Reasons Why the Greek Crisis Will Only Get Worse

Stock-Markets / Eurozone Debt Crisis Jul 30, 2015 - 04:23 PM GMTBy: Investment_U

Sean Brodrick writes: So Europe brought Greece to heel like an unruly dog, eh? And the government of that sad-sack nation got stuck with the same onerous debt terms it was trying to avoid when it held a referendum?

Sean Brodrick writes: So Europe brought Greece to heel like an unruly dog, eh? And the government of that sad-sack nation got stuck with the same onerous debt terms it was trying to avoid when it held a referendum?

German bankers win, life goes on... right?

Nope.

If anything, the crisis in Greece is only going to get worse. Let me give you three reasons why...

No. 1: The Economic Situation Is Only Getting Worse

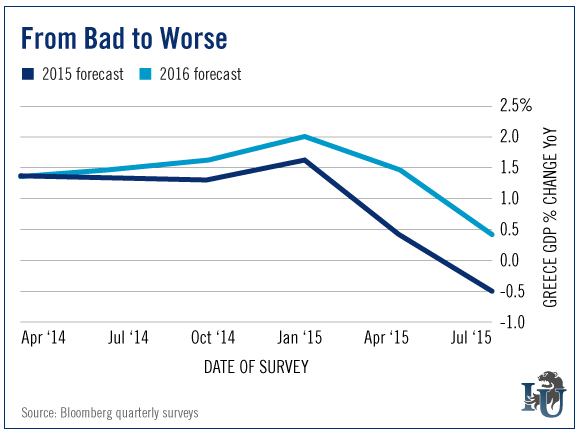

Rightly or wrongly, the reason Greece tried to wriggle out of its debt obligations is its economy simply can’t grow the way things are. And sure enough, since Greece was forced to grovel and accept Germany’s terms, Greece’s economy will continue to shrink.

The country’s GDP should contract 0.7% in 2015. That’s down from a 0.8% expansion in 2014, according to most estimates.

It will be the seventh annual decline in eight years. Overall, Greece’s economy has shrunk by 25% since 2008.

And the smaller the economy gets, the less of a debt burden it can bear (and the more it depends on European handouts). It’s a vicious cycle that feeds on itself.

Also, remember how shocking Greece’s unemployment rates were, with 25.9% of the general population and more than half of young people out of work? Well, that’s getting worse, too. General unemployment will average 26.3% this year.

No. 2: The Banks Are Still in Trouble

Now that Europe is giving Greece more cash injections, its banks were supposed to unfreeze. People were supposed to be able to get access to their money.

Nope.

In fact, Greek banks, which have basically been frozen for a month, are expected to keep cash controls in place for months to come.

This is worsening the economy (see point No. 1). That’s because banks limit withdrawals to 420 euros a week. That chokes economic activity and borrowers’ ability to repay loans.

Oh, and the Greek stock market, which was also closed for a month, keeps putting off opening up.

Greece owes Europe 300 billion euros. Even the International Monetary Fund says Greece can’t pay that back. Yet Germany shows no signs of allowing debt forgiveness.

To recapitalize and unfreeze the banks would take a back-of-the-envelope injection of another 25 billion euros. So would that be added to the debt that Greece already can’t pay?

Some problems have no solutions.

No. 3: Greece Still Isn’t Bailed Out

The problems that drove Greece into crisis aren’t fixed. The can has been kicked down the road for a bit. The country’s debt is now 170% of GDP. And since the economy is shrinking, the debt-to-GDP ratio is only going to get worse.

Greece is supposed to sit down with its international creditors to talk about a new bailout package. The meetings with officials from the European Commission, European Central Bank and International Monetary Fund were supposed to start last week.

Then the meetings were supposed to start today. Then they were delayed again.

Do you get the feeling that maybe no one wants to have these meetings? Maybe because both sides know that without debt forgiveness, there is no solution to Greece’s economic crisis.

This ongoing Greek tragedy could have many more acts to play out.

To be sure, Greece doesn’t have any real impact on the U.S. It’s even a minor peripheral figure in Europe as a whole. But at the heart of the crisis is whether the euro is a viable currency - does it do more harm than good to weak nations that adopt it?

I think the answer to that question is one that could rock the euro and send ripples through the global financial system.

Regardless, there are several opportunities for investors in Greece. I gave my analysis and favorite picks to play this situation in a recent report. But whatever you do, just be sure to do your own due diligence.

Good investing,

Sean

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.