Stock Market 4 Year Rest or P4

Stock-Markets / Stock Markets 2015 Aug 09, 2015 - 09:08 AM GMTBy: Tony_Caldaro

The market started the week at SPX 2104. It ticked up to SPX 2106 to start the week, then traded down to 2087 on Monday. A rally started Monday afternoon carrying the SPX to 2113 by Wednesday. Then the market pulled back to end the week at SPX 2078. For the week the SPX/DOW were -1.55%, the NDX/NAZ were -1.60%, and the DJ World was down 0.9%. On the economic front positive reports outpaced negative ones. On the uptick: personal income/spending, the PCE, construction spending, factory orders, ISM services, and consumer credit. On the downtick: ISM manufacturing, the ADP, monthly Payrolls, plus the trade deficit and weekly jobless claims rose. Next week will be highlighted by Industrial production, Retail sales and the PPI.

The market started the week at SPX 2104. It ticked up to SPX 2106 to start the week, then traded down to 2087 on Monday. A rally started Monday afternoon carrying the SPX to 2113 by Wednesday. Then the market pulled back to end the week at SPX 2078. For the week the SPX/DOW were -1.55%, the NDX/NAZ were -1.60%, and the DJ World was down 0.9%. On the economic front positive reports outpaced negative ones. On the uptick: personal income/spending, the PCE, construction spending, factory orders, ISM services, and consumer credit. On the downtick: ISM manufacturing, the ADP, monthly Payrolls, plus the trade deficit and weekly jobless claims rose. Next week will be highlighted by Industrial production, Retail sales and the PPI.

LONG TERM: bull market

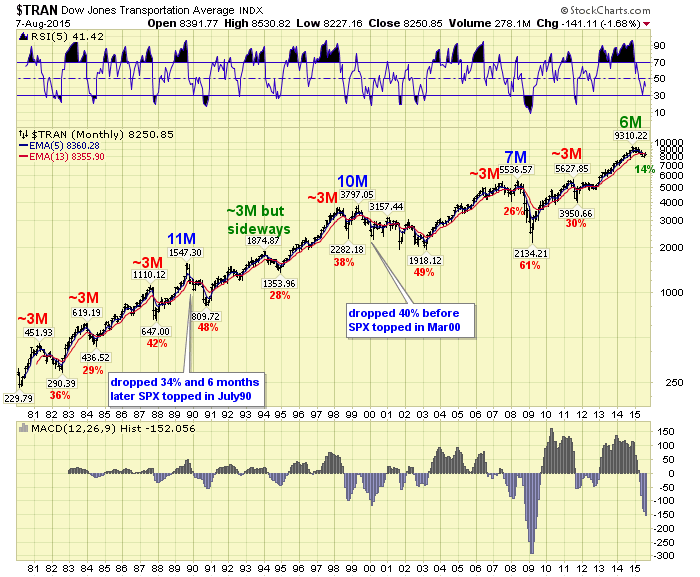

The last two weekends we have noted a potential Primary III top in the SPX, DOW, NYSE, and TRAN. Since many follow the Dow Theory, and the Transports have been leading these indices to the downside, we decided to take an historical look at the TRAN. Over the past 35 years the TRAN have had 11 significant declines. The current 14% decline being the latest. Of the 10 that have completed, 1982-2011, seven times the SPX and TRAN topped within three months of each other. Two times the TRAN topped 10 to 11 months earlier, and one time 7 months later. In every case, except one, the SPX followed with a significant correction. Historical relationships would suggest a 90% probably of a significant decline ahead.

Within the last year the TRAN topped in November and the SPX recently put in its high in May: six months later. So for comparison purposes we can disregard the seven, somewhat coincident, three month relationships. And for that matter the 2008 top, which was somewhat of a commodity driven aberration following the three month signal in 2007. That leaves us with the two comparative events. The eleven month leading signal in 1989, and the ten month leading signal in 1999.

After the August 1989 top in the TRAN, the SPX continued to move higher even after the TRAN had dropped 34% in just five months. Then six months later the SPX topped in July 1990. After the May 1999 top in the TRAN, the SPX continued to move higher even while the TRAN continued to decline. This time the SPX topped in March 2000, after the TRAN had already declined 40%. In both instances, when the TRAN/SPX tops were more than three months apart, the TRAN required at least a 34% decline before the SPX topped and headed lower. The current decline in the TRAN, from the November 2014 high, is only 14%. This historical analysis suggests the TRAN would need to drop to 6145 before the SPX would actually take notice and start its decline. The TRAN ended the week at 8251. So what could happen with the SPX if the TRAN does not decline that much, or takes several more months to do so?

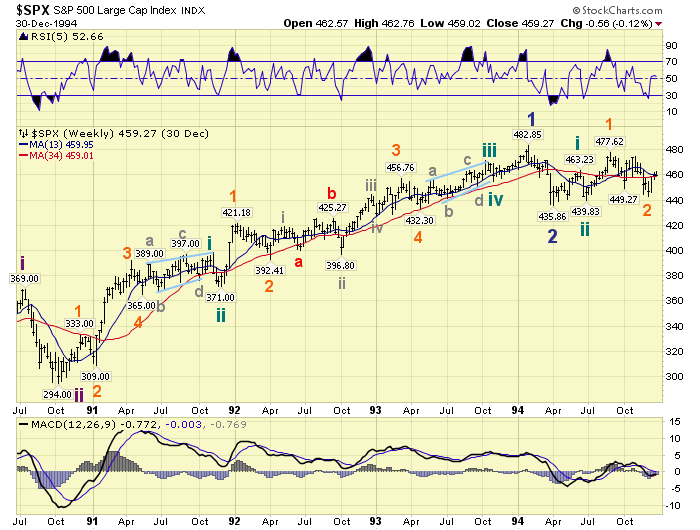

To answer that question we need to review what occurred in the SPX the one time it did not follow the TRAN lower. In February 1994 the TRAN topped and started a ten month decline. During that period the TRAN lost 28% of its value. The SPX topped in January, had a three month correction, and then went sideways for the rest of the year while the TRAN continued its decline. Look familiar? It should, this is exactly what the SPX has been doing all year: going sideways.

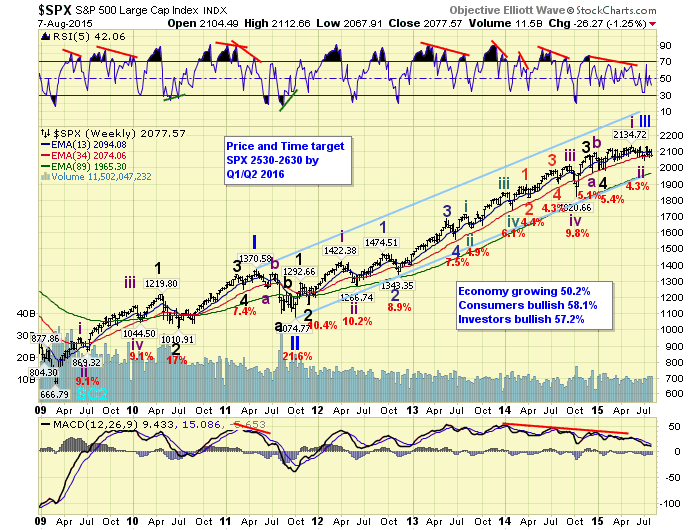

The wave labeling is somewhat different, and the actual trends are a bit different, but there are other similarities to the current market. The entire yearly range in 1994, bottom to top, was 10.8%. The entire yearly range for 2115, so far, is 10.8%. At the January 1994 high we had counted five waves up from the October 1990 low. That five waves could have ended the third wave of the 1987-2000 bull market. It didn’t. The market only took a sideways pause after a four year run from 1990-1994. The third wave of that bull market did not end until 1998. Similarly, the recent four year run in this bull market, 2011-2015, could have ended its third wave, Primary III. Or maybe it is also taking a pause after a 4 year run. The last comparison is this. After maintaining fed fund rates at a relatively lower level at the time, for an extended period, the FED started increasing rates throughout 1994. The first increase was a surprise, the FED was not so transparent then, the rest were anticipated or surprises as well. Today’s transparent FED has been positioning for a potential rate increase since March.

In summary. It appears the SPX will probably not have made a significant top until the TRAN have declined into the 6400’s. Until it does, the SPX is likely to remain within the 1981-2135 range. If the TRAN are not going to decline that much, find support, and then start to move higher. The SPX is likely to find support soon, and then gradually work its way higher as well. As a result of this analysis we feel the Primary III top and Primary IV underway, has a less than 50% chance of occurring. Let’s put it at 60/40 against.

MEDIUM TERM: choppy uptrend under pressure

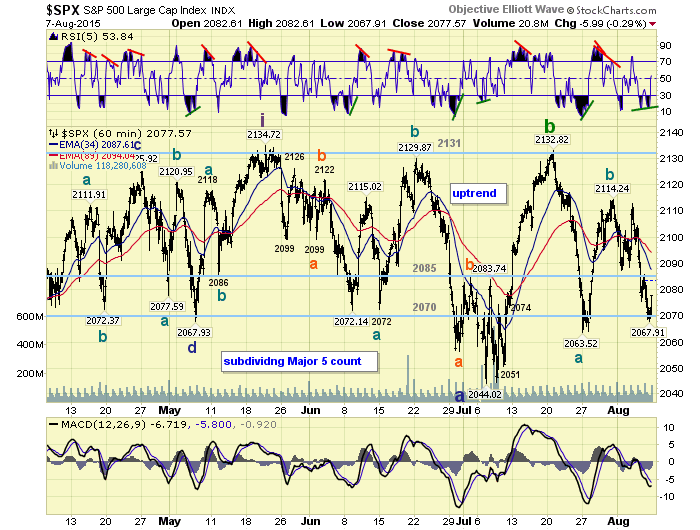

After a downtrend low in early-July, which we initially labeled the Intermediate wave ii low, the market rallied from SPX 2045 to 2133. It looked like a good kickoff to Intermediate wave iii, but we observed a problem. The entire advance appeared to be three waves and corrective, not impulsive: 2074-2051-2133. After the SPX 2133 high the market started to pullback. At first the pullback looked small, still allowing room for an impulse wave to develop. But the pullback accelerated to the downside and overlapped SPX 2074 on its way to 2064. The uptrend was indeed corrective.

This suggested the early-July downtrend low was actually only wave A of Intermediate wave ii, the uptrend wave B, and a wave C to complete Intermediate ii would follow. After making a short term low at SPX 2064 the market rallied, again in three waves, to a lower high at 2114. Since that high the market has dropped to SPX 2087, rallied in three waves to 2113, and now has dropped to 2068 on Friday. Clearly all the activity from the early-July low, as well as most of the year, has been corrective.

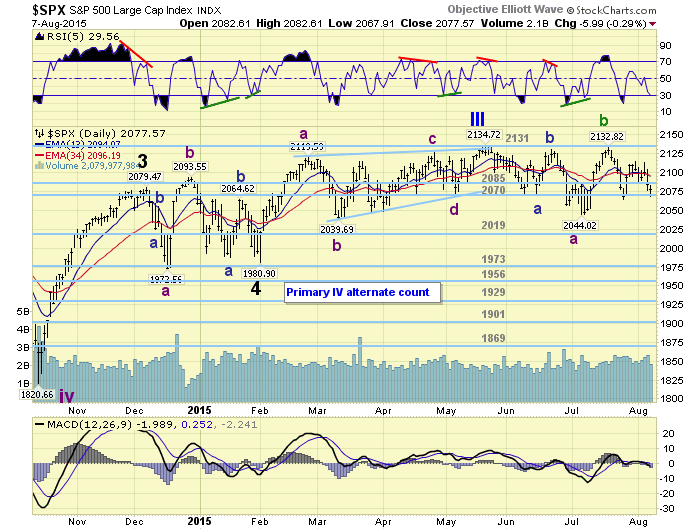

Our preferred count suggests the SPX will need to revisit the 2045 area in the coming weeks. At SPX 2045 the current decline from 2114, Minute C, will equal the previous decline (2133-2064), Minute A. This would also create a complex flat from the May all time high of SPX 2135. This count is displayed on the hourly chart below. The alternate count, a Primary III high at SPX 2135, is displayed on the daily chart above. As noted in the previous section we believe this is a secondary count. Medium term support is at the 2070 and 2019 pivots, with resistance at the 2085 and 2131 pivots.

SHORT TERM

We are counting the May all time high at SPX 2135 as Intermediate wave i, and the market activity since then nearly all of Intermediate wave ii. The first downtrend, during this correction period, was to SPX 2044 (91 points), which we labeled Minor A. The uptrend that followed rallied to SPX 2133 for Minor B. Since that high Minor C should be underway. A perfect complex flat would suggest a low of SPX 2044. If Minor C is to equal Minor A the low should be at SPX 2042. If, as noted previously, the two declining waves within Minor C are equal (Minute C and A), then the low should be at SPX 2045. So we have three wave structures all pointing toward the low-mid SPX 2040’s. Also, if you recall, a 61.8% retracement of the Intermediate wave i uptrend is at SPX 2040.

Should the market break below that level the next area of support would be the 2019 pivot range. This would then suggest Intermediate wave ii is taking the form of a complex zigzag. Should the market fall even further, into the 1973 pivot range, then the Primary wave IV scenario would gain credibility. Short term support is at the 2070 pivot and the SPX 2040’s, with resistance at the 2085 pivot and SPX 2114. Short term momentum displayed a positive divergence at Friday’s SPX 2068 low, and ended the week at neutral. Best to your trading this choppy market.

FOREIGN MARKETS

Asian markets for the week were mixed for a net loss of 0.2%.

European markets were mostly higher but Greece dragged the average down: 2.2% loss.

The Commodity equity group were all lower for a 2.9% loss.

The DJ world index is still in a downtrend and lost 0.9%.

COMMODITIES

Bonds remain in an uptrend but lost 0.1% on the week.

Crude is still in a downtrend and lost 6.2% on the week.

Gold remains in a downtrend as well and lost 0.1% on the week.

The USD is still in an uptrend and gained 0.2% on the week.

NEXT WEEK

Tuesday: Wholesale inventories. Wednesday: the Budget deficit. Thursday: weekly Jobless claims, Retail sales, Export/Import prices and Business inventories. Friday: Industrial production, the PPI and Consumer sentiment. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2015 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.