Strong Bearish Signal Given Today on the Tadawul (Saudi Stock Exchange)!

Stock-Markets / Saudi Arabia Aug 03, 2015 - 10:07 AM GMTBy: Submissions

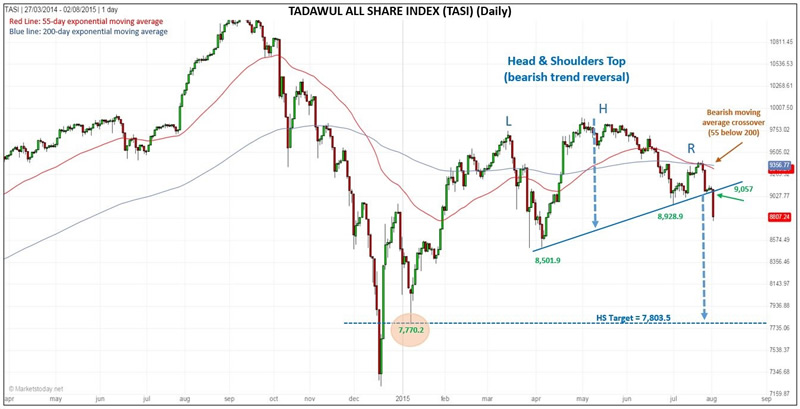

Bruce Powers writes: A bearish head and shoulders top formation (HS) was triggered today on the Tadawul All Share Index (TASI), with the index falling 3.20 per cent to end the day at 8,807.24. The bearishtrigger was on a move below the neckline at 9,057. Momentum picked up on the way down with the index closing in the bottom quarter of the day’s range.

An additional bearish signal was given on today’s drop below previous support at 8,928.27, triggering a continuation of the short-term down trend. Last week, the shorter 55-day exponential moving average (ema) crossed below the longer 200-day ema, providing an early warning that selling pressure could intensify. The 55-day spent the past two months above the 200-day ema (bullish) after staying below it since mid-December 2014.

The target from the HS pattern is approximately 7,803.50, right in the area of support at 7,770.2 seen during a spike low on January 6th of this year. Together, this creates an eventual high probability target zone from around 7,803 to 7,770.

This target zone can be expanded slightly when taking into account the larger view as seen in the enclosed weekly chart. We can add in previous resistance (now potential support) from the swing high in 2012, which was at 7,944.4. In addition, the long-term uptrend channel line converges with the above price areas, giving further support to the chance that a decline will be held at or above the 7,944 to 7,770 price zone.

By Bruce Powers, CMT

About MarketsToday.net: MarketsToday.net® is an online financial portal covering the Middle East stock markets, plus spot Forex, oil, and precious metals, published in both Arabic and English. It is designed to help keep investors and traders up-to-date with the latest news, quotes, performance trends, and market developments in the Middle East stock markets.

Copyright 2015 © MarketsToday - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.