Two Tactics for Bigger Biotech Investing Profits

Companies / BioTech Aug 20, 2015 - 10:43 AM GMTBy: ...

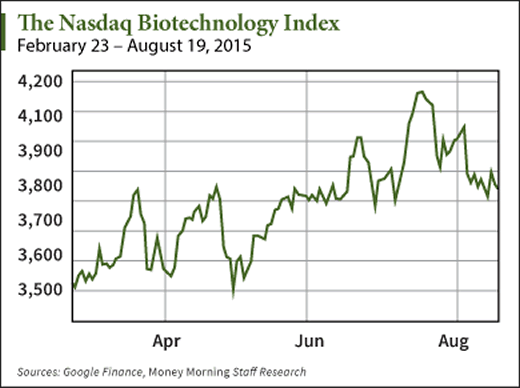

MoneyMorning.com Ernie Tremblay writes: Over the past six months, we've seen the Nasdaq Biotechnology Index, an indicator for the entire sector, take some wild swings up and down, often by as much as 10% from week to week.

That's in stark contrast to the previous half-year, when we experienced a relatively steady upward swell.

This year's unsettling international headlines haven't helped. In just the last few months, we've battled doom-and-gloom sentiment on the debt crisis in Greece, currency manipulation in China, cratering oil prices, the burgeoning debt crisis in Puerto Rico, and the specter of a September rate hike from the Fed.

The most important factor driving this volatility is more complicated than "bad news," though. We'll get to that in a moment.

There is good news: This turbulence isn't insurmountable. And the simple tactics I'm about to share with you could dramatically improve your profits in this choppy market.

How We'll Adapt to a Rapidly Changing Sector

More important than negative headlines are the shifting dynamics of this particular sector.

A flood of new investors, chasing after the huge potential profits in biotech but armed with very little understanding of pharmaceuticals or medtech, has proven hyper-reactive to the slightest agitations in the market, driving prices this way and that.

Media chatter about bubbles and overvaluation – both nonsense – have made a lot of these investors even more skittish. And a few unscrupulous professional market manipulators have made the situation more extreme by bidding stocks up or down even further, depending on momentum.

So, the kinetics of biotech are shifting – and you should shift with them.

In fact, in my Biotech Insider Alert investment service, we're going to use them to our advantage and make our positions even stronger by taking two simple steps to help protect us from market volatility generally and biotech sector volatility in particular:

- We're going to discipline our entry into new positions by using buy limit orders. Practically speaking, I will suggest to my subscribers the highest price they should pay for shares of a new recommendation, and they can either set that limit through their brokers, or more informally, buy only up to the suggested price limit. We'll keep these limits as tight as possible and practical. This approach should help to curb significant price swings in either direction.

- We're going to dollar average our entries over time. That is, when I send Biotech Insider Alert recommendations, I will suggest subscribers buy shares in increments, rather than all at once, using a small portion of their investment funds with each purchase. And to help you out with this, I will send out an alert when it comes time to make each purchase.

So I may, for example, recommend entering a new position in four installments, and I'll then send an alert as the time for each installment arrives.

This will also will give us the added advantage of buying in at times when price per share dips, so that our average price will be lower.

With both of these changes in place, we should effectively guard against major swings in volatility, and even use them to our advantage.

I recommend you use a similar approach in your biotech investing, for greatest leverage and maximum gains.

More from Ernie

A highly contagious virus is sweeping the globe and has made its way to the United States. It's 1,000 times more deadly than Ebola and kills every 58 seconds. Because this virus shows virtually no symptoms, millions of Americans are already infected and don't even know it. The worst part? Boomers are five times more likely to contract this infection. This video will show you exactly how to protect yourself. Do not ignore this warning. It's a matter of life and death.

Source http://moneymorning.com/2015/08/20/two-tactics-for-biotech-investing-profits/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.