Inflation Hitting Emerging Markets

Economics / Emerging Markets Jun 22, 2008 - 08:31 PM GMT Financial Times: Goldman close to $7 billion SIV bail-out

Financial Times: Goldman close to $7 billion SIV bail-out

“Goldman Sachs is close to finalising a plan to restructure a $7 billion investment vehicle formerly run by London-based hedge fund Cheyne Capital, in a move that could potentially usher in a crucial new phase in the credit turmoil.

“The US bank's proposed reorganisation of the so-called structured investment vehicle is set to be just the first of a number of deals that could see about $18 billion worth of SIV assets restructured in the coming months.

“The deal, which could be signed as early as Tuesday, is likely to be closely watched by the financial industry, since Cheyne is one of the largest independent SIVs – and the deal marks the first time that any collapsed SIV has been restructured in this way. The SIV went into receivership last autumn when the value of its credit assets, such as mortgage-linked securities, plunged.

“The Cheyne restructuring, which has been brokered after nearly 10 months of negotiations, will require the receivers to organise an auction of the Cheyne assets in the coming weeks, to establish a transparent price for these instruments. This is important because in recent months it has often proved impossible to value these murky assets.

“Once this price is established, Goldman will then create a new off-balance sheet vehicle to buy the assets, with the transfer of assets being funded by the US bank for just one day before being sold on to the new vehicle. Under the plan senior creditors in the SIV will be given a range of options including reinvesting in this new vehicle.

“… the move will bolster hopes that banks are starting to create solutions to the long-running woes of SIVs, and the plethora of other, shadowy credit entities that have exploded in size this decade, in the so-called ‘shadow banking world'.”

Source: Anousha Sakoui, Financial Times , June 16, 2008.

Bloomberg: John Paulson says writedowns may reach $1.3 trillion

“John Paulson, founder of the hedge fund company Paulson & Co., said global writedowns and losses from the credit crisis may reach $1.3 trillion, exceeding the International Monetary Fund's $945 billion estimate. ‘We're only about a third of the way through the writedowns,' Paulson told the GAIM International hedge fund conference in Monaco today. ‘There are a lot of problems out there and it will continue to be felt through the year. We don't see any signs of stabilizing.'”

Source: Tom Cahill and Poppy Trowbridge, Bloomberg , June 18, 2008.

BCA Research: Commodity pits driving monetary policy and government bonds

“The run-up in commodity prices is dominating media headlines and is spooking investors. However, the annual rate of change in food and energy prices is now at an extreme, which is unsustainable. Crude oil prices have risen 100% from year-ago levels and would need to surge close to $200/bbl by the end of 2008 just to maintain the current pace of inflation.

“Moreover, the macro backdrop in the developed world is not conducive to sustained underlying price pressures. The US and Japan are close to or in recession, the UK economy is heading there rapidly, and the euro area is on target for a period of below-trend growth.

“So far, there is no evidence of second round effects in any of these economies or risk of a wage inflation spiral. In fact, monetary restraint in response to commodity induced price pressures over the next few months would likely amplify the downturn in global growth. Still, government bond markets will remain at risk until oil prices correct decisively or there is evidence that the disinflationary impact of the ongoing slowdown in the G7 economy is starting to unfold. For now, we recommend standing aside and maintaining a benchmark duration allocation. Stay tuned.”

Source: BCA Research , June 19, 2008.

Bloomberg: China “not smart” to invest in US bonds

“China's government, which invests up to a third of its $1.68 trillion in currency reserves in Treasuries, is ‘not smart' to invest in US debt and should seek higher returns, a former legislator said.

“‘I don't think it's a smart move to invest in US bonds,' said Cheng Siwei, former vice chairman of the National People's Congress, China's legislature, at a Beijing conference. ‘We need smart capitalists to invest ourselves,' instead of lending money to American investors and earning interest, he said.

“Cheng's remarks on November 7 that China should improve the structure of its foreign reserves by favoring stronger currencies helped pushed the dollar to record lows against the euro. He said today his comments represented his ‘personal opinion, not the government's policy.'

“Countries in Asia have amassed a record $4.2 trillion in foreign exchange reserves since the 1997-98 financial crisis, seeking to protect their economies from a similar regional currency slump.”

Source: Belinda Cao, Bloomberg , June 13, 2008.

David Fuller (Fullermoney): “It is different this time” is seldom a good bet

“It may seem counterintuitive but if we have learned two important things over our investment years, they are:

1. Cease buying and commence selling when the crowd is euphoric.

2. Buy or at least hold onto your long positions when the news is all gloom and doom.

“But, David, what if it really is different this time?

“It might be, but that is seldom a good bet. Meanwhile, stock markets appear at least temporarily oversold and crude oil has not extended its uptrend. Today's pessimism is not a dramatic, climactic signal such as we last saw in January and March, but it is an indication that people are becoming too pessimistic once again.”

Source: David Fuller, Fullermoney , June 19 2008.

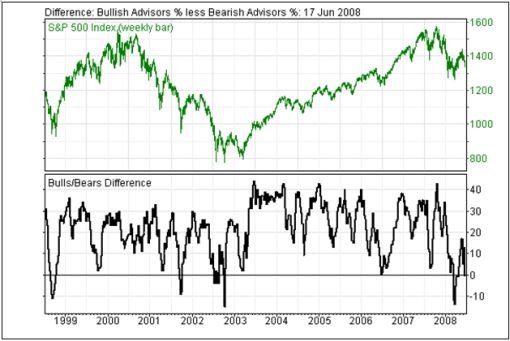

David Fuller (Fullermoney): Bearish sentiment indicates stock market rebound

“… this graph speaks for itself. There has never been a reading at current or lower levels that was not soon followed by a sharp rebound, including during the last bear market. This indicates to me that we are within a week or two of a bear squeeze, providing at least a tradable rally in which I aim to participate.”

Source : Investors Intelligence (via Fullermoney ), June 18, 2008.

Richard Russell (Dow Theory Letters): Lowry's statistics spell trouble

“I did a double-take when I read Lowry's statistics after the close of yesterday's market. Buying Power Index at a multi-year low and Selling Pressure Index at a multi-year high. And the two Indices at about their widest (most bearish) spread in history or since the 1930s. What the devil could this mean? My guess can be summed up in one word – trouble.”

Source: Richard Russell, Dow Theory Letters , June 19, 2008.

Financial Times: US corporate earnings expected to fall

“US corporate earnings are expected to decline for the fourth straight quarter when the reporting season kicks off next month as companies battle a sharp rise in production costs.

“Second-quarter earnings for S&P 500 companies are forecast by analysts to fall 9%, according to Thomson Reuters.

“The bulk of the latest quarterly decline in profits is led by financials, seen falling 53%, and consumer discretionary groups, forecast to slide 14%.

“In contrast, energy companies are expected to boost earnings growth by 22% during the quarter as oil remains near a record $140 a barrel.

“However, the surge in energy and food prices in recent months is feeding into much higher production costs at a time when the economy remains sluggish. Given the weak economic backdrop, economists doubt that companies can fully pass along their higher production and service costs to consumers.

“In spite of recent stimulus cheques being sent to many consumers, corporate profit margins look vulnerable.

“Analysts expect third-quarter earnings growth to rebound with a gain of 13.9% over the same period last year when the first impact of the credit crisis was felt.”

Source: Michael Mackenzie, Financial Times , June 18, 2008.

Reuters: Goldman reduces price targets for US banks

“US banks may need to raise $65 billion of additional capital to cope with mounting losses from a global credit crisis that will not peak until 2009, Goldman Sachs & Co analysts said on Tuesday.

“The new capital would be on top of $120 billion already raised by the industry, analysts led by Richard Ramsden said.

“‘Banks will not turn until a peak in credit costs is in sight,' the analysts wrote. ‘Moreover, weaker banks are unlikely to benefit from consolidation as bank deals always slow when credit is deteriorating and larger banks are hamstrung by their own problem assets as well as accounting requirements.'

“Goldman said it lowered its price targets for 14 banking companies and cut its 2008 earnings-per-share forecasts for 11.

“Among the banks for which Goldman cut both are BB&T, PNC Financial Services, SunTrust Banks, US Bancorp and Wells Fargo.

“Goldman also lowered its price targets for Wachovia and Washington Mutual, and its earnings outlook for Bank of America.”

Source: Reuters , June 17, 2008.

GaveKal: Lower oil prices should boost Chinese equities

Source: GaveKal – Checking the Boxes , June 20, 2008.

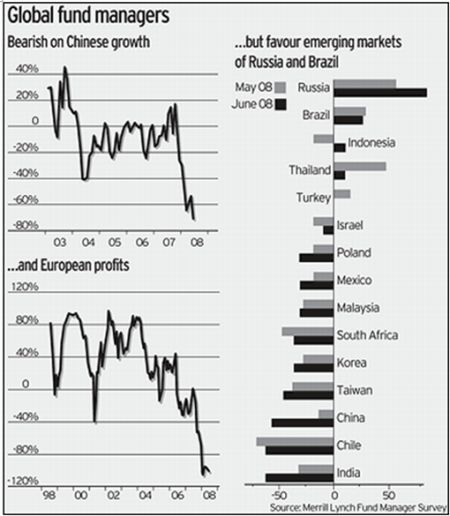

Telegraph: China and India lose their appeal for investors on inflation fears

“The world's fund managers are pulling their money out of China and India at a record pace on mounting fears of inflation and are now more pessimistic about global equities than at any time in the past decade.

“The latest survey of investors by Merrill Lynch shows that Europe has become the most unpopular region, while Britain is still trapped in the doldrums.

“But the big surprise is the sudden change in view on the emerging powers of Asia, as overheating and spiralling oil costs spoil the boom.

“‘World growth is slowing and yet central banks might still have to tighten monetary policy, that is what is scaring people,' said David Bowers, the organiser of the survey. The vast majority of fund managers think earnings forecasts have lost touch with reality.

“The exodus from China reached fever pitch this month as investors slashed their net ‘weighting' position to -58, down from -14 in May. The Shanghai bourse had already fallen by almost half since October.

“India fell to -63 as investors took fright at the country's budget and trade deficits. There is concern over a relapse towards Nehru-era policies after Delhi halted trading in a range of commodity futures and restricted rice exports.

“The survey of 204 fund managers worldwide suggests that the love affair with emerging markets is going cold.

“Fund managers are still super-bullish on Russia, betting that the energy boom has life yet. A net 62% are overweight oil and gas shares. The most hated trio are travel and leisure (-66), banks (-62) and property (-60).

“A record number (net 29%) are now underweight on European equities; many have switched into cash as they wait for the European Central Bank to inflict punishment – ever more likely after eurozone inflation reached an all-time high of 3.7% in May.

“As the new story unfolds, America is coming back into favour, emerging as a sort of safe haven in a fast-changing world where trusted institutions command a premium. Investors are quietly rotating back into Wall Street – despite a chorus of pessimists. A net 23% are overweight US equities, the highest since August 2001.

“The long awaited ‘decoupling' has begun. The United States looks like the winner after all.”

Source: Telegraph , June 19, 2008.

David Fuller (Fullermoney): Japan – the best industrialized stock market for today's economic climate?

“Is this the best industrialised stock market for today's economic climate? Oh no, I can sense some of you thinking – he is going to mention Japan. Yes, and you may recall the adage: The best investment opportunities occur when those who know it best, love it least, because they have been disappointed most.

“Sure, one could easily argue that Japan is a politically ossified old people's home, destined to disappoint investors in perpetuity. This claim is not short of circumstantial evidence.

“If the bears are right, Japan's stock market will soon break downwards once again. After all, on weekly charts the Nikkei and Topix bounced in March from where one might expect, looking at the earlier data, but have now rallied back to their overhanging top formations and the declining 200-day MAs.

“Interestingly, however, Japan is the only developed country stock market that I am aware of where the reaction lows for major indices since March are still rising, albeit only just. Consequently the Nikkei and Topix have shown relative strength since mid-May, as we can see from the daily charts.

“I have said before that Japan cannot hold out on its own, but if Wall Street and other markets are now steadying in response to an oversold condition then Japan is a likely upside leader. Obviously the higher reaction lows need to hold, otherwise Japan falls back into its trading range of the previous three months, as have many other indices.

“Why might it maintain this relative performance? I can think of two good reasons: 1. Japan, I believe, is the most efficient user of oil, although Germany is probably a close second. 2. Japan certainly has the lowest inflation rate of any country, but it is likely to rise.

“These two factors could be significant at a time when everyone is understandably concerned about high oil prices and global inflationary problems. However Japan has the world's highest savings rates, partly due to the long deflation, but the prospect of higher inflation should encourage consumer demand. Also, we often hear about Japan's demographic problems but at least that means fewer poor to feed. Japan also has the lowest interest rates and a soft currency.”

Source: David Fuller, Fullermoney , June 16, 2008.

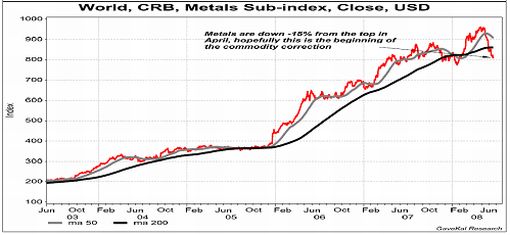

GaveKal: Is this the beginning of the commodities correction?

Source: GaveKal – Checking the Boxes, June 20, 2008.

News Daily: T Boone Pickens – oil production has topped out

“World crude oil production has topped out at 85 million barrels per day even as demand keeps climbing, helping to drive a stunning surge in prices, billionaire oil investor T. Boone Pickens said on Tuesday.

“‘I do believe you have peaked out at 85 million barrels a day globally,' Pickens, who heads BP Capital hedge fund with more than $4 billion under management, said during testimony to the Senate Energy and Natural Resources Committee.

“The United States alone has been using ‘21 million barrels of the 85 million and producing about 7 of the 21, so if I could take just a minute on this point, the demand is about 86.4 million barrels a day, and when the demand is greater than the supply, the price has to go up until it kills demand,' Pickens told lawmakers.”

Source: News Daily , June 17, 2008.

Bloomberg: Emergency oil summit preview

Source: Bloomberg , June 19, 2008.

Financial Times: Saudi plans to raise oil output

“The price of crude hit a new all-time high of $139.89 on Monday as a weakening US dollar and fresh disruption in North Sea oil production overshadowed Saudi Arabia's plant to boost its oil production to its highest level in more than 25 years, Carola Hoyos, FT's chief energy correspondent, analyses the ‘high-risk' Saudi move.”

Source: Richard Edgar, Financial Times , June 16, 2008.

GaveKal: Can oil roll over?

“Today, the main question for investors everywhere is still oil. If crude stays at US$135/bbl, then this spells lower growth and lower margins for business. In Asia the implications would be growing budget deficits and more rapid money creation, which would add to inflationary pressures. Inflation, in turn, implies lower price-to-earnings multiples. This is obviously not a very attractive scenario for anyone. So the key question is: can oil roll over and, if so, how?

• Option # 1: New supply comes on stream. This takes time. Even if OPEC opens the spigot (and Saudis looked poised to do just that), increased production will not come on line overnight.

• Option # 2: Demand backs off. We are already seeing this. Not just with America's gas guzzlers cutting back, but in Asia where slowing growth in industrial production/fixed asset investment will get an extra downward shove as many governments reduce fuel subsidies.

• Option # 3: Sledgehammer monetary policies. Central banks could kill off liquidity to cool inflation (the Volcker method), but they would kill their economies in the process, and put companies into bankruptcy.

• Option # 4: A ‘Plan B' on energy: Governments could take coordinated action to reduce the speculative component of the oil bubble by: cutting back subsidies, announcing rational energy programs, tightening regulations on the trading of energy futures, etc.

“In light of the unattractiveness of the other three options, it is reasonable to think that a global coordinated effort – a ‘Plan B' – would come to fruition. After all, the current generation of policymakers will not want to be remembered for having fiddled while Rome burned. However, after nothing happened at last weekend's G8, hope is waning. At this point, it looks like ‘Option #2' is the more likely outcome – fuel demand will back off. But in the process, someone out there, a marginal or less stable member of the world economic community, will go bust. That's the reality we are living in today, and that is why we are seeing things like China's domestic stock market declining ten days in a row, India intervening to support its currency, Vietnam swooning under 25% inflation, etc.

“What's an investor to do in this environment? As we see it, it makes sense to stick with countries where inflation/monetary aggregates are within reason: i.e., the US, Japan, Taiwan and Switzerland. Coincidentally, these are also the nations that have been outperforming over the past couple of weeks.”

Source: GaveKal – Checking the Boxes , June 18, 2008.

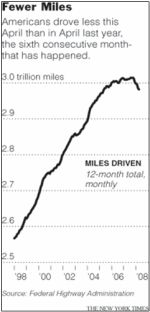

The New York Times: Americans finally driving less

The New York Times: Americans finally driving less

“As the price of gasoline quadrupled over the last decade, American drivers seemed to defy the laws of economics by pumping more into their vehicles year after year.

“But this is the year American drivers appear to be finally succumbing to price shock at the pump, according to a new report by Cambridge Energy Research Associates … It says the slowdown in the economy and soaring gasoline prices have finally persuaded Americans to drive fewer miles in fewer gas-guzzling vehicles.

“‘US gasoline demand will likely decline in 2008 for the first time in more than 17 years,' says the report … ‘For the first time since the 1970s and early 1980s the number of miles driven by Americans has clearly begun trending downward.'

“The Transportation Department reported on Wednesday that Americans drove 1.8% fewer miles on public roads in April 2008 compared with the same month last year, the sixth consecutive month of driving mileage declines.

“Sales of pickup trucks, minivans and sport utility vehicles have fallen below 50% of new passenger vehicle sales this year for the first time since 2001, the report says, as consumers turned to smaller vehicles in favor of fuel economy. ‘It's kind of stunning,' said Aaron F. Brady, a co-author of the report. ‘It was over 50% as late as February and by May it fell under 44%. It's like falling off a cliff.'

“Drivers, meanwhile, are becoming more prudent in their driving habits, either by using public transportation, carpooling or just cutting down on unnecessary trips, the two authors said in an interview. ‘Public transit ridership is surging all over the country,' said Samantha Gross, the other author.”

Source: Clifford Krauss, The New York Times , June 19, 2008.

Bloomberg: China raises fuel, electricity prices

“China, the world's second-biggest oil consumer, will raise the prices of gasoline and diesel by 1,000 yuan ($145.50) a metric ton, starting tomorrow, the National Development and Reform Commission said on its website. The nation will also raise jet fuel prices by 1,500 yuan a ton tomorrow, the top policy planner said. On July 1, China will increase electricity prices by an average 0.025 yuan a kilowatt-hour, the NDRC said. China will impose temporary caps on thermo-coal prices until the end of this year, it said. The country must cut energy use by at least 5% for every unit of gross domestic product annually for the next three years to meet its 2010 objective …”

Source: Wang Ying and Theresa Tang, Bloomberg , June 19, 2008.

Financial Times: Fed holds clue to gold's next move

“Gold bugs are becalmed. After breaching $1,000 an ounce in March, the metal has spent the past two months at $850 to $950. Such a range, in which the price is close to the 200-day moving average, has chartists salivating. A break-out either way may signal a lurch to new highs or a sharp fall – but which?

“With supply issues taking a back seat, the answer depends on which of gold's demand drivers – let's call them physical, funk, funds, fuel and forex – commands the tiller.

“The impact of physical demand is weak. World Gold Council figures show jewellery demand, for instance, fell 21% between the first quarter of 2007 and the same period in 2008, but gold prices still rose.

“Financial market and geopolitical-induced funk is most potent when it comes out of the blue, so there is no knowing what could soon trigger a flight to gold. But it seems to have lost some of its safe-haven status in this regard of late.

“A flow of money into products such as exchange-traded funds has been a powerful force for pushing gold higher. Demand for gold ETFs doubled to 73 tonnes, or $2.2 billion, over the year to the end of March. Retail investors like gold.

“A more powerful, long-dormant force may be back. Gold bulls can again promote the metal as a hedge against inflation. And at the vanguard of inflation is the soaring price of fuel. Oil and gold have enjoyed a tight correlation since mid-2007, but it has been somewhat estranged during crude's recent leap towards $140.

“But the best guide to trends in gold has long been found in the forex markets. The correlation between the dollar and gold price is long and tight. The greenback's pull-back from record lows over recent months triggered gold's 12% fall from its peak to today's $886.

“With the dollar so sensitive to interest rate policy, the US Federal Reserve holds the clue to gold's next move.”

Source: Jamie Chisholm, Financial Times , June 18, 2008.

Telegraph: Things will get worse, warns Bank of England governor Mervyn King

“Families will see their standard of living stagnate this year while the value of their homes will fall further, the Bank of England Governor has warned.

“The coming months represent the biggest challenge for the economy for two decades, Mervyn King said, adding that some households will find them ‘particularly difficult'.

“In his most sombre message yet, Mr King said families were being squeezed hard by higher electricity and food prices on the one hand and slowly-increasing wages on the other.

“He told Alistair Darling and leading City dignitaries in London that the experience would be even tougher than the credit crunch, and warned that the ‘era of cheap mortgage finance … is over'.

“Mr King said: “This year our real take-home pay will rise at a slower pace than national productivity. Rising fuel, gas, electricity and food prices, mean that average real take-home pay will stagnate this year.

“‘It will not be an easy time, and I know that some families will find it particularly difficult.'”

Source: Edmund Conway and Robert Winnett, Telegraph , June 19, 2008.

Financial Times: UK house price declines intensifying

“House prices fell by 0.6% in May in England and Wales according to the latest FT House Price Survey published on Friday, the third monthly drop in a row and the sharpest one month fall since February 1995. Norma Cohen, FT's economics correspondent, talks to Daniel Garrahan of FT.com about the data.”

Source: Daniel Garrahan, Financial Times , June 13, 2008.

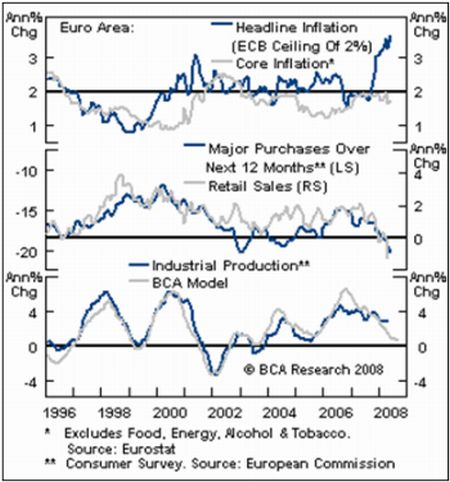

BCA Research: Euro area price pressures persist

“Elevated CPI inflation continues to provide fuel for ECB hawks.

“Yesterday's CPI report showed that euro area headline inflation rose in May to 3.7% YoY (from 3.3%). While the jump was largely driven by surging energy and food prices, the core measure also edged higher on the month.

“The release will only help reinforce the ECB's recent hawkish rhetoric. The central bank has become increasingly determined to reign in price pressures and inflation expectations, due to growing concerns of pass-through. Indeed, ECB President Jean-Claude Trichet warned earlier this month that the central bank may lift the policy rate by 25 basis points. While a one-off rate hike is a possibility, it will be difficult to attain the consensus needed from the PIGS (Portugal, Italy, Greece and Spain), given that their economies are on track for a period of below-trend growth.

“Still, the ECB will continue to talk aggressively and try and jawbone inflation expectations lower, at least until there is clear evidence that price pressures are starting to ease. Bottom line: Although the backup in euro area bond yields look stretched (and we have switched to a benchmark duration allocation), we remain underweight euro area bonds within a global hedged fixed income portfolio.”

Source: BCA Research , June 17, 2008.

Financial Times: German investor confidence plunges

“German investor confidence has plunged to its lowest for almost 16 years, according to a survey, highlighting nervousness about the outlook for Europe's largest economy.

“The ZEW index, which is intended to give a guide to future economic developments, dropped by 11 points to minus 52.4 points this month, its lowest since December 1992. That suggested fears are mounting of a significant economic slowdown.

“But analysts pointed out that the survey was not necessarily a good guide to the scale of the expected deceleration. Recently it has tended to exaggerate trends in activity. By contrast, the Ifo German business confidence survey has remained relatively strong, reflecting the confidence of business leaders.

“‘While industry captains see business evolving in line with the long-run trend in the next six months, investors seem to see Germany heading for a recession,' said Elga Bartsch at Morgan Stanley. ‘Eventually one of them will be proven wrong. We believe that it is likely to be the investor community.'”

Source: Ralph Atkins, Financial Times , June 17, 2008.

Bloomberg: EU seeks to rescue new treaty

Source: Bloomberg , June 19, 2008.

Ambrose Evans-Pritchard (Telegraph): Emerging markets face inflation meltdown

“Central banks across much of Asia, Latin America, and Eastern Europe will soon have to jam on the brakes or risk a serious crisis as inflation spirals into the danger zone.

“As the stark reality becomes ever clearer, this year's correction in emerging market bourses and bond markets has now accelerated into a full-fledged rout.

“Shanghai's composite index touched a fourteen-month low of 2,900 yesterday. It follows moves this week by the central bank raised reserve requirement yet again, draining a further $60 billion from the banking system. Chinese stocks have now slumped by almost 50% since peaking in October.

“In India, Mumbai's BSE index has lost 27% of its value as the exodus of foreign funds accelerates. The central bank has raised rates to 8% to curb inflation and halt a run on the rupee, but critics still say the country waited too long to tackle overheating. The current account deficit has shot up to near 3.5% of GDP. A plethora of subsidies has pushed the budget deficit to 9% of GDP.

“Russia, Brazil, India, Vietnam, South Africa, Indonesia, Nigeria, and Chile – among others – have all had to raise interest rates or tighten monetary policy in recent days. Most are still behind the curve.

“‘The inflation genie is out of the bottle: easy money is the culprit,' said Joachim Fels, chief economist at Morgan Stanley.

“‘Weighted global interest rates are 4.3%, while global inflation is above 5%. The real policy rate in the world is negative,' he said

“The currencies of Korea, Thailand, the Phillippines, and Malaysia have come under pressure this week as investors scramble for dollars in moves that echo the East Asia crisis in 1997-1998. Several countries have had to intervene to slow the currency slide.

“The sudden shift in sentiment appears to follow comments by Ben Bernanke and Tim Geithner, the heads of the US Federal Reserve and the New York Fed, leaving no doubt that Washington has lost patience with the crumbling dollar.

“It is almost unprecedented for Fed officials to take a public stand on the Greenback. The orchestrated move is clearly aimed at halting the vicious circle in the oil markets, where crude prices are feeding off dollar weakness – with multiples of leverage.”

Source: Ambrose Evans-Pritchard, Telegraph , June 17, 2008.

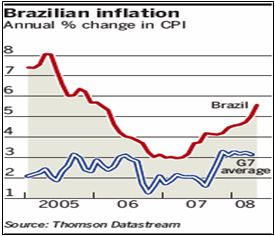

Financial Times: Brazil's central bank warns on inflation

“Inflation is the biggest threat facing Brazil and the rest of the world, Henrique Meirelles, president of Brazil's central bank, has told the Financial Times, making an appeal to other central bankers to join the task of keeping international price rises under control.

“Inflation is the biggest threat facing Brazil and the rest of the world, Henrique Meirelles, president of Brazil's central bank, has told the Financial Times, making an appeal to other central bankers to join the task of keeping international price rises under control.

“‘The biggest concern over the next 12 months for Brazil and the rest of the world is inflation,' he said in an interview in São Paulo. ‘The risk is that prices for food and raw materials will continue to rise. If every central banker decides that this is a problem for other countries, nobody will do anything and there will be [faster] worldwide inflation.'

“The US Federal Reserve and other central banks have cut interest rates over the past nine months to ward off the threat of recession. But Mr Meirelles said he was confident that central bankers would now turn their attention to the greater threat of inflation.

“‘It is important that now we are seeing authorities in general taking a different attitude, which is welcome,' he said. ‘Inflation is really the most important challenge now.'

“Brazil's central bank began raising its target overnight interest rate in April after two years of monetary loosening. The rate, known as the Selic, fell from 19.75% in September 2005 to 11.25% in September 2007. The bank has since raised it twice by half a percentage point each time in April and May, to 12.25%.

“Most economists expect the rate to reach 14.25% by the year end.”

Source: Jonathan Wheatley, Financial Times , June 18, 2008.

Financial Times: New Zealand poised to fall into recession

“… New Zealand is on the cusp of a downturn and risks seizing the dubious honour from the US of becoming the world's first developed nation to sink into recession, as measured by two consecutive quarters of negative gross domestic product growth.

“GDP numbers for the January-March quarter due this month are forecast to show a contraction of at least 0.3%. TD Securities and other economic forecasters are predicting a 0.2% decline for the April-June quarter.

“With a GDP of NZ$155 billion ($116 billion), New Zealand's economy is small by world standards but is watched with interest by the US, UK and Australia, which are also grappling with the ill-effects of rising household debt, large current account deficits and a correction in the housing market.

“Strong indications from the Reserve Bank of New Zealand that interest rates – at 8.25 per cent second only to Iceland in the developed world – will be heading down in the coming months have taken the heat out of the yen carry trade, through which Japanese professional and retail investors hunted high-yielding currencies such as the Kiwi, the New Zealand dollar.”

Source: Peter Smith, Financial Times , June 15, 2008.

Financial Times: Hendrik du Toit on Africa and commodities

“The chief executive of Investec Asset Management talks to FT's Pauline Skypala about the African investment story, structural change on that continent and commodity-driven fads.”

Source: Pauline Skypala, Financial Times , June 13, 2008.

Click here to go back to Part 1

Did you enjoy this posting? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.