Stock Market Primary IV Underway?

Stock-Markets / Stock Markets 2015 Aug 22, 2015 - 07:21 PM GMTBy: Tony_Caldaro

The market started the week at SPX 2092. After a gap down opening on Monday the market quickly recovered to hit SPX 2103. It traded at that level again on Tuesday, and then ran into three straight gap down openings for the rest of the week. On Friday the SPX hit 1971 and closed there. For the week the SPX/DOW were -5.8%, the NDX/NAZ were -7.1%, and the DJ World index was -5.3%. On the economic front reports came in slightly to the positive. On the uptick: the NAHB, the CPI, housing starts, existing home sales, the Philly FED and the GDPN. On the downtick: the NY FED, building permits, leading indicators, the WLEI, plus weekly jobless claims rose. Next week’s reports will be highlighted by the next report on Q2 GDP, Durable goods, and PCE prices.

The market started the week at SPX 2092. After a gap down opening on Monday the market quickly recovered to hit SPX 2103. It traded at that level again on Tuesday, and then ran into three straight gap down openings for the rest of the week. On Friday the SPX hit 1971 and closed there. For the week the SPX/DOW were -5.8%, the NDX/NAZ were -7.1%, and the DJ World index was -5.3%. On the economic front reports came in slightly to the positive. On the uptick: the NAHB, the CPI, housing starts, existing home sales, the Philly FED and the GDPN. On the downtick: the NY FED, building permits, leading indicators, the WLEI, plus weekly jobless claims rose. Next week’s reports will be highlighted by the next report on Q2 GDP, Durable goods, and PCE prices.

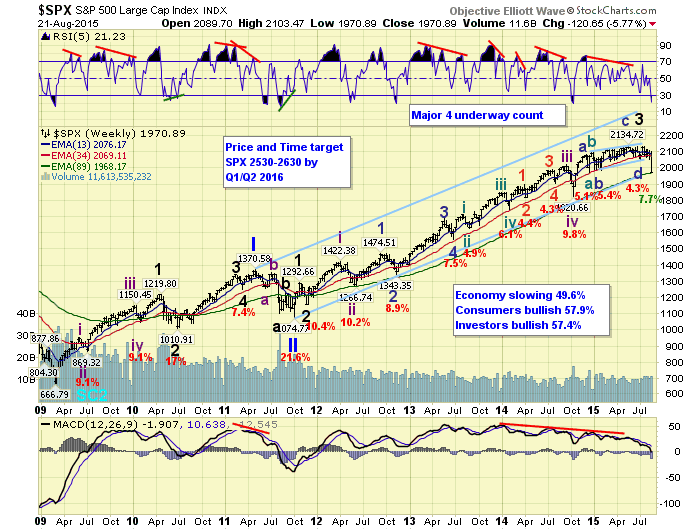

LONG TERM: bull market

Last weekend we introduced a third corrective count: Major wave 4. This new count, along with the Intermediate wave ii and Primary IV counts, all suggested defensive positions as the market would likely be heading lower soon. We gave four levels of support with varying wave degree implications: the low SPX 2040’s, the 2019 pivot, the 1973 pivot, and SPX 1820. Three of these levels were hit as the market moved to the downside this week.

Breaking the first two levels suggested the Intermediate wave ii, subdividing Major wave 5 labeling, could be eliminated. We held this count for most of the year as we had expected the ECB’s EQE to stimulate the US stock market, as well as Europe. After months and months of choppy action it was quite obvious this was not occurring. A little over a month ago we introduced the Primary IV count as four of our long term indicators had turned negative. Soon after one of those indicators reversed higher. Now, this week, a different set of long term indicators turned negative. So this count is still viable and remains posted on the SPX daily chart. A Primary IV correction would suggest a decline back to the October 2014 lows around SPX 1821.

A Major wave 4 correction still fits the wave patterns in all four major indices. It does not display a compressed Major wave 4 and short diagonal Major wave 5, as labeled with the Primary III May top count. It suggests all the price activity from the October Intermediate wave iv low was a diagonal triangle Intermediate wave v, in both the DOW and SPX. While the leading NDX/NAZ impulse from that low in five waves. Either way the market is clearly downtrending again after months and months of choppy activity.

We continue to label this six year bull market as a five primary wave Cycle [1]. Primary waves I and II completed in 2011, and Primary wave III has been underway, or recently completed, since that October 2011 low. If Primary IV is underway it should end with the largest percentage correction since 2011. All corrections in the SPX, since Primary II, have been limited to 10.4% or less. If Major wave 4 is underway it should end with less than a 10.4% correction.

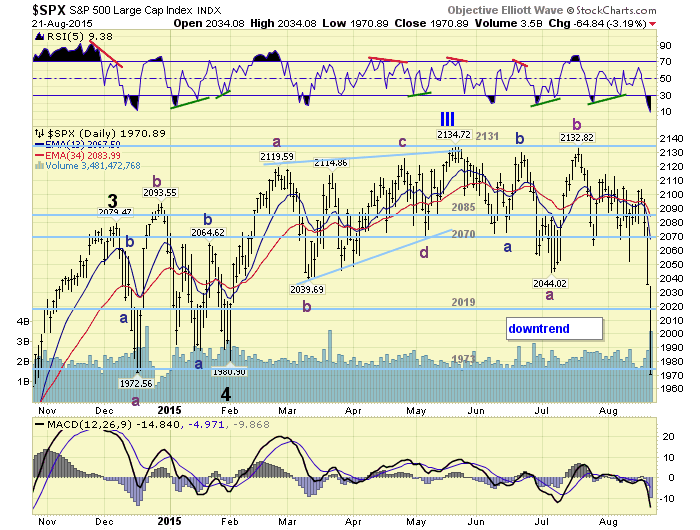

MEDIUM TERM: downtrend

For months on end the market remained in a choppy pattern, even through Wednesday of this week. After the FOMC minutes were released on Wednesday the market rallied to SPX 2096. Then with Thursday’s gap down opening, and losing the six month support level at SPX 2040 at the close, the market tumbled during Friday’s options expiration.

While our long term sector indicators are not aligned with a Primary IV scenario, the technical indicators are getting there. The SPX weekly MACD has now joined the DOW and turned negative for the first time since 2011. The SPX monthly MACD remains on a sell signal with the DOW, and the RSI is also heading toward an oversold level not seen since 2011. The market will need a sharp reversal next week to keep these indicators from collapsing further.

With the drop below the SPX 2040 level at Thursday’s close the subdividing Major wave 5 scenario was eliminated. Especially with the DOW completely retracing its uptrend by Thursday’s close. Since the market has turned weak late-Thursday through Friday we are favoring the Primary IV scenario, and updated the hourly chart with that count. The weekly chart continues to display the Major wave 4 scenario. To keep that count alive the market needs to rally strongly next week, without breaking down too much further. Similar to what it did at the Major wave 2 low. Medium term support is at the 1956 and 1929 pivots, with resistance at the 1973 and 2019 pivots.

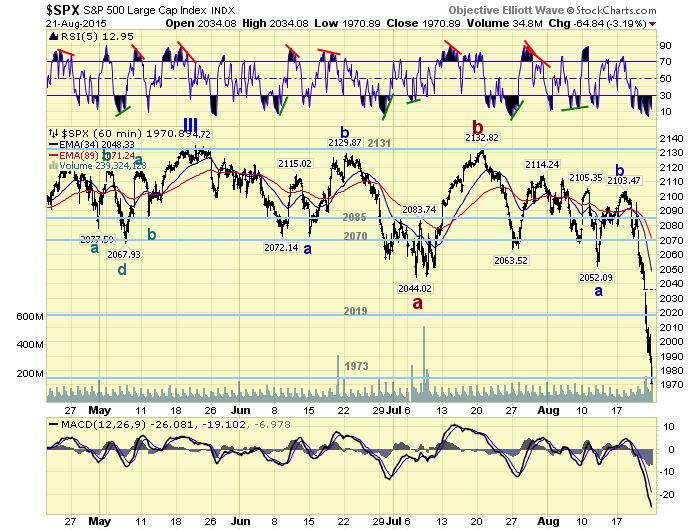

SHORT TERM

With Thursday’s/Friday’s market activity, we not only updated the hourly chart to match the daily chart. But also shifted the first significant wave of the downtrend over to the SPX 2052 level. This would put it more in proportion with the recent selloff. At Friday’s SPX 1971 low Minor C is within one point of a 1.618 relationship (1972) to Minor A. Should the 1973 pivot range hold the market could experience a good rally next week. If not, the 1956, 1929 and even 1901 pivots would be next.

After four years of a rising market, and the loss of the six month support at SPX 2040, it appears many are hedging or simply taking profits. Short term support is at the 1956 and 1929 pivots, with resistance at the 1973 and 2019 pivots. Short term momentum ended the week extremely oversold. Best to your weekend and week!

FOREIGN MARKETS

The Asian markets were all lower for a loss of 5.6%.

The European markets were all lower as well for a loss of 6.3%.

The Commodity equity group also all lower losing 6.0%.

The DJ World index lost 5.3%.

COMMODITIES

Bonds remain in an uptrend and gained 1.1%.

Crude remains in a downtrend and lost 4.1%.

Gold has nearly confirmed an uptrend and gained 4.2%.

The USD confirmed a downtrend and lost 1.6%.

NEXT WEEK

Tuesday: Case-Shiller, FHFA housing, New home sales and Consumer confidence. Wednesday: Durable goods orders. Thursday: Q2 GDP (est. +3.1%), weekly Jobless claims and Pending home sales. Friday: Personal income/spending, PCE prices, and Consumer sentiment. Saturday: a Jackson Hole speech by FED vice chair Fischer.

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2015 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.