One of the Most Useful Stock Markets Reports You Will Ever Read

Stock-Markets / Stock Markets 2015 Aug 07, 2015 - 01:50 PM GMTBy: EWI

Would foreknowledge of the news put you ahead of the investment crowd?

Would foreknowledge of the news put you ahead of the investment crowd?

Editor's note: You'll find the text version of the story below the video.

Consider this July 23 Reuters headline:

GM earnings more than doubles on U.S. truck demand

Suppose you had the news about GM's earnings a day in advance. Would you have gone long the market?

If you had, you'd have been on the wrong side of the trend. U.S. stock indexes finished lower on the day (the Dow fell into the red for the year).

But doesn't news drive the stock market? The financial media sure thinks so, as do many investors.

But the evidence suggests that news lags the stock market.

Here's why: Shifts in collective psychology unfold almost immediately in the stock market, via every investor decision to buy or sell. Yet these shifts take a longer time to surface in the economy, politics, cultural trends, etc. So, the "good" news about GM's earnings and U.S. jobless claims were the result of the optimism in the market's prior uptrend -- not the "cause" of real-time stock market action.

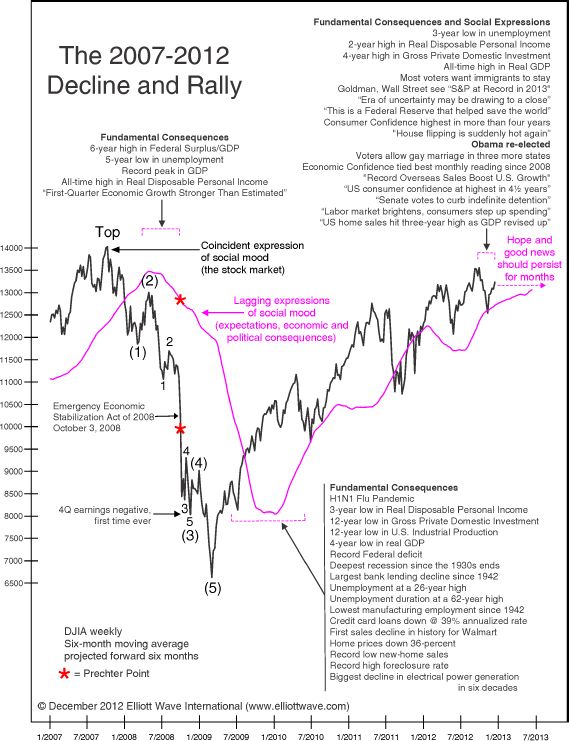

A chart from the December 2012 Elliott Wave Theorist, which Robert Prechter calls "one of the most useful reports about markets you will ever read," helps to illustrate the point:

[Note: the "Prechter Point" in the chart above represents the center of the violent downward stock market wave in 2008. It marks the point when investors shift from hoping for the best to fearing the worst.]

Here's what the Socionomics Institute's Alan Hall says about the chart:

As you can see ... a number of positive economic consequences lagged the October 2007 peak in the stock market. Expressions of mood and economic consequences also lagged the March 2009 bottom in the stock market, as bad economic news subsequently flooded the media. The lag is evident with respect to the rally from 2009 to 2012 as well. ...

Most people miss the turns in social mood and the stock market because they tend to assign social-mood and stock-market causality to "good news" or "bad news" reported long after the change in the trend of social mood has already occurred. The best economic news tends to come when the stock market is already past its high, and the worst economic news tends to come when the stock market is already past its low. The more aware you become of this dynamic, the more you can think independently of the crowd.

Download Your Free eBook: Market Myths ExposedThis 33-page eBook takes the 10 most dangerous investment myths head on and exposes the truth about each in a way every investor can understand. |

This article was syndicated by Elliott Wave International and was originally published under the headline (Video, 2:59 min.) "One of the Most Useful Reports About Markets You Will Ever Read". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.