UK CPI and GBPUSD vs TWI Divergence

Currencies / British Pound Aug 18, 2015 - 03:55 PM GMTBy: Ashraf_Laidi

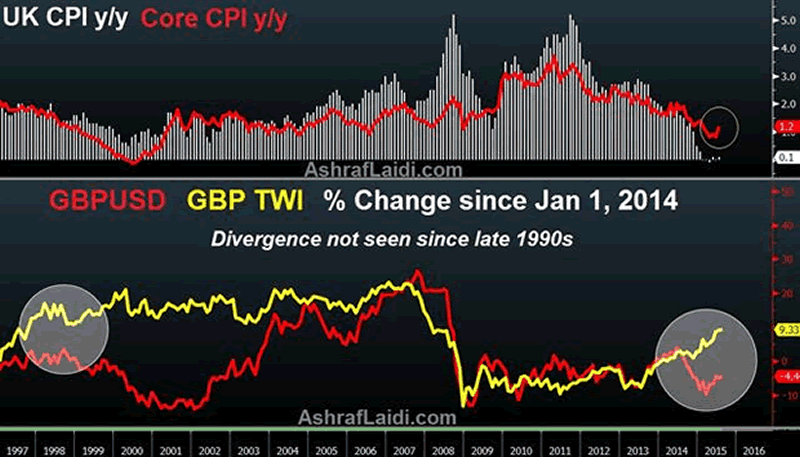

Sterling hit fresh 2-month highs as UK inflation improved in July, with headline CPI edging up to 0.1% y/y from June's 0.0%, and beating the Bank of England's 0.0%. The notable increase was in core CPI, which rose to a 5-month high of 1.2% vs expectations of 0.9% and a June reading of 0.8%.

The rise in CPI had been attributed to higher clothing and footwear prices as discounts were reported to have taken place earlier this summer than last year. House prices edged up 5.7% in June from May's 5.6%.

Watching Core-CPI Spread

As the spread between UK core and headline CPI bounces back to 1.1%-- nearing February's all-time high of 1.2%-- and the headline figure remains compressed, further gains in the core rate will get the attention of sterling bulls, especially with no reprieve in energy prices.

GBPUSD vs TWI Divergence

The role of sterling in containing inflation remains notable. But even more important is the divergence between sterling's trade-weighted index (using the BoE's broad TWI) and GBPUSD spot rate, which had widened between July 2014 and April of this year before gradually narrowing. The divergence between the two rates was last seen in the late 1990s, coinciding with plummeting oil prices. But unlike in the 1990s, when the divergence extended into Spring 2000, today, GBPUSD is rising back up alongside the TWI, with any dips in cable being bought instantly.

Growing expectations of a Fed hike had kept GBPUSD under pressure, but rising odds of a BoE rate hike relative to other central banks helped lift GBP against all major currencies, thereby sending GBP's TWI to fresh 7-year highs earlier this month.

Barring UK earnings and other endogenous factors, Fed hike expectations remain the chief factor in slowing down sterling's TWI ascent. Any receding odds of a September liftoff will likely lift GBPUSD back towards the $1.60 figure and closer to $1.65 where the main longer term 100 and 200-month moving averages lie.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.