Drown Your Stock Market Sorrows With Pizza, Wings and Beer

Companies / Investing 2015 Aug 20, 2015 - 03:07 PM GMTBy: Investment_U

Matthew Carr writes: The markets have been wobbly. A long-boiling currency war is starting to bubble up. On top of that, China’s markets are hitting the skids as its economy slows. Japan’s economy is sputtering, too. And Greece is a toxin.

Matthew Carr writes: The markets have been wobbly. A long-boiling currency war is starting to bubble up. On top of that, China’s markets are hitting the skids as its economy slows. Japan’s economy is sputtering, too. And Greece is a toxin.

The S&P 500 topped the 2,100 mark for the first time on February 17. Here we are six months later... still hovering at that level.

It’s igniting a lot of anxiety among investors who are searching for safety as well as gains. But for a moment, let’s set all of that aside and talk about something more comforting...

Pizza, beer and wings.

To be clear, I’m not suggesting investors simply drown their sorrows in comfort food. Instead, I want to show you a way to profit. Because just like we’re in preseason for the NFL, we’re in preseason for these three industries.

For the Love of Pizza

Pizza... it’s as American as apple pie (never mind that both are imports from Europe). Roughly 93% of Americans eat at least one slice per month.

Pizza accounts for 10% of all food service sales. But over the coming months, those orders should really ramp up.

Just look at the calendar. Football season is less than a month away, followed by National Pizza Month in October. Then we have Halloween... the night before Thanksgiving (aka national “no one wants to cook” day)... New Year’s Eve... New Year’s Day...

And let’s not forget pizza’s biggest day of the year, Super Bowl Sunday. A whopping 61% of people say pizza is a must-have for the big game. Delivery drivers will travel an average of 4 million miles on just that day alone.

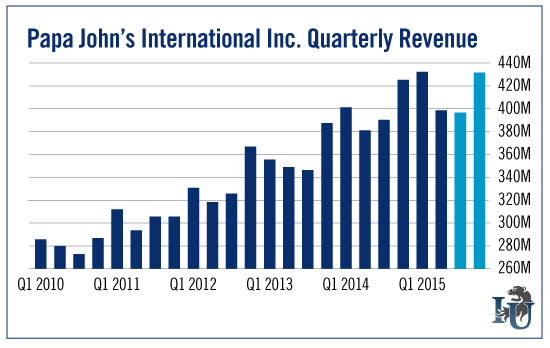

Let’s take a look at how this impacts the quarterly revenue of a pizza chain like Papa John’s (Nasdaq: PZZA)...

The second and third quarters for Papa John’s - as well as other publicly traded pizza chains - are generally the slowest of the year. But then we get into that six-month blitz I just described - the fourth and first quarters - when sales really rise.

Compared to its peers in the North American restaurant sector, Papa John’s already has a strong balance sheet. Its sales outpace the industry average, 11.06% versus 7.76%.

At the same time, in a period when a stronger dollar is dragging down profitability, Papa John’s has already seen earnings per share (EPS) increase 17.5% or more in the first two quarters. And its EPS is projected to rise at least 15.3% for the next two.

As you can see above, the majority of gains in share price over the past five years have taken place between now and the first quarter, thanks to all those pizza-centric holidays.

But there is one company that’s seeing better revenue and EPS in the restaurant sector than Papa John’s. It deals in pizza’s famous sidekick... chicken wings.

BDubs Soars to New Heights

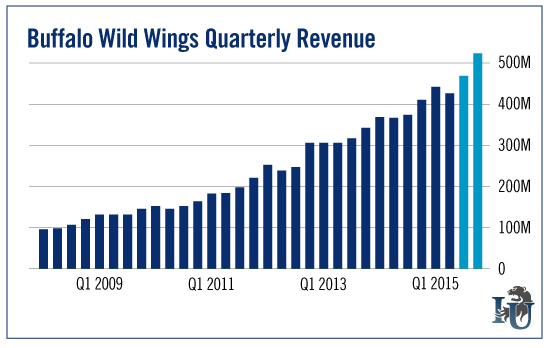

Almost every Sunday during the NFL season, my friends and I get together and order pizza and chicken wings. And if Buffalo Wild Wings’ (Nasdaq: BWLD) quarterly revenue is any indication, we're not the only ones.

Similar to the trend we see in Papa John’s quarterly revenue, Buffalo Wild Wings will see revenue jump in the third and fourth quarters. In fact, it should jump to record levels this year.

At the moment, shares of Buffalo Wild Wings are trading at a new all-time high. The company has seen revenue growth over the past year of 19.7% while EPS has increased 30.71%.

Last month, it also announced it had bought out 108 of its best-performing franchises and converted them to company-owned. In the month of July alone, there were 44 buyouts.

Just as with Papa John’s, the majority of gains shareholders of Buffalo Wild Wings see each year occur between now and its first quarter report.

Toss Back Some Profits

Since we’ve just stuffed our faces with pizza and wings, we need something to wash it all down. And nothing goes better with a good greasy meal than beer.

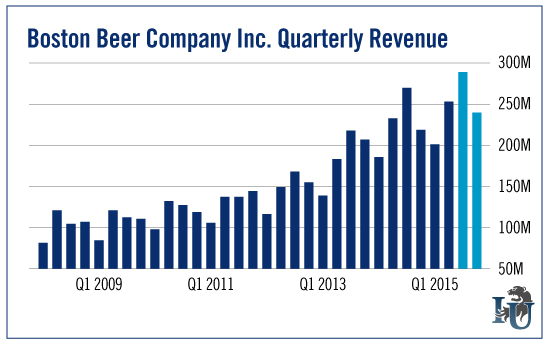

The top beer-drinking days in the U.S. span Memorial Day weekend to - you guessed it - the Super Bowl. One of the purest domestic plays on this trend? Boston Beer (NYSE: SAM), the brewer of Samuel Adams and a number of popular beer alternatives.

(Now, I refer to Boston Beer as one of the purest domestic beer plays because it doesn’t really rely on exports. Anheuser-Busch InBev [NYSE: BUD], for example, is dependent on growth in international markets.)

In the second quarter, Boston Beer saw core shipments increase 7% and depletions increase 6% - driven by growth in its Angry Orchard, Twisted Tea and Traveler labels. These are the company’s hard cider, hard lemonade and shandy offerings, which have become increasing popular as traditional beer sales have struggled to expand.

You’ve probably seen the Traveler commercials on television. And the company is in the process of rolling out its Coney Island Hard Root Beer.

On top of all this, Boston Beer’s historically best quarter of the year is on the horizon, as shown in the chart below.

Over the past year, Boston Beer’s revenue has climbed more than 22%, well above the 5.07% the North American beverage sector has seen. EPS is up 26.9%, again well beyond that of the 1.39% increase its peers have seen.

It’s in a great spot as we head into that time of the year when people consume pizza, chicken wings and beer in large quantities. And don’t forget, in addition to the start of the NFL season next month, we also have MLB playoffs inching closer. Then there are the NHL and NBA seasons close behind.

Plus, it won’t be long until we’re entering the holiday season. For many, beer will be an absolute staple.

Good investing,

Matt

Source: http://www.investmentu.com/article/detail/47188/drown-market-sorrows-with-pzza-bwld-sam#.VdYINk3bK0k

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.