Why the Stock Market Sell-Off Happened – and How to Make Money on It

Stock-Markets / Stock Markets 2015 Aug 24, 2015 - 02:03 PM GMTBy: ...

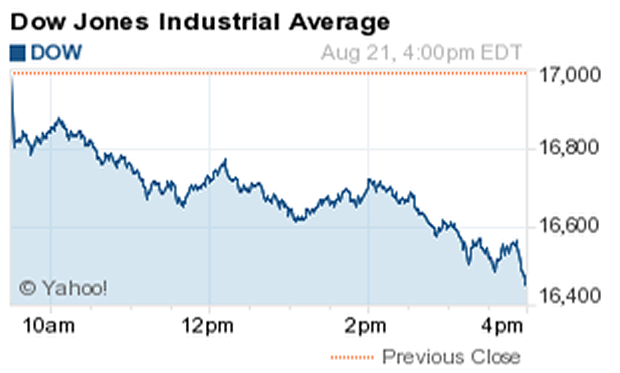

MoneyMorning.com  Shah Gilani writes: It shouldn't come as any surprise that U.S. stocks went into free-fall mode last week.

Shah Gilani writes: It shouldn't come as any surprise that U.S. stocks went into free-fall mode last week.

The signs were everywhere. I'll prove it to you in a moment.

What's likely to happen next is no less frightening, so investors better look for cover.

But before that happens, I'm going to show you all the telegraphed signs that this was coming and what to look for next.

Then I'm going to show you how to cash in…

Investors Were Only Too Happy to Forget About the Fed

The big, big picture that too many investors lost sight of was that the U.S. Federal Reserve's zero interest rate policy (ZIRP) and massive quantitative easing moves didn't stimulate economic growth.

And it didn't work when the European Union, Japan, and China tried them, either.

Lower interest rates were supposed to stimulate consumption, production, and gross domestic product (GDP) growth. And they were designed to lift asset prices – in the case of the Fed, this was an articulated policy goal.

In the Federal Reserve's "wealth effect" scenario, consumers would feel better about the economy's prospects (and their own) by watching stock prices rise.

Rising stock prices, fueled by cheap money in the U.S. that financed $2.7 trillion worth of stock buybacks in the past six years, of course lifted share prices and increased earnings per share metrics (because the same or lower earnings are measured against fewer shares).

The one-two punch of corporations buying their shares at ever-increasing prices and better earnings metrics made stocks look better and better to the untrained eye. And that created a "virtuous momentum"-fueled push to higher highs for equity averages.

While other countries were following the Federal Reserve's lead, China not only lowered interest rates but embarked on a debt-fueled stimulus tear – including runaway infrastructure spending.

According to McKinsey Global Institute research, China's total public and private debt burden skyrocketed from less than $7 trillion in 2007 to more than $28 trillion by mid-2014. And still, China's GDP growth has been slipping badly.

The combination of low interest rates diverting investment capital and savings into capital markets, chasing equities and increasingly lower yielding fixed income securities, and China's stimulus efforts to increase infrastructure, manufacturing, and its exports, which led to over production and stockpiling of commodities, brought us to this point.

That's a big, big picture I just painted, of course. But beneath that, mechanical realities were signaling trouble.

The price of oil has been sliding. When the price of the most important commodity in the world starts to slide, it's not just because America's new record production of 10 million barrels a day is tipping the supply side of the equation.

And it's not that other producer countries desperate for revenue (which is another indication of trouble) are pumping furiously.

The price of oil, that critical bellwether, is crashing because global demand hasn't been rising as much as it was, because global growth is slowing. That's been a flashing light.

Planet of Debt

It's been a great 28-century run, but Greece is on probably its last legs. That's another sign, not just about Greece, but about the burden of debt in general.

There's no way Greece can pay the more than $350 billion it owes, and that's just in bailout loans.

There's no way Japan can repay its government's $11 trillion in debt, which will be three times Japan's GDP by 2030.

The United States is no slouch in the debt department either. Globally, debt burdens have been climbing higher.

And that takes us back for a moment to that big, big picture: Central banks slashing interest rates is a scheme to cut governments' cost of financing their increasing debts.

The only pathway out of everyone's debilitating debt spiral is for economic growth to accelerate (that's of course what everyone hoped low interest rates would accomplish) to such a point that higher tax revenues help pay down debt and that robust growth leads to inflation, which reduces the cost of debt.

That's why central banks want inflation – and that's another crystal clear clear signal of trouble: There's no inflation.

Then there's China. The saying used to be, when the United States sneezes, the world catches a cold.

That's now true of China. And China is sneezing, hacking, loading up on NyQuil and taking three days off work.

Chinese officials tried to push Chinese stock markets higher by cheerleading them on through party papers and TV shows.

Millions of new brokerages accounts have been opened since the end of 2014, and Chinese "speculators" have been lavished with margin to buy into China's hot stocks.

The central planners' hope was to get China's debt-ridden corporations, especially state-owned and controlled corporations, to be able to issue equity to new stock investors in order to offload balance sheet debt onto equity market plungers.

That didn't work. When Chinese stocks crashed, that was a giant flashing light screaming trouble.

There's just no good news left to lift stocks higher. There's no market leadership from any industry, other than the brief momentum runs made by some tech darlings and a bunch of hot biotech companies promising next-century solutions… to yesterday's problems.

And Here's Where It Ends… and Where We Clean Up

And there's the final straw, the Federal Reserve's leaning towards raising rates.

All these signals were flashing yellow, then bright red in the past few weeks.

We caught them all in my Short-Side Fortunes newsletter service and are very short and very, very happy, because we are short China, oil, Europe, and all the U.S. equity averages.

I'm looking for an oversold bounce at some point, but to me, if we get one on thin volume, it will be a chance to just load up for the next downdraft.

There's nothing holding markets up any more. It's truly frightening.

Central banks have shot their ammo. Their bazookas are smoking empty pipe-dreams now.

That's the most frightening reality now: The emperor wears no clothes.

What the markets need is a good, long flushing-out. Not that I want to see that, even though we are short, but that's what they need to squeeze out excesses built into artificially inflated equity prices and bond prices.

It's not too late to take profits, if you still have them. And it's not too late to hedge against further downside moves, or to make money if stocks have a lot further down to go, which I think they do.

Since puts are now so expensive, the best way to hedge and the best way to profit from any further selling would be to buy inverse exchange-traded funds (ETFs) like ProShares Short Dow30 (NYSE Arca: DOG), or ProShares Short QQQ (ETF) (NYSE Arca: PSQ). We own both in my Short-Side Fortunes service, and they provide great short exposure to the big American indexes.

As sure as this sell-off's been clearly signaled, there will be signals when we're near the bottom.

There were clear signals in March 2009 that the market was turning up, which I wrote about right here. I'll be writing here again to tell you when this storm has passed.

Get Even More High-Profit Crash Recommendations

Source http://moneymorning.com/2015/08/24/why-the-sell-off-happened-and-how-to-make-money-on-it/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.