The Fiat Yuan

Currencies / China Currency Yuan Aug 13, 2015 - 12:39 PM GMT Seth Lipsky/The New York Sun/8-11-2015

Seth Lipsky/The New York Sun/8-11-2015

“If the Communist Chinese devalue the yuan against a dollar that is appreciating against gold, has the yuan gone up or down? We ask because the leading story on the New York Times Web site this morning reports not only that the Chicom authorities ‘sharply devalued’ the renminbi but also that the move ‘could raise geopolitical tensions and weigh on growth elsewhere.’ We ran the Times’ entire text through the Sun’s old hand-crank Von Mises brand language-specie prose separator. It failed to find any mention of — or even allusion to — gold.”

Further on

“In China, in any event, it has disclosed a bubble in stocks and certain other assets that has crested in recent years. What this adds up to, according to a wire from David Malpass, one of the fastest and shrewdest economists on the beat, is a ‘de-linking’ of the yuan and the dollar. He reckons that the Chinese communists are ‘laying the groundwork for a yuan bloc and closer relationships with other Asian currencies.’ By our lights this is but another consequence of the failure of the Congress to exercise its constitutional power to coin money and regulate the value thereof and of foreign coin and to fix the standard of weights and measures.”

Go here for the full editorial – Well worth the few minutes it takes to read it.

MK note: Seth Lipsky, the editor of the New York Sun, offers an interesting take on the yuan devaluation. This piece was written before Chinese authorities devalued the yuan again – another 1.3% earlier today after nearly 2% the day before. Yesterday, I posted that the markets were likely to now put “the specter of further yuan devaluations. . .on the front burner.” I agree with David Malpas’ interesting framework to all of this. This is looking more like a mechanism than the one-off to which the PBOC alluded in its accompanying public relations release. I had to chuckle at Lipsky’s concluding question. . . . . .

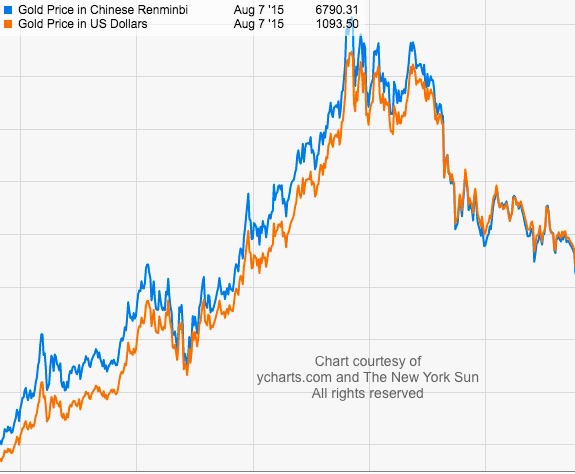

MK note 2: Zeroing-in on the chart, isn’t it interesting how the yuan gold price mirrors exactly the dollar price? One wonders if the de-pegging of the yuan from the dollar is connected in policy terms to the opening of the Shanghai Fix later this year. China says it wants a say in the gold price and that’s why it established its own fix outside of London and New York’s purview. If the price of gold in yuan goes higher, it adds value to both Chinese gold reserves, which are likely much higher than recently announced, and to the asset structure of the Chinese people and banks that are hoarding it. In fact the low announcement may have been in anticipation of the devaluation strategy. Too, if the yuan price goes higher, it could force the dollar price higher in order to discourage arbitrage of physical metal globally into China. All of this is speculation, of course, and not to be taken as golden gospel. The complexities, though, are intriguing and food for thought.

Extracts published with The New York Sun‘s permission.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.