Trade for Income in a Tax-advantaged Accounts

InvestorEducation /

Learn to Trade

Aug 16, 2015 - 09:11 AM GMT

By: DailyWealth

By Brian Hunt and Ben Morris: Today, we're going to show you how to make more money from your trading... with almost no extra work...

You don't have to learn any new skills. You don't need to buy any exotic investments. And you don't need to spend any extra time on your trading.

This simple idea could add tens of thousands, even hundreds of thousands, of dollars to your retirement savings.

Here's the idea: Trade for income in a tax-advantaged account. This could be a traditional IRA or Roth IRA, which you can quickly set up with almost any online brokerage... It could even be a 401(k), if your employer offers self-directed accounts.

You've almost certainly heard this idea before... And you may already invest in an IRA or a 401(k). But if you're not taking full advantage, you'll want to see how much more money you could be making.

Today, we'll use a traditional IRA for our example. Most folks with an income can contribute at least $5,500 a year to an IRA, pre-tax. That's $5,500 less income you'll have to pay taxes on come April... And you can compound that money for years without paying taxes on your gains.

You'll be taxed on your gains only when you start taking money out of your IRA. You'll pay income tax on your distributions depending on your tax bracket at that time.

We'll have to make some assumptions here to keep the math simple... But the benefits will be clear.

Let's say you're in the 25% tax bracket now... and that you'll be in that same bracket when you start taking distributions from your IRA in the future.

Here's how the math works...

If you contribute $5,500 a year to your IRA for six years, that's $33,000. If you had to pay a 25% tax on that income, you'd be left with just $24,750.

Now, let's get to the trading...

In DailyWealth Trader, since our launch in May 2012, our average annualized returns with our trading-for-income strategy of selling puts and covered calls has been 12.4%. But let's say (again, an uncertain assumption) you can use this strategy to earn 10% a year for the next 20 years.

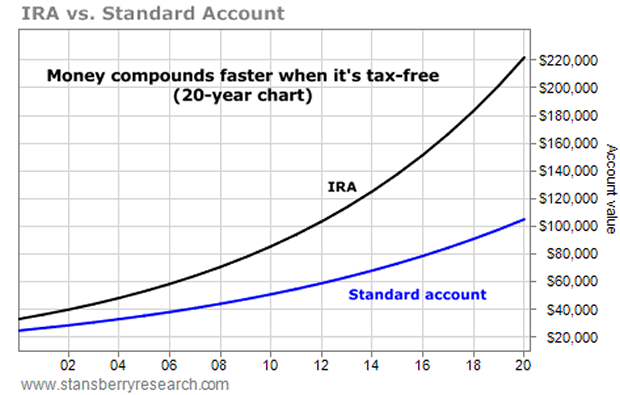

In your IRA, you haven't yet paid taxes... so you start with $33,000. In a standard trading account, you start with $24,750. If you earn 10% a year for 20 years, here's how your account will grow. (Remember, in a standard trading account you'll have to pay 25% income taxes on your short-term trading returns. That turns a 10% annual return into a 7.5% annual return. In an IRA, you build on the full 10% return.)

At the end of 20 years, you would have $222,007 in your IRA, or $105,134 in a standard trading account.

Of course, you won't take the full $222,007 out of your IRA all at once... But to keep things simple, let's apply the 25% income tax to that amount. Your $222,007 comes out to $166,506 after taxes. That's $61,371 more than if you had paid taxes upfront.

By trading in an IRA, you earned 58% more for retirement. It's a huge difference.

What if you only have 10 years? After accounting for taxes, it works out to $64,195 from your IRA trading versus $51,011 in a regular brokerage account. It's still 26% more money.

There's no other way to earn so much extra cash with so little work. If you're not trading in tax-advantaged accounts, don't wait any longer.

Regards,

Brian Hunt and Ben Morris

http://www.dailywealth.com

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

By Brian Hunt and Ben Morris: Today, we're going to show you how to make more money from your trading... with almost no extra work...

By Brian Hunt and Ben Morris: Today, we're going to show you how to make more money from your trading... with almost no extra work...