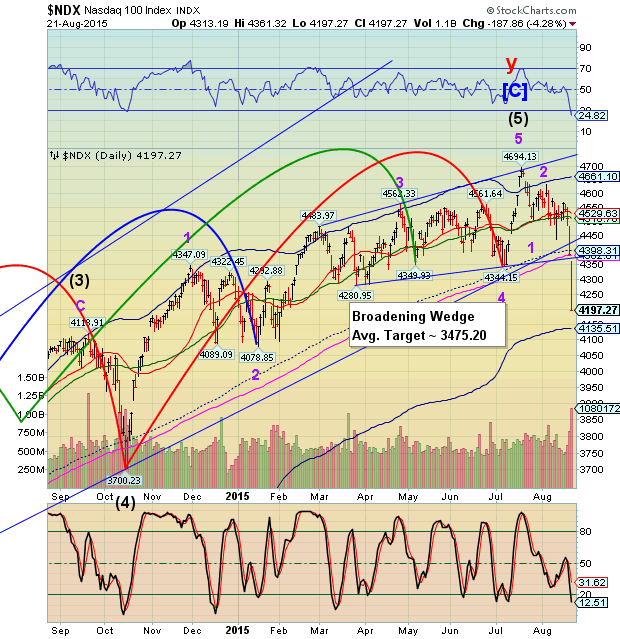

NASDAQ 100 futures have been halted at the 5% limit down marker at 3992.10.

ZeroHedge reports, “NASDAQ 100 SEPTEMBER FUTURES HIT CIRCUIT BREAKER, HALTED - RTRS

Nasdaq Futures below 4,000!”

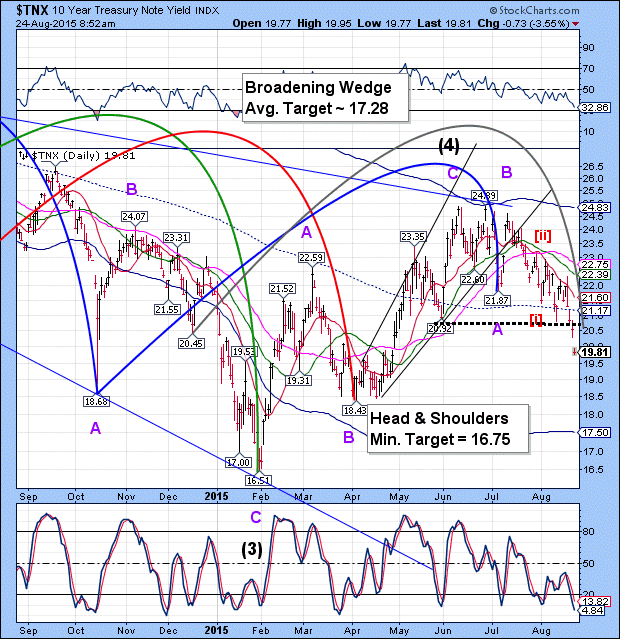

TNX dropped solidly beneath its Head & Shoulders neckline this morning. This now confirms money flowing out of equities and into treasuries.

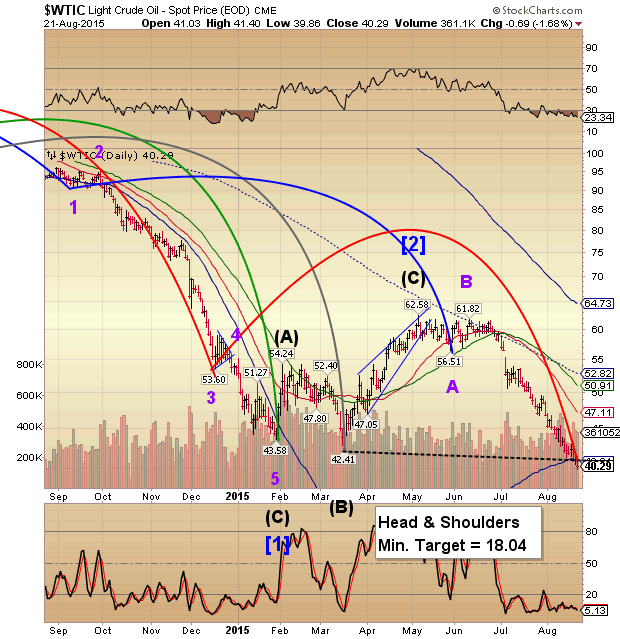

Crude dropped to a new low at 38.60 this morning. I have been discussing the two elements for making a low last week. The distance element (i.e., the Cycle Bottom) was reached late last week. However, the time element may extend to the end of this week, overriding the first element. That seems to be the case as WTIC may decline until the next Primary Cycle Pivot, due on September 1.

Today may be a blockbuster day!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.