Stock Market 7 Year Crash Cycle - What’s So Special about the Number “7”?

Stock-Markets / Financial Crash Aug 14, 2015 - 01:45 PM GMTBy: Peter_Degraaf

Everything in life moves in cycles. Seconds, minutes, hours, days, all add up to become part of a cycle. Some cycles, such as the beating of the heart move fast, while a millennium moves very slow. This article will draw your attention to a very important 7 year cycle. (Charts courtesy Stockcharts.com unless indicated).

Everything in life moves in cycles. Seconds, minutes, hours, days, all add up to become part of a cycle. Some cycles, such as the beating of the heart move fast, while a millennium moves very slow. This article will draw your attention to a very important 7 year cycle. (Charts courtesy Stockcharts.com unless indicated).

The number 7 is much more prevalent in nature than most of us realize: There are 7 oceans, 7 continents, 7 vertebrae in the neck,

7 layers of skin (2 outer and 5 inner), ocean waves roll in sevens, the rainbow has 7 colors, sound has 7 notes, there are 7 directions, The Jewish Menorah has 7 candles, there are 7 holes in your head (go ahead and count them), the earth was created in 7 days (including a day of rest), a cube has 7 dimensions (including the inside), the male body has 7 parts, the number 7 is used 735 times in the Bible.

Seven is the number of completeness and perfection (both physical and spiritual). It derives much of its meaning from being tied directly to God’s creation of all things. According to Jewish tradition, the creation of Adam occurred on October 7th, 3761 B.C. (or the first day of Tishri, which is the seventh month on the Hebrew calendar). The word 'created' is used 7 times describing God’s creative work (Genesis 1:1, 21, 27 three times; 2:3; 2:4). There are 7 days in a week and the Sabbath is on the 7th day. There are 7 deadly sins, 7 virtues, 7 gifts of the Holy Spirit, 7 classical planets, 7 numbers in a N/A phone number (after the area code), 7 hills in Istanbul, Rome and Jerusalem, 7 liberal arts, 7 wonders of the ancient world, 7 is the number of games in the playoffs for NHL, MLB and NBA. The number 7 is also important in Hinduism, Islam and Judaism.

There is an obvious 7 year cycle in economics:

Reaching back to forty nine years ago (7 x 7), in 1966 the USA experienced a ‘credit crunch’. In August of that year the US bond market suffered a serious ‘liquidity crisis’.

Seven years later in 1973, the world experienced an ‘oil embargo’ followed by a dramatic rise in the price of oil. There were long lines of cars at gas stations.

Move forward by 7 years and in 1980 Wall Street avoided the collapse of some of its banks and brokerage houses by forcing the Hunt Brothers to stop accumulating silver. The brokerages were shorting silver in the futures markets, where the Hunt Brothers were buying contracts and taking delivery. FED Chairman Paul Volcker allowed the COMEX to adopt a change in trading rules over a weekend. This change in rules forced the Hunts to come up with hundreds of millions of dollars in margin money with no advance warning. Silver peaked at 49.00 and gold topped out at $875.00, while interest rates peaked at 22%.

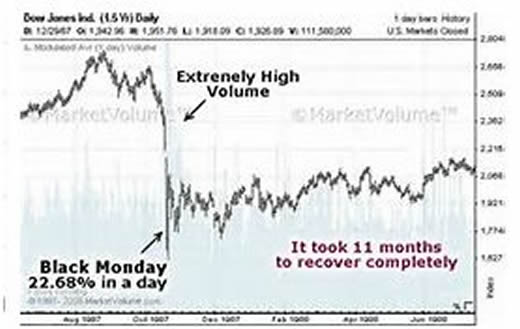

Another seven years passed and in the fall of 1987 stock markets crashed around the world. ‘Black Monday’ of October 1987 saw the Dow lose 22% in one day. (Chart courtesy ‘Marketvolume’)

Then seven years later, in 1994, the bond markets crashed.

Seven years passed and in 2001 Wall Street was closed for 5 days due to the militant Islamists attack on the World Trade Center in New York. The DOW lost 684 points on Sept 17th 2001. Banks received billions of dollars of newly created money from the Federal Reserve, to keep the system afloat.

Image of Wall Street Bull

The seven year cycle moved on and in 2008 we saw the Subprime Housing Market Collapse, along with the overnight bankruptcy of Lehman Brothers. The Lehman investment bank fell so fast, none of the employees had any idea their jobs were disappearing. The DOW lost 777 points on Sept 29th 2008. The banking system almost collapsed, (banks refused to cash checks except after a three day ‘hold’, for fear that the issuing bank might fail), but the US FED saved the day, by massive injections of newly created cash, not only into US banks, but also some Canadian and foreign banks. The debt problem was ‘solved’ with more debt!

It seems incredible that all of these crashes occurred seven years apart!

2015 is the next domino in the sequence. The financial problems of 2008 have not been addressed – only covered up with more money printing.

"I told them the real 2014 deficit was $5 trillion, not the $500 billion or $300 billion or whatever it was announced to be this year. Almost all the liabilities of the government are being kept off the books by bogus accounting. The government is 58% underfinanced. Social Security is 33% underfinanced. So, the entire government enterprise is in worse fiscal shape than Social Security is, but they are both in terrible shape. [On future prospects] If you take all the expenditures that the government is expected to make, as projected by the Congressional Budget Office (CBO), all the spending on defense, repairing the roads, paying for the Supreme Court Justice salaries, Social Security, Medicare, Medicaid, welfare, everything, and take all those expenditures into the future, and compare that to all the taxes that are projected to come in, then the difference is $210 trillion. That is the fiscal gap. That is our true debt."

Lawrence Kotlikoff a professor of Economics at Boston University, in testimony before the US Senate,

This chart shows the US Federal debt rose from zero to nine trillion dollars between 1776 and 2008. Since Mr. Obama has been in the White House, this debt has doubled to over 18 trillion dollars, while the US debt ceiling has been abandoned! He has added as much debt in 7 years as all former presidents together, in the preceding 242 years! Anyone with any understanding of keeping a budget knows that this is a recipe for disaster. In 2008, 25 percent of all Americans in the 18 to 29-year-old age bracket considered themselves to be “lower class”. But in 2014, an astounding 49 percent of all Americans in that age range considered themselves to be “lower class”. The percentage of Americans who are fully employed is back at 1982 levels. For the first time in US history businesses are closing faster than new ones starting up.

Stock markets are overdue for a major correction. The energy for the current stock market rise has come primarily from the printing presses. Central bankers are now running out of options to save the financial system, after years of adding money to the money supply.

Canadian and European banks are just as vulnerable to a crash as US banks. In 2013 the Canadian government added ‘bail-in’ to banking law. Just as was the case in Cyprus, banks can change deposits into bank shares, should a liquidity crisis occur. The shares would likely be subject to a time limit during which they will not be tradable. European banks are also able to confiscate depositor’s money via bail in. Meanwhile cash is on track to becoming obsolete (please read my article: ‘The Battle against Cash’, at www.pdegraaf.com)

The seven year cycle has been dealt with in great detail by Jonathan Cahn, author of ‘The Harbinger,’ in his latest best seller: “The Mystery of the Shemitah.”

Interestingly, the Jewish Shemitah has often ended at about the same time as the market crashes listed in this article. The last Shemitah ended on Sept 29 2008, the day the DOW shed 7%. The 2001 Shemitah ended on Sept 17th 2001, the day the DOW dropped 684 points. The current Shemitah is due to end on Sunday September 13th 2015.

Featured is the gold chart from 2007 - 2009. Gold was finishing a pullback in 2008, very similar to the correction that started in 2011 – a pullback that appears to be ending. (See next chart). This 2008 gold bottom occurred right around the 2008 stock market crash.

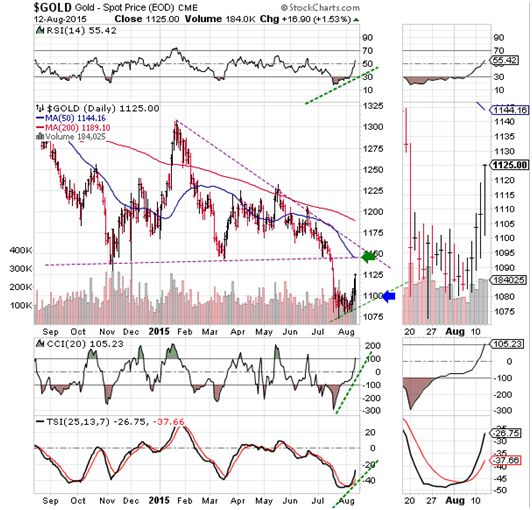

Featured is the current gold chart. Price found support at the $1075 level and is heading for the first target at the green arrow. A pullback is expected to find support at the blue arrow. The supporting indicators are positive (green lines). China is buying gold at a rate of 2,000 tonnes per year, while India and Russia along with several smaller Asian nations are absorbing 1,000 tonnes per year. This is more gold than the mines of the world are producing. The deficit has been made up by dishoarding on the part of Western Central Banks. These banks are running out of gold! Fundamentals are ‘gold-bullish’.

During periods of financial turmoil people have always turned to gold for safety.

Featured is the silver chart from 2007 – 2009. Shortly after the stock market was crashing, silver ended a pullback that began in early 2008.

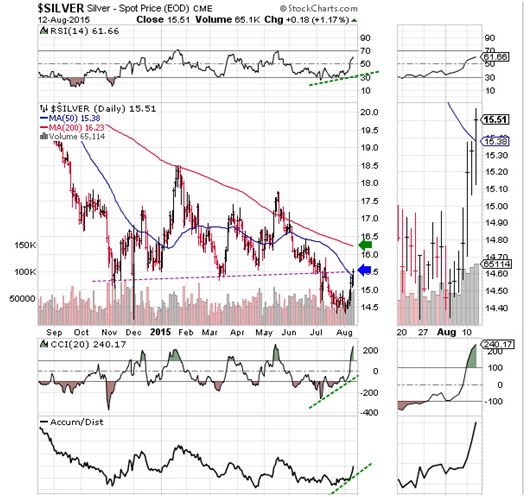

Featured is the current silver chart. Price found support at the 14.50 level and the supporting indicators are positive. There is resistance at the two arrows. As soon as price rises above the two arrows, the next silver rally will be underway.

“The Prudent see Danger and take Refuge.” Proverbs 22:3 NIV.

Protect yourself – prepare for the worst and hope for the best.

By Peter Degraaf

Peter Degraaf is an on-line stock trader with over 50 years of investing experience. He issues a weekend report on the markets for his many subscribers. For a sample issue send him an E-mail at itiswell@cogeco.net , or visit his website at www.pdegraaf.com where you will find many long-term charts, as well as an interesting collection of Worthwhile Quotes that make for fascinating reading.

© 2015 Copyright Peter Degraaf - All Rights Reserved

DISCLAIMER:Please do your own due diligence. Investing involves taking risks. I am not responsible for your investment decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.