A Perfect Buying Opportunity in Biotech Stocks

Companies / BioTech Aug 23, 2015 - 02:37 AM GMTBy: Investment_U

Bob Creed writes: If you’ve held a position in the biotech sector over the last few years, it may have felt like you were on a roller coaster. Fortunately, this is one coaster that’s well worth the ride.

Bob Creed writes: If you’ve held a position in the biotech sector over the last few years, it may have felt like you were on a roller coaster. Fortunately, this is one coaster that’s well worth the ride.

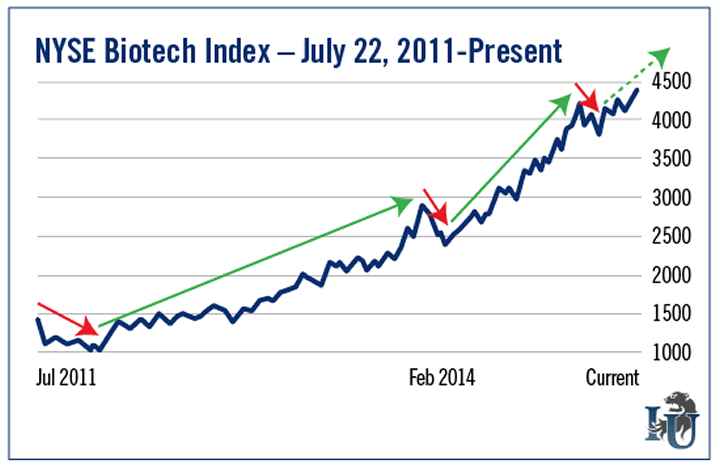

This week’s chart looks at the performance of the NYSE Biotech Index (NYSE: BTK) since July 2011. As you can see, biotech stocks have seen plenty of volatility. But any big drops were more than made up for by even bigger uptrends.

For example...

Starting at the left in today’s chart, from July 2011 to November 2011 the sector saw a 45% drop. This was followed by a 2 1/2-year bull run that ended with a gain of 194%.

Then, between February 2014 and April 2014, the sector saw a 19.6% drop. After that came a 79% charge that ended in March 2015.

From there to April 2015, biotech suffered another 11.3% drop. But in the four months since, we have started on the next uptrend...

So far, the sector has already rebounded almost 7.5%. That’s including the slight downtrend we’ve experienced over the past few weeks.

Has it been a wild ride? Certainly. But as you can see, it’s also been an incredibly profitable one.

Since July 2011, biotech has shot up more than 177%.

Healthcare analyst and Chief Income Strategist Marc Lichtenfeld commented on the uptrend in a recent article for Investment U. In his words, “this is about as strong and perfect of a trend as you’ll see... And it suggests we should see higher prices for the foreseeable future.”

Subscribers of Marc’s healthcare-based trading service Lightning Trend Trader are sure glad they banked on this trend. In recent months, his recommended plays have generated 59.59% on Auxilium Pharmaceuticals... 61.75% on Synergy Pharmaceuticals (Nasdaq: SGYP)... and a whopping 111.77% on Pharmacyclics (Nasdaq: PCYC).

Biotech has its risks, sure. And as you’ve seen, it can be very volatile. But in today’s markets, you’d be hard-pressed to find a sector that can generate such extraordinary returns in short periods of time.

Editorial Note: Marc has been bullish on biotech for years, but we’ve never seen him THIS excited about a single company. According to him, it’s the most profitable stock opportunity he’s found in his two decades in the markets. It’s expected to double investors’ money within the next year. In fact, Marc is so sure about it, he’s betting his own paycheck. To get all the details, click here.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.