Submerging Stock Markets

Stock-Markets / Stock Markets 2015 Aug 05, 2015 - 11:37 AM GMTBy: Ed_Carlson

This week's commentary takes a look at emerging markets but first a review of the most recent Hybrid Lindsay forecast for the Dow Industrials index.

The July 14 commentary mentioned the official forecast for a low in the period July 24-31 but also explained why "a tradable low is very close". Indeed, last week's low was seen that day. The next forecast-high generated by the Hybrid Lindsay model is expected late in the week of August 10 or early during the week of August 17.

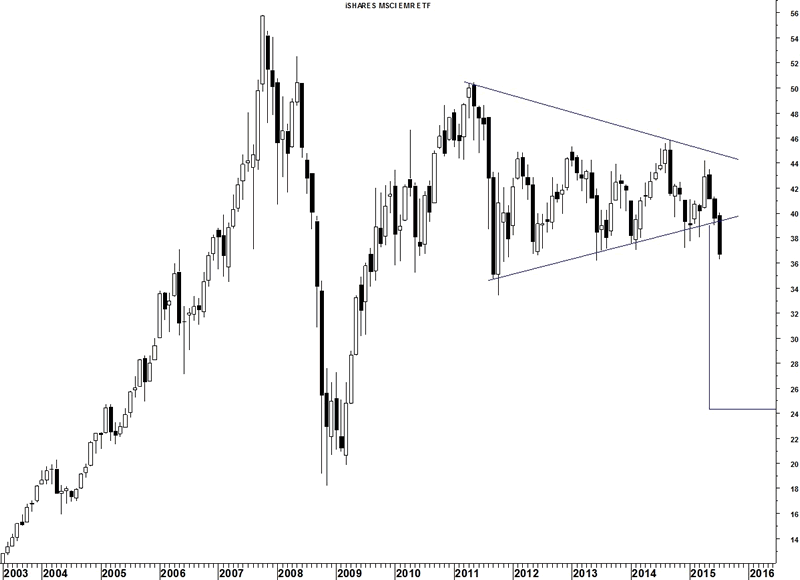

The MSCI Emerging Markets index can be traded via the ETF, EEM. Other than a brief respite last spring, emerging markets have been suffering from a rising value in the US Dollar since late 2014. A cycle low is expected this week and is confirmed by a positive divergence in the daily Coppock Curve. Longer term however, things don't look too good for emerging markets. As mentioned in my July 21 commentary, the Dollar still has strong upside potential despite what might happen in the near-term. Remember, a soaring U.S. currency triggered debt defaults in Latin America in the 1980s. A decade later, the dollar's appreciation forced Asian countries to drop their peg to the greenback, throwing the region into crisis. EEM has triggered a symmetrical triangle on the monthly chart which measures a minimum decline to 24.00 - a 35% drop from last Friday.

Try a "sneak-peek" at Lindsay research (and more) at Seattle Technical Advisors.

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2015 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.