Gold & Silver Money Has Devolved Into Debt and Plastic

Commodities / Gold and Silver 2015 Jul 28, 2015 - 10:49 PM GMTBy: DeviantInvestor

Central banks will disagree;

Central banks will disagree;

Keynesian economists probably disagree;

Too-Big-To-Fail banks don’t care;

But I think the following is generally accurate regarding the devolution of gold and silver money.

IN THE BEGINNING: Gold and silver coins were used as real money for several thousand years. Gold and silver were universally recognized as a store of value.

140 YEARS AGO: The $20 Gold Double Eagle Coin was globally recognized as money. It contained 0.9675 ounces of gold and its purchasing power was unquestioned.

137 YEARS AGO: The $1 Morgan Silver Dollar was universally appreciated and valued. The silver dollars contained 0.77 ounces of silver, were pretty, used in daily commerce, and minted by the millions in the U.S.

AND THEN CAME PAPER MONEY:

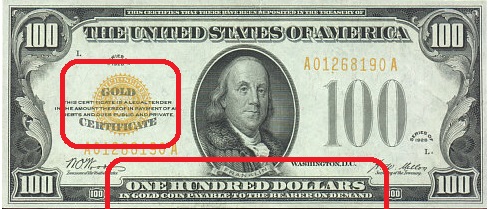

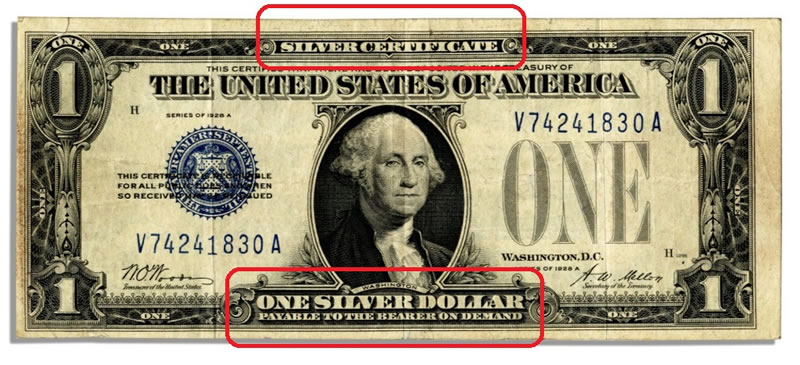

The U.S. government issued Gold Certificates and Silver Certificates that were officially exchangeable for gold and silver. These intrinsically worthless pieces of paper were valuable because they were considered “as good as gold” or silver.

Eventually the gold and silver certificates disappeared and Federal Reserve Notes replaced them. The Federal Reserve Notes looked similar to gold and silver certificates, but sadly, they were nothing more than a piece of paper that represented a loan from (hence the word “note”) or obligation of the United States, issued by the Federal Reserve.

These Federal Reserve Notes passed as money because the government decreed they were legal tender, and they were backed by “the full faith and credit” (confidence) of the U.S. government. Unfortunately the notes are not money, have no intrinsic value, and are not backed by assets. They are loans to the U.S. government backed by the debts of the United States and the future taxing power of the government.

Even if they weren’t real money, the Federal Reserve Notes did the job – commerce and business thrived, but money was no longer a store of value. The Federal Reserve and government deficit spending created inflation, and a five cent cup of coffee inflated into $2 coffee along with higher prices for almost everything.

DEBT AND CREDIT CARDS: Use your credit card, the vendor pays a fee to the bank, and you pay interest on the debt. We use Federal Reserve Notes (debts) to pay our credit card bills (debt). We “invest” excess dollars (debts) in bank accounts (debts the bank owes you), bonds (debts) or something else. Gold and silver were supposedly no longer needed in the financial system, and gold has become a “legacy” or “traditional” asset, taxed like an investment, and is no longer considered an alternate currency. The Chinese, Russians, Arabs, and Indians disagreed, but gold and silver prices have been “managed” so westerners would not lose confidence in the paper and digital replacements for real money.

Other replacements for real money: Prepaid Visa Cards, Debit Cards, Cell Phone Charges, Bitcoin, and more.

WHAT HAVE WE DONE TO OUR MONEY IN THE NAME OF CONVENIENCE AND BANKER PROFITS?

CONFIDENCE: Our financial system works because we have confidence that we can spend debt based currencies, with no intrinsic value, and the next person will exchange goods for those currencies. He will make the exchange because he is confident he also can exchange currencies for other goods he needs.

The financial system is based on confidence in the ability to exchange debts for goods – you accept my IOU and I will accept your IOU.

WHAT HAPPENS WHEN THE CHAIN OF CONFIDENCE IN THE “FULL FAITH AND CREDIT” BREAKS?

Clearly, the financial elite can’t allow confidence in the system to slip away… but confidence weakens when (for example):

- Global debt of $200 Trillion is increasing far more rapidly than the underlying economies which must support that debt.

- Cyprus banks “bail-in” (confiscate) depositor money to cover bad bank investments.

- Greek banks are closed and ATMs distribute only 60 euros per day.

- Chinese stocks crash

- $100 Trillion in bonds are recognized as unpayable and worth far less than face value.

- S. pension plans are underfunded by $Trillions and retirees are worried.

- Inflation in Argentina/Ukraine/wherever heats up and the governments prepare to drop more zeros off the new currency.

- Gold prices rise for whatever reason.

Summary:

Years ago gold and silver were money. Physical coins were replaced with gold and silver certificates. Those certificates were replaced with “Notes” or debt of the U.S. government issued by the central bank. Those notes have largely been replaced by more ephemeral digital debts in the form of credit card debt, debit accounts, checking accounts, short term debts (T-bills), longer term debt (such as 10 year notes) and derivatives of those debts. The intrinsic value of those notes and debt instruments is minimal – they are accepted because they are accepted, UNTIL THEY AREN’T.

When that day arrives, we will wish we still used gold and silver as money.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.